Kitco’s senior market analyst Jim Wyckoff partially agrees with acclaimed author Robert Kiyosaki’s gold call. In a new interview, he detailed how gold and several other assets will move up in the short term.

Senior analyst backs gold rally

According to Jim Wyckoff, the recovering US economy will cause commodity prices to skyrocket as global demand rises. In a recent interview, Wyckoff said, “There is now a feeling that the Fed is nearing the end of its monetary policy tightening cycle. “Inflation appears to be under control and on a downward trajectory,” he said.

According to Wyckoff, “It looks like we’re going to have a soft landing for the US economy in the coming months.”

Wyckoff predicts that the strengthening US economy will lead to price increases on gold, silver, oil and commodities. He says it seems increasingly likely that the US economy will emerge unharmed from two years of high inflation and high interest rates:

This was the largest predicted recession ever to occur. Even if there is a slight recession, it will only be moderate.

US inflation real trigger of gold rally

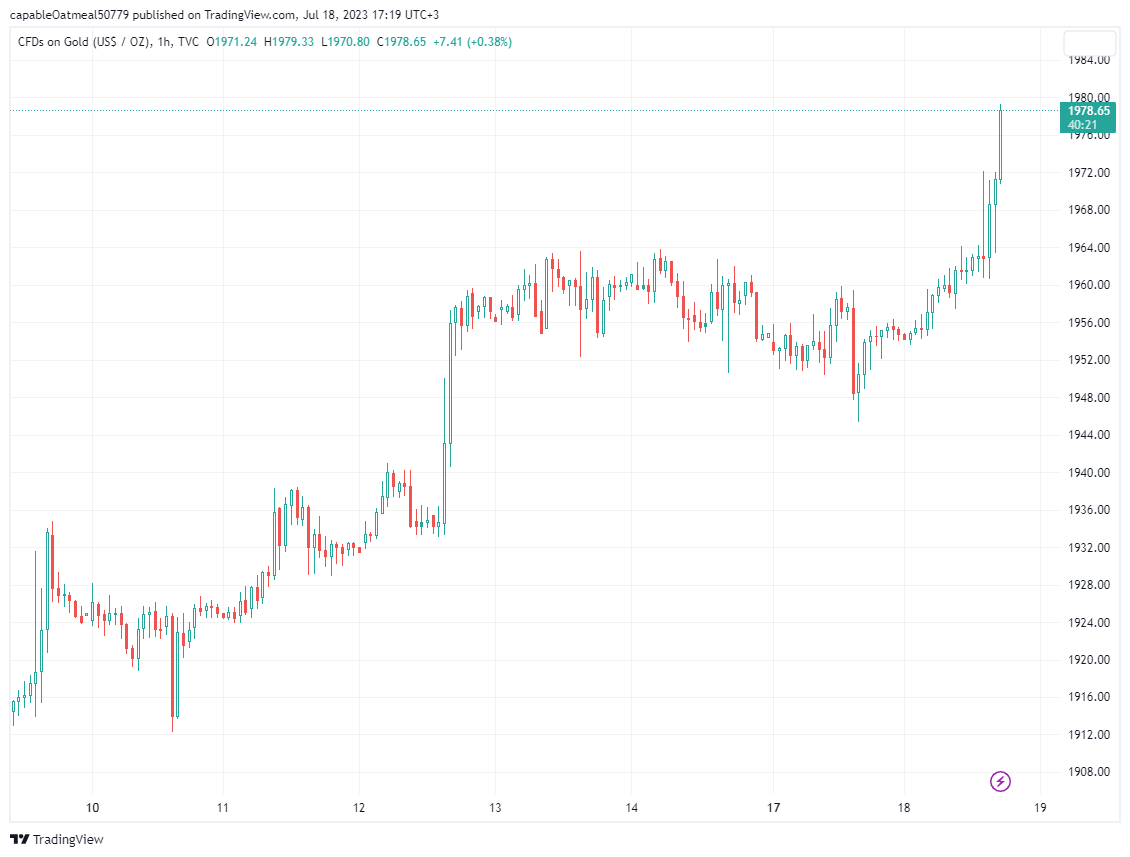

Wyckoff drew attention to the better-than-expected CPI and PPI reports last week. Following the data, he pointed to the recent strength of precious metals prices as signs of shifting market sentiment:

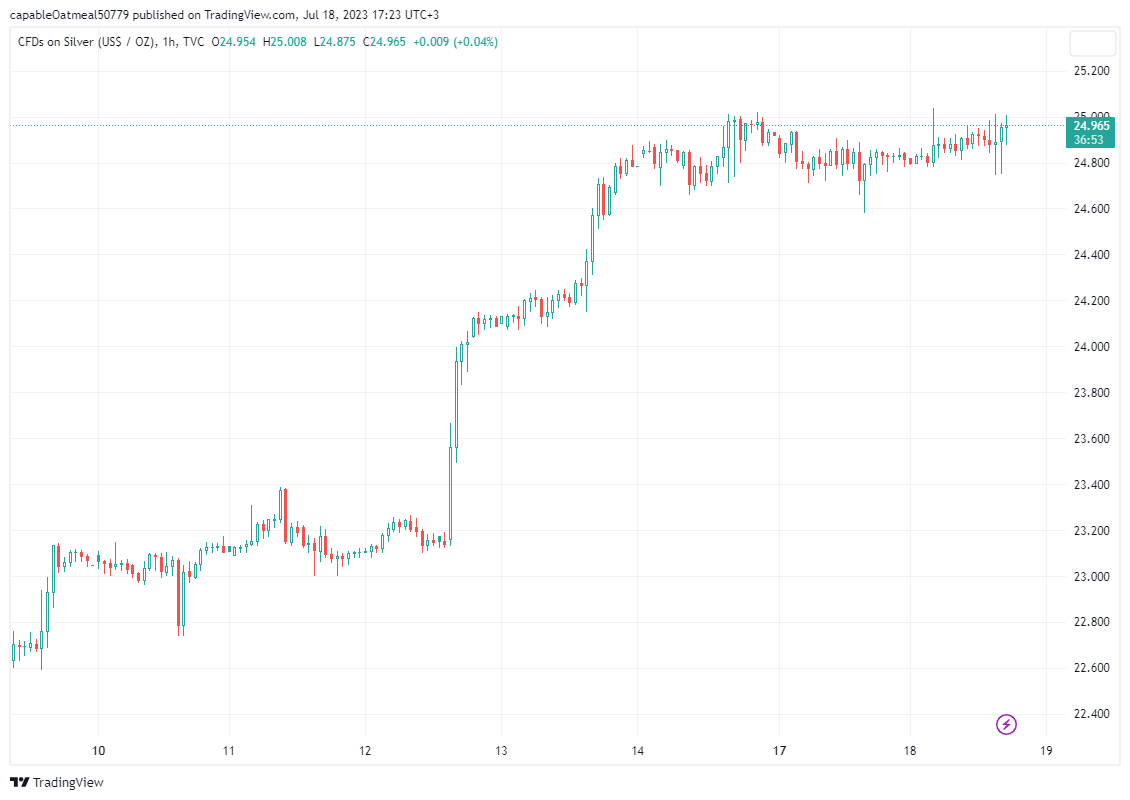

We have seen a solid recovery in the gold market and a strong recovery in the silver market. There is a growing sense in the market that there could only be one or two small Fed rate hikes before this tightening cycle ends. This is good for the US economy, this is good for the world economy. It indicates better demand for raw goods.

Wyckoff also emphasizes the importance of positive economic data. In addition, the Fed says that the change in monetary policy expectations is also putting pressure on the US Dollar Index:

As those who closely follow the gold and silver markets know, the Dollar Index and metals tend to trade in the opposite direction on any given day, so seeing the US Dollar Index hit a two-month low is good news for commodity market bulls.

These show that the day’s price will rise further in the short term.

Wyckoff said that the safe-haven offer of gold left the market some time ago, so low inflation figures and fears of waning recession will not spoil the momentum of the precious metal. “The market is now focusing on better economic growth worldwide in major economies. It generates better demand for gold and silver,” he said.

He added that after the CPI and PPI statements, which rose from $23.36 on Wednesday morning to $25.24 on Friday, the big move of silver could be the beginning of its long-awaited exit. At this point, he said, “We see that silver is a poor man’s gold and I think the silver market has caught up a bit. We reached a two-month high in silver. Techs are on the rise for silver. This indicates that the price will increase further in the short term.

Wycoff also recommends that commodity investors who want to validate the Fed policy shift hypothesis should keep a close eye on oil prices:

Crude oil started to recover this week and hit a two-month high. If crude oil continues its downward trend, it will be an ominous omen for the rest of the crude commodities sector, including metals, but this better demand scenario for markets around the world, including metals and crude oil, seems to be right now.

BRICS meeting is approaching

An announcement of a gold-backed BRICS currency will appear in August. Wyckoff says he doesn’t believe this will have a meaningful impact on gold or the US dollar:

As we have seen time and time again in Bitcoin and cryptocurrencies and other so-called rivals challenging the supremacy of the ‘King Dollar’, all that has happened so far has been a challenge, never a big deal. At least for the foreseeable future, the US dollar will be the benchmark for the world’s currency in times of geopolitical uncertainty. You see people wanting to own US treasuries where they have to pay US dollars to own or get dollars. The US Dollar Index is bearish, but the overall US dollar situation in world money markets has not changed and will likely not change in the near future.

August 22, 2023, in Johannesburg, South Africa, BRICS nations announce gold backed crypto. US $ will die. Trillions of US $ rush home. Inflation through the roof. Buy Gold,

Silver. Bitcoin to $120k next year.— Robert Kiyosaki (@theRealKiyosaki) July 11, 2023

However, the famous writer Robert Kiyosaki says that unlike Wyckoff, the BRICS meeting will be devastating for the US dollar. cryptocoin.comIn his recent statements, which we quoted as A.Ş., he renewed his call for gold, silver and BTC to be saviors.