Bitcoin (BTC) price is struggling to find support for its downside move after the $19,543 low. In the short term, a close of $20,000 will be a relief. Now with the first days of September slowly moving forward, analysts’ forecasts are also getting complicated due to important Ethereum and Cardano updates.

Bitcoin price could drop further in September

Experts do not rule out that September will be a volatile period for the crypto market as well. According to a Bloomberg report, September has historically been one of the worst months for Bitcoin. BTC has recorded a drop every September since 2017. According to the report, the price of Bitcoin has closed the month of September with an average of 8.5% red in the last 5 years. However, Ethereum also showed a bearish trend over the same period. Cryptocoin. comAs you follow, Bloomberg analysts predict that the Ethereum price will drop to $ 1,000 in this framework.

Major factors of decline expectation

The crypto market has moved in line with the US stock market all this year. The correlation between the two markets remains strong. However, September tends to be a tough month for stocks as well. Also, the Fed’s hawkish decisions continued to have a negative impact on the Bitcoin price throughout the year. High volatility could become a central stage for Bitcoin price in the coming months as rising interest rates put pressure on risky markets like BTC. This environment has already dragged the Bitcoin price into descending and ascending wedges for a while.

Bitcoin price is on the verge of triggering a breakout

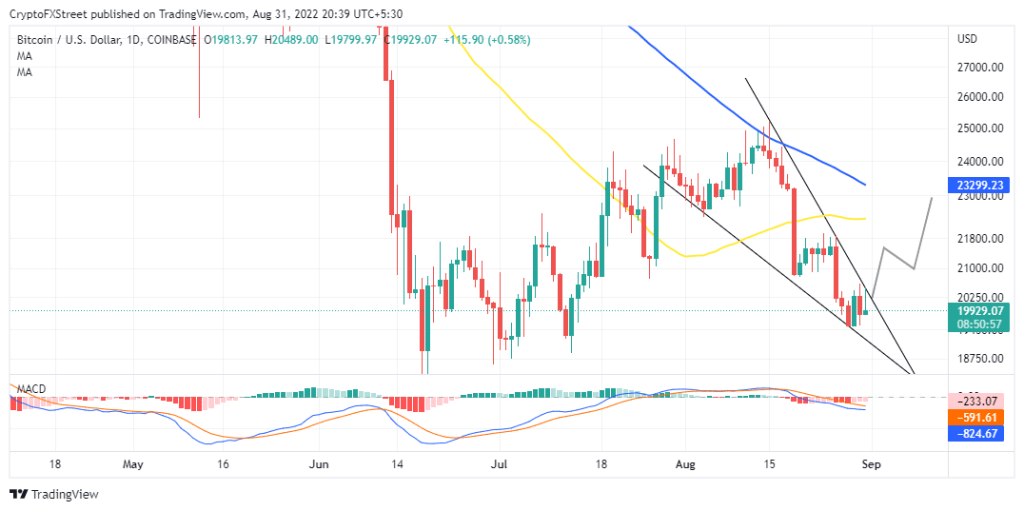

A wedge formation on the daily chart represents a potential bullish breakout for BTC. However, the move is largely due to Bitcoin price’s ability to break through the upper trendline as shown in the chart.

Bitcoin price has a solid support zone between $19,482 and $20,089. IntoTheBlock data shows that around 798,500 addresses that have bought before added roughly 457,900 BTC in the range. Investors in this region are likely to tackle potential dips by leaving the path of least resistance for Bitcoin price to the upside. On the other hand, a sudden rally above $21,000 will be the unexpected scenario. In this case, analyst John Isige predicts that the price will fluctuate between $20,763 and $21,370 for a while. They can also choose to liquidate around 800,000 addresses that bought around 386 BTC in the range. A break above this zone could change the resistance at $21,590 and $22,978.

Is Ethereum different?

Not according to popular Twitter analyst Rekt Capital. In his latest analysis, he said he believes ETH will resume its downtrend after a bounce.

If $ETH enjoys stronger follow-through from this recent successful retest of orange support…

Then #ETH will be able to go up and form a macro Lower High, much like in early 2021

That Lower High would form at ~$1800#Crypto #Ethereum pic.twitter.com/OnXqfOZegu

— Rekt Capital (@rektcapital) August 29, 2022

Rekt also says that although ETH is trading between $1,500 and $1,800 as in March 2021, the less-than-stellar response from ETH bulls at range support shows the difference in trend.

$ETH enjoys a +6% bounce from the orange area

Compared to early 2021 however, the reaction is not as volatile now

There was no wick into the orange area to demonstrate a strong buy-side reaction

That said however, #ETH is holding this region as support well#Crypto #Ethereum https://t.co/s8AHLXKFIQ pic.twitter.com/44vZ6wMerQ

— Rekt Capital (@rektcapital) August 29, 2022

Meanwhile, the Ethereum merge will start on September 6th. Another analyst, Michaël van de Poppe, says that after a successful update, Ethereum price will head towards $2,200. However, he is worried that the price will drop to $1,350 in the short term.