Altcoins like Bitcoin (BTC) and Dogecoin (DOGE) were green at the weekly open, but general resistance levels will continue to pose a challenge in the short term. As we reported on cryptokoin.com, after nine consecutive weeks of red weekly candles, Bitcoin (BTC) made a green weekly candle on June 5. Earlier this week, buyers continued their momentum with a strong weekly open that pushed BTC price up to $31,800. Can the bulls sustain higher or will the bears sell aggressively and drive the price down? We convey the analysts and analyst opinions for the 10 cryptocurrencies that will make the most of a possible trend turn…

What awaits SHIB, BTC, DOGE and these 7 altcoins this week?

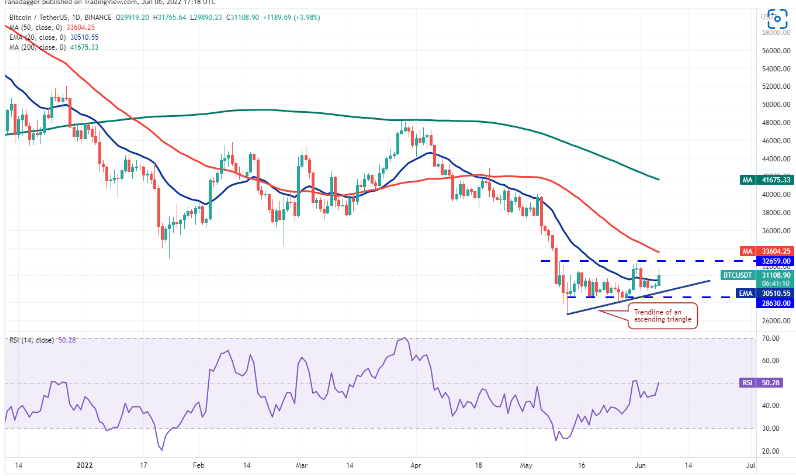

Bitcoin (BTC) and Ethereum (ETH)

Bitcoin broke above the 20-day exponential moving average ($30,510). The bulls are trying to push the price towards the overhead resistance at $32,659. The price action of the last few days has formed an ascending triangle pattern that will complete on a break and close above $32,659. If this happens, the BTC/USDT pair could start a new upward move. The formation target of the breakout from the triangle is $38,618. The 20-day EMA has flattened out and the relative strength index (RSI) is near the midpoint, indicating that selling pressure is easing. This positive view may be invalidated if the price drops sharply and breaks below the trendline of the triangle. The pair could then decline to the strong support at $28,630, where the bulls may try to stop the decline. A break and close below this support could turn the advantage in favor of the bears. Looking at

Ethereum, buyers are trying to push above the overhead resistance at the 20-day EMA ($1,930) on June 6. If they are successful, the ETH/USDT pair could gain momentum and rally to $2,016. Above this level, the pair could reach the stiff overhead resistance at $2,159. Bears are likely to defend this level aggressively. If the price bounces back from this resistance, the pair could consolidate for a few more days between $2,159 and $1,700. The long wick on the June 6 candlestick indicates that the bears continue to defend the 20-day EMA. This indicates that sentiment remains negative and traders are selling on rallies. The bears will now try to push the pair below $1,700 and continue the downtrend.

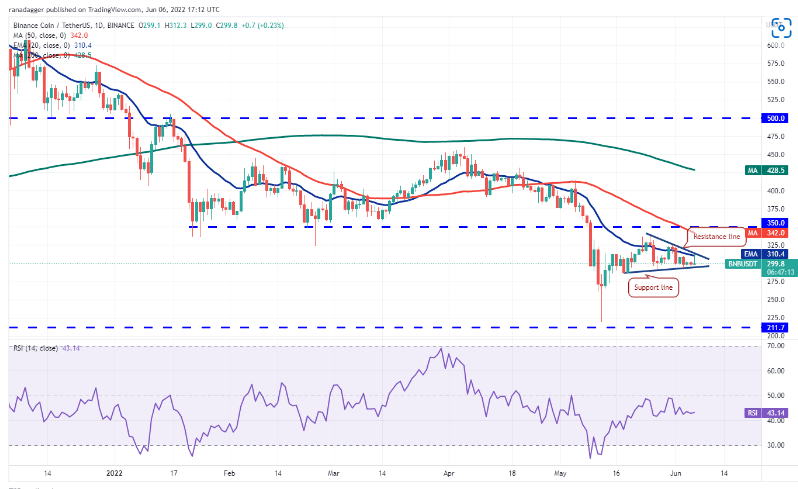

BNB and Ripple (XRP)

BNB formed a symmetrical triangle pattern, indicating indecision between bulls and bears. The bulls are trying to push the price above the resistance line but the bears are not willing to give up. If the price turns down from the overhead resistance, the bears will try to push the BNB/USDT pair below the support line. If they manage to do so, the pair could drop to $265 where buying could occur. Alternatively, if the bulls push the price above the resistance line and sustain it, it indicates that the sellers have lost their grip. The pair could then rally to the $350 breakout level. This is an important level to watch out for, as a break and close above it could signal the end of the downtrend.

Ripple (XRP) is trading inside a bearish triangle pattern. The bulls are trying to push the price above the downtrend line, but the bears pose a strong challenge as seen from the long wick on the day’s candlestick. If the bulls push the price above the downtrend line, it will reject the bearish pattern. This could push the XRP/USDT pair to $0.46 and then to the psychological level of $0.50, resulting in a short squeeze. Conversely, if the price turns down from the downtrend line, the pair could decline to the $0.38 support. If the bears pull the price below $0.38, the descending triangle pattern will be completed. The pair could then decline to the key support at $0.33. A break and close below this support could resume the downtrend.

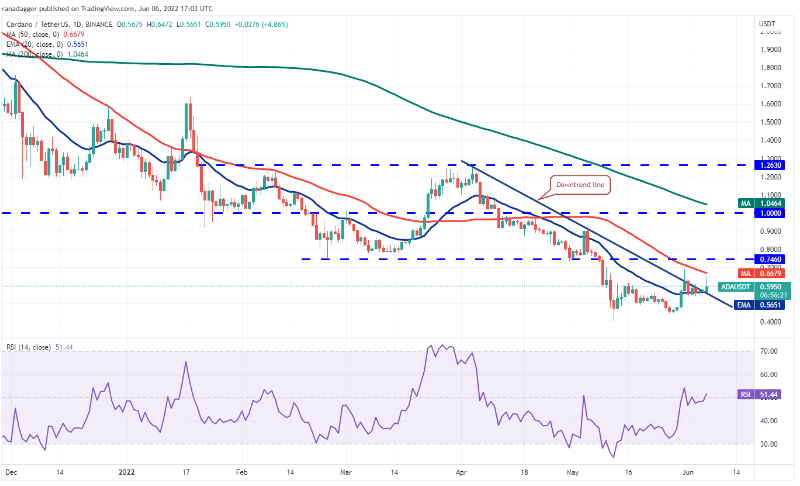

Cardano (ADA) and Solana (SOL)

Cardano (ADA) has seen the 20-day EMA of (0.56) over the past few days. dollar) and showed the accumulation of bulls. Buying rallied on June 6 and the bulls are attempting to push the price above the 50-day SMA ($0.66). If they are successful, the ADA/USDT pair could rally to the $0.74 breakout level. This level could act as a major hurdle again, but if the bulls overcome it, the recovery could gain momentum. The pair could rally to $0.90 later. The 20-day EMA index has flattened and the RSI index is hovering just above the midpoint, giving buyers a slight edge. This bullish view could be invalidated in the short term if the price drops and breaks below the 20-day EMA. If this happens, the pair could gradually slide towards the strong support at $0.44.

Solana (SOL) dropped below the critical support of $37 on June 4, but a minor positive is that the bulls are buying at the lower levels. This may have caught the aggressive bears off guard, resulting in a strong recovery as seen from the long tail on the day’s candlestick. The RSI indicator has formed a positive divergence and indicates that the bearish momentum may be decreasing. The bulls are trying to push the price above the 20-day EMA ($46). If they are successful, the SOL/USDT pair could rally to $55 and later to $60. Conversely, if the price drops from the 20-day EMA, it will indicate that the trend remains negative and the bears are selling in rallies. The bears will then make another attempt to resume the downtrend by pulling the pair below $35.

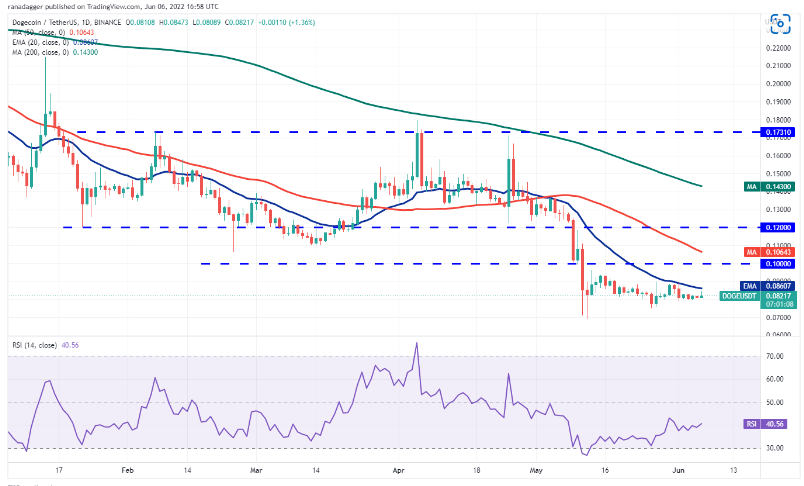

Dogecoin (DOGE) and Polkadot (DOT)

Dogecoin (DOGE) has been trading between the 20-day EMA ($0.08) and $0.08 for the past few days. It’s stuck, but this tight-ranging trade is unlikely to continue for long. If buyers push the price above the 20-day EMA, the DOGE/USDT pair could rally towards the psychological resistance of $0.10. This level could act as a hurdle again, but if the bulls overcome it, DOGE could rise to $0.12. Contrary to this assumption, if the price drops from the 20-day EMA, it will suggest that the bears continue to be sold on minor rallies. If the bears sink the price below $0.08, the pair could drop to $0.07. A break and close below this support will indicate the resumption of the downtrend.

Polkadot (DOT) has formed a symmetrical triangle that often acts as a continuation pattern. Buyers are trying to push the price above the 20-day EMA ($10) and challenge the resistance line of the triangle. A break and close above the triangle will be the first indication of a potential trend change. The DOT/USDT pair could rise to $12 and then attempt a rally to the $14 breakout level. Bears are likely to defend this level aggressively. Alternatively, if the price breaks through the overhead resistance and breaks below the triangle, it will indicate that the bears are in control. The pair could later decline to $8 and then retest the intraday low of May 12 at $7.30.

Avalanche (AVAX) and Shiba Inu (SHIB)

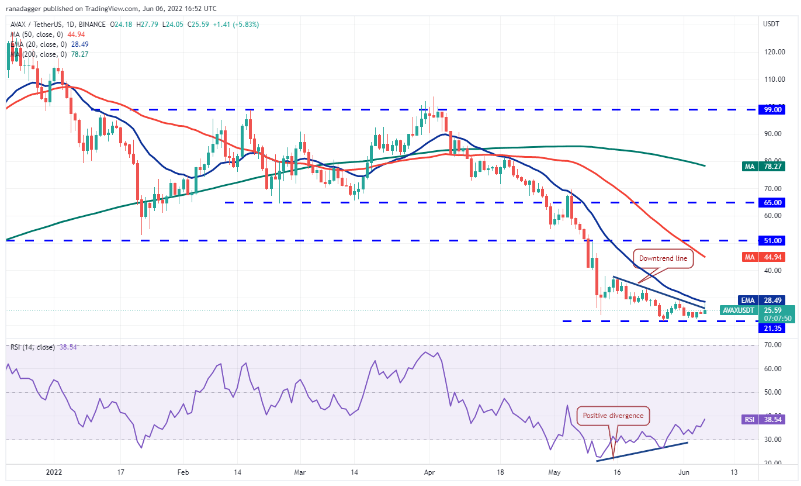

Avalanche (AVAX) jumped $22.14 on June 4 and bulls $21.35 support is strong He showed that he was in some way defensive. Buyers pushed the price above the downtrend line and are attempting to clear the overall hurdle at the 20-day EMA ($28). If they do, the AVAX/USDT pair could gain momentum and start its upward journey towards $33 and then $37. Such a move would indicate that the bulls are back in the game. Contrary to this assumption, if the price drops from the 20-day EMA, it will indicate that the bears remain active at higher levels. The pair could slide towards $21.35 later. A break and close below this support could initiate the next leg of the downtrend.

Looking at the Shiba Inu, buyers have successfully defended the $0.000010 support for the past few days, but the Shiba Inu (SHIB) is below the 20-day EMA ($0.000012). they couldn’t get over it. This indicates that buying is declining at higher levels. Tight range trading between $0.000010 and the 20-day EMA is unlikely to continue for long. If the bears sink the price below $0.000010, the SIBI/USDT pair could retest the intraday low of May 12 at $0.000009. A break and close below this level could signal a resumption of the downtrend. Alternatively, if buyers push the price above the 20-day EMA, the pair could rally to the overhead resistance at $0.0014. Bears are expected to make a strong defense at this level.