The sentiment in the cryptocurrency market is mixed ahead of the Federal Reserve’s rate decision. Uncertainty also makes future forecasting difficult. However, an AI algorithm using various technical indicators reduces uncertainty with SHIB, BTC and XRP forecasts for February.

AI predicts SHIB price for February 28, 2023

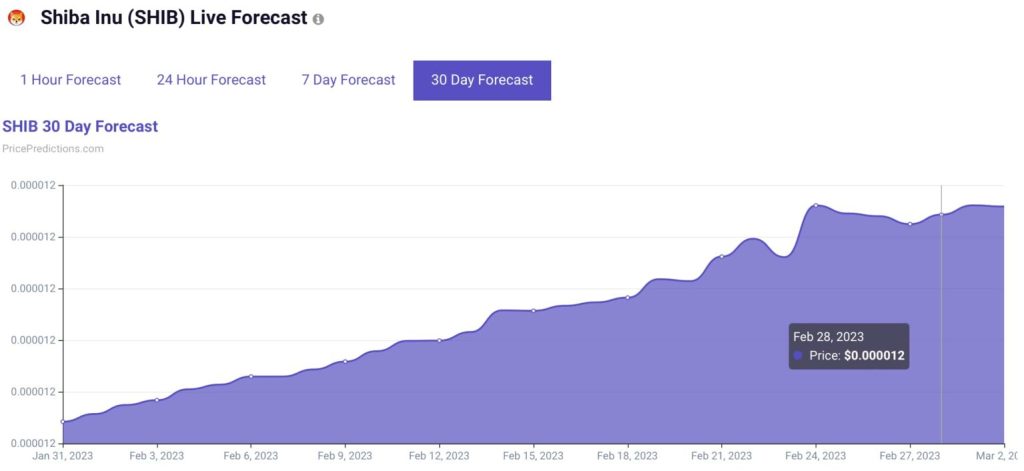

cryptocoin.com As you’ve followed, the price of Shiba Inu (SHIB) has risen sharply since the beginning of 2023. With the Shibarium upgrade, which is said to be implemented in February, the dog-themed meme coin has entered the investor’s radar. According to data as of January 30 from machine learning algorithms on the artificial intelligence (AI) crypto tracking platform PricePredictions, the SHIB price will trade at $0.000012 on February 28.

SHIB February 28 price prediction / Source: PricePredictions

SHIB February 28 price prediction / Source: PricePredictionsPricePredictions machine learning algorithms combine technical analysis (TA) indicators including Moving averages (MA), moving average convergence divergence (MACD), relative strength index (RSI), Bollinger Bands (BB) and more to make predictions. AI’s estimate represents a 3% increase from SHIB’s current price of $0.00001165.

The sentiment in TradingView’s 1-day technical analysis indicators is mixed for the meme coin. It is in the ‘sell’ zone on oscillators 2. However, the moving averages suggest ‘strong buy’ at 12. It also points to ‘buying’ in summary 12.

SHIB 1-day sentiment indicators / Source: TradingView

SHIB 1-day sentiment indicators / Source: TradingViewAI predicts BTC price for February 28, 2023

Bitcoin (BTC) has recorded a 40% increase since the beginning of the year. Thus, it made a great start to 2023. The bullish momentum has emerged as a result of investors grasping the optimistic news on macroeconomic issues. Also, investors are hoping that the current trend can continue as it is the first cryptocurrency to continue its upward trajectory in February.

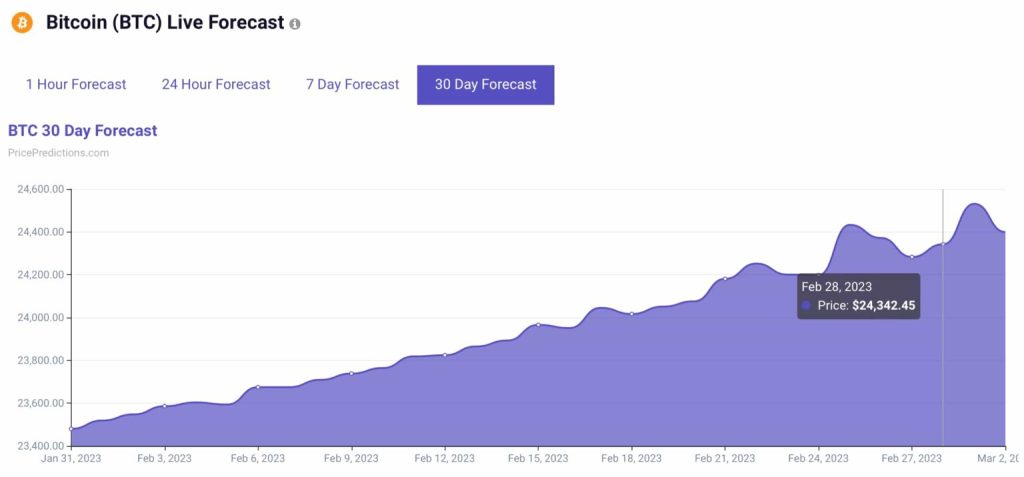

Bitcoin looks set to end January by making its fourth consecutive weekly green candle for the first time since August 2021. So investors can expect more of the same at the end of next month. Specifically, the machine learning algorithms at PricePredictions predict that Bitcoin will likely continue to rise higher to trade at $24,342 on February 28, 2023. AI’s price prediction represents a 4.5% increase from the current price of Bitcoin.

Bitcoin 30-day price prediction chart / Source: PricePredictions

Bitcoin 30-day price prediction chart / Source: PricePredictionsMeanwhile, according to PricePredictions’ forecast on January 24, Bitcoin will hit $23,868 on Valentine’s Day, February 14, 2023. At press time, the price of Bitcoin was trading at $23,115, up nearly 1.24% over the past 24 hours.

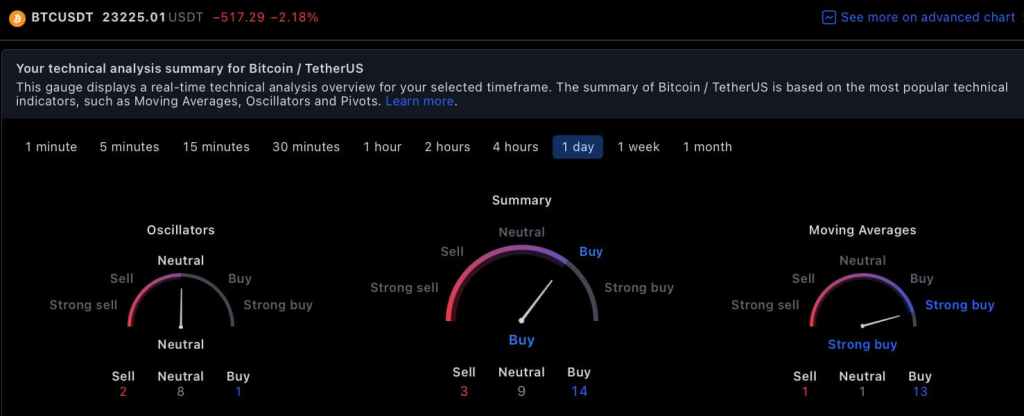

Bitcoin’s technical analysis on TradingView is mixed. Summary 14 shows the ‘buy’ sentiment. Also, the moving averages suggest ‘strong buy’ at 12. However, the oscillators stay at ‘neutral’ with 8.

Bitcoin 1-day technical analysis / Source: TradingView

Bitcoin 1-day technical analysis / Source: TradingViewAI predicts XRP price for February 28, 2022

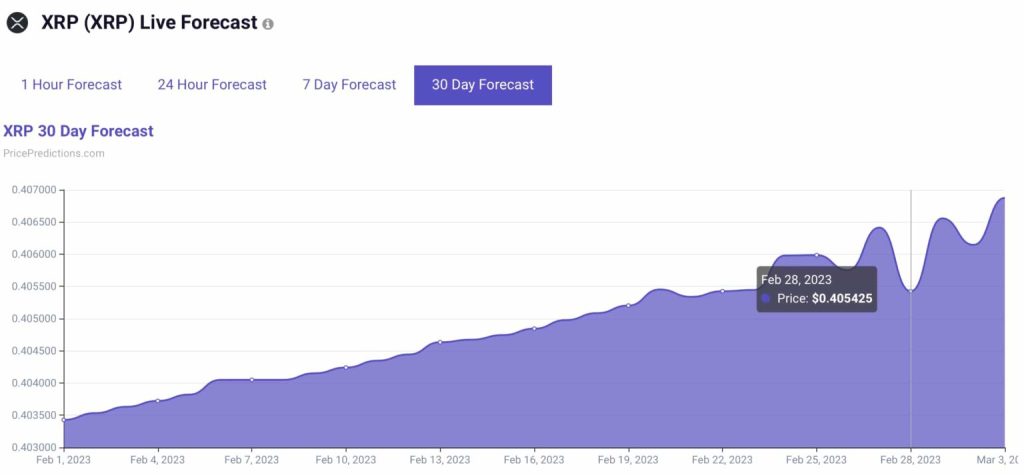

We are nearing the end of the dispute between Ripple Labs and the US Securities and Exchange Commission (SEC). Investors hope that a positive decision in the lawsuit against the financial regulator will have a significant bullish effect on the Ripple price in the near future. PricePredictions’ machine learning algorithm predicts that XRP will continue its positive trend from January to the end of February. According to the data, the value of the token will rise to $0.405 on February 28 before rising again in March. AI’s price prediction represents a 0.87% increase over the token’s current price.

XRP price prediction / Source: PricePredictions

XRP price prediction / Source: PricePredictionsXRP is currently trading at $0.4078, up 3.59% in the last 24 hours and down 3.46% from the previous week. Currently, XRP has a notable support level near $0.36503. Meanwhile, the first resistance zone is at $0.42611.

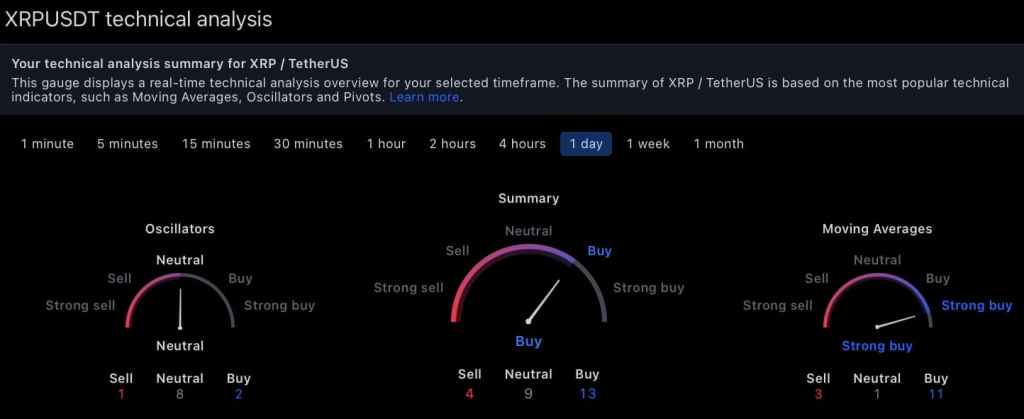

Bulls are watching XRP closely for a breakthrough during the token’s prolonged consolidation period. Market participants who believe that the value of XRP will fall could be responsible for the recent price stability by dumping the token in large quantities. XRP, on the other hand, seems to have responded to this initiative by creating tremendous demand for the currency. XRP technical analysis on TradingView is also mixed. Fits the ‘buy’ sentiment in Summary 13. Also, the moving averages suggest ‘strong buy’ at 13. However, the oscillators stay at ‘neutral’ with 8.

XRP 1-day TA indicators / Source: TradingView

XRP 1-day TA indicators / Source: TradingView