After the FTX events, three Bitcoin and altcoin exchanges attracted attention. Huobi, Gate.io and Crypto.com were the focus of investors. Here is the reason…

Bitcoin and altcoin exchanges under the spotlight

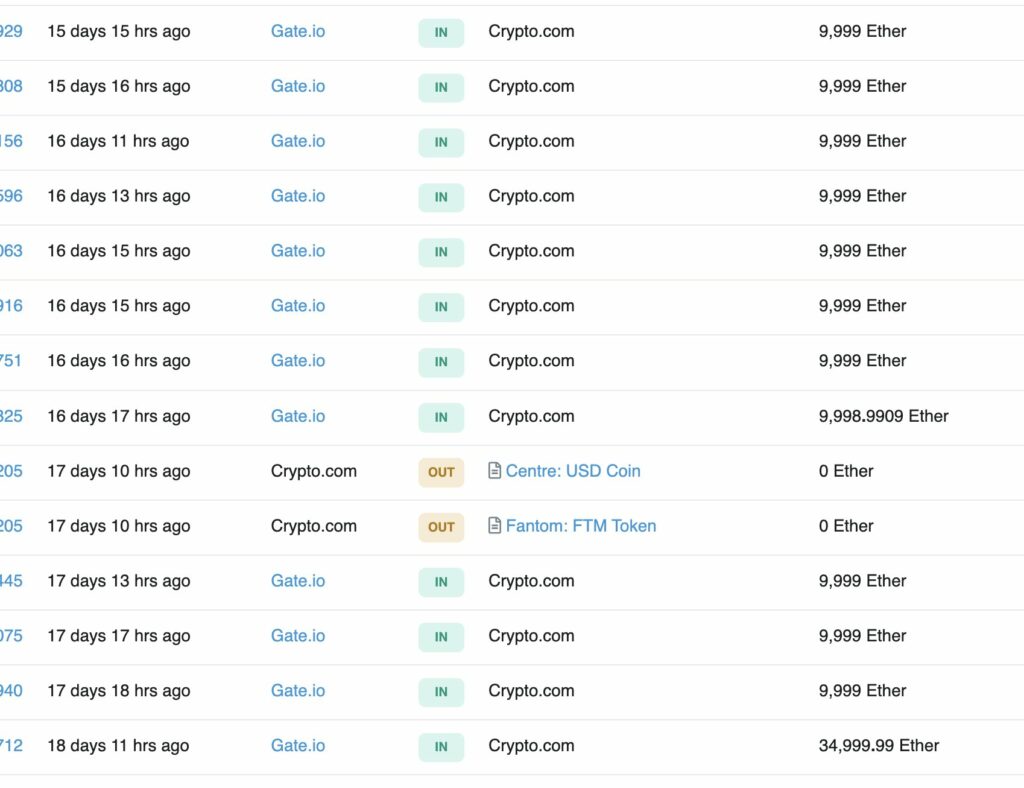

In light of the FTX collapse, Binance CEO CZ’s attempt to divulge evidence of reserve forced other market players to do the same. As the exchanges started to declare the evidence of funds, the previous transactions of the platforms also attracted attention. cryptocoin.com As we reported, approximately 300,000 ETH was transferred from Crypto.com wallet to Gate.io. While many people questioned the reason behind this, the exchange said that this transaction was made by mistake.

Crypto.com CEO said the transaction was accidental. He added that this was a mistake and that Ethereum was planned to be transferred to another Crypto.com cold wallet. ETH was also accidentally transferred to a whitelisted address on Gateio. Later, he announced that Gateio had resent the coins in question to Crypto.com.

Huobi’s transactions also attracted attention

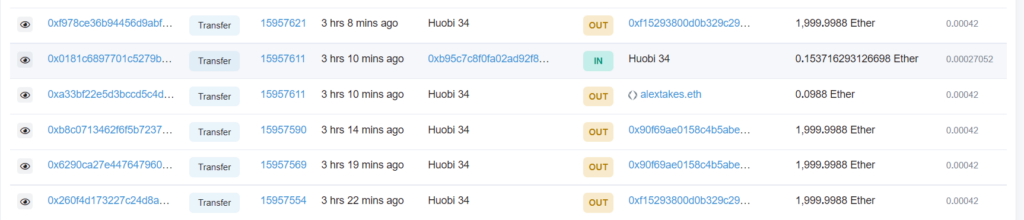

Another exchange that has reportedly been involved in major transfers before or after proof of reserves is Huobi. One of the Huobi wallets, labeled Huobi 34, transferred 10,000 ETH right after the instant proof-of-reserve image. At the time of the snapshot, the wallet in question had 14,858 ETH, after which only 4,044 ETH remained. However, Huobi made a statement on the subject and enlightened the users.

Huobi pointed out that the transfer was made in line with the transaction of an institutional investor. It turned out that the exchange has transferred 10 thousand ETH to Binance and OKX. The team reported that all reserves are now recovered and operating normally. As of November 12, the platform stated that the total estimated value of the reserves was $3.5 billion. Data from blockchain analytics firm CryptoQuant provides better analytics for ETH transfer. It shows that a total of 12,000 ETH ($15.14 million) left Huobi at the time of the said exit.

Exchanges publish evidence

Since the FTX crash, crypto exchanges have been scrambling to issue proof of reserve to users to ensure their funds are not diverted to other investments. On November 10, leading crypto exchange Binance released a list of its cold wallets and reserves, revealing $69 billion in crypto reserves. Huobi has promised to release another Merkel Tree Proof of Reserve audit conducted by a third party within 30 days to further boost user confidence.

As it is known, Binance CEO CZ has issued a warning to all crypto investors. This warning came amid ongoing allegations of possible manipulation of reserves by exchanges. He informed investors that large movements of funds that occurred before or after the release of proof of reserve by any exchange was an open question mark. However, there is no certainty that the Binance CEO’s comments are targeting a specific exchange.