Some cryptocurrencies have seen an increase in short positions in the last 12 and 24 hours. While this could indicate a dominant bearish trend in the crypto market, the associated short selling volume could also create short selling opportunities for bullish investors. Crypto analyst Vinicius Barbosa evaluates long/short ratio data on CoinGlass. Specifically, he talks about a ‘short squeeze’ for two altcoins that are among the index’s top 10.

Short squeeze warning for DOGE: Altcoin may skyrocket!

Dogecoin (DOGE) has seen a huge increase in derivatives volume recently. Previous increased volume continues to impact meme-coin with a massive short position worth $718.23 million in the last 24 hours. Meanwhile, DOGE 24-hour long positions are worth $627.60 million, with a ratio of 46.63% versus 53.35% respectively. Interestingly, these figures are higher than the dollar value of long and short positions on XRP, which has a larger market cap than Dogecoin. DOGE is trading at $0.0771 at the time of writing.

DOGE 12 and 24 hour Long/Short ratio. Source: CoinGlass

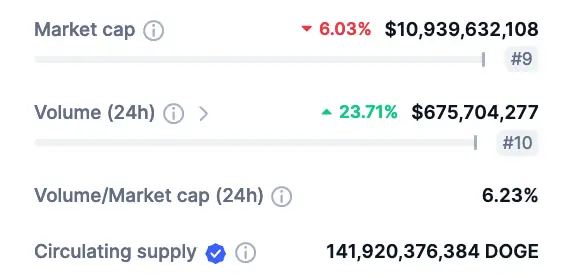

DOGE 12 and 24 hour Long/Short ratio. Source: CoinGlassAccording to CoinMarketCap, the amount of short positions opened in the last 24 hours is higher than the $675.70 million observed in DOGE’s 24-hour spot volume. Moreover, these short positions are equal to 6.5% of the $10.94 billion market cap. Additionally, both indicate that a ‘short squeeze’ for the altcoin could happen at any time.

Dogecoin market cap and volume (24 hours). Source: CoinMarketCap

Dogecoin market cap and volume (24 hours). Source: CoinMarketCapShort squeeze or bearish sign for LINK?

Interestingly, Chainlink (LINK) is another highly weighted altcoin for shorts. It was also already featured in the last ‘short squeeze’ warning on 17 November. However, the short squeeze never materialized. This may indicate a dominant bearish sentiment that came with last week’s news about stablecoins.

After BlackRock announced the risks that USDT and USDC could pose to Bitcoin (BTC), BIS published a study on stablecoins. As you know, altcoin Chainlink has a dependence on this asset class. Therefore, it was mainly negative news that affected his performance. However, the $589.77 million in short positions opened in the last 24 hours suggest there are associated short squeeze risks for LINK. This amount constitutes 52.51% of short positions.

LINK 12 and 24 hour Long/Short rate. Source: CoinGlass

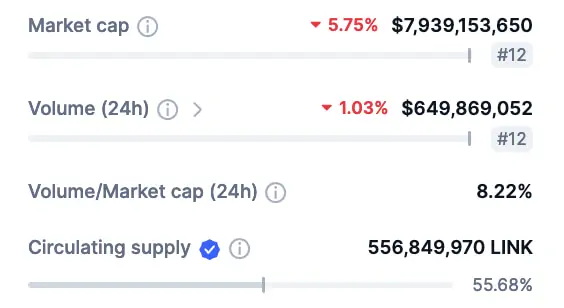

LINK 12 and 24 hour Long/Short rate. Source: CoinGlassAdditionally, Chainlink’s market cap of $7.94 billion and exchange volume of $649.87 million increases the relevance of the current bearish trend, which investors can explore with a short squeeze.

Chainlink market cap and volume (24 hours). Source: CoinMarketCap

Chainlink market cap and volume (24 hours). Source: CoinMarketCapBy the way, it should be noted that there is no guarantee that there will be a short squeeze in these altcoin projects. Estimates and opinions belong to the analyst and are definitely not investment advice. For this reason cryptokoin.comAs, we recommend that crypto investors do their own research.