Market Turmoil: Short-Term Bitcoin Holders React

On Monday, short-term holders of bitcoin (BTC) made a strategic exit from the market, incurring losses as the cryptocurrency’s value plummeted. This downturn prompted derivative traders to also reassess their positions, resulting in a notable decrease in open futures bets on the Chicago Mercantile Exchange.

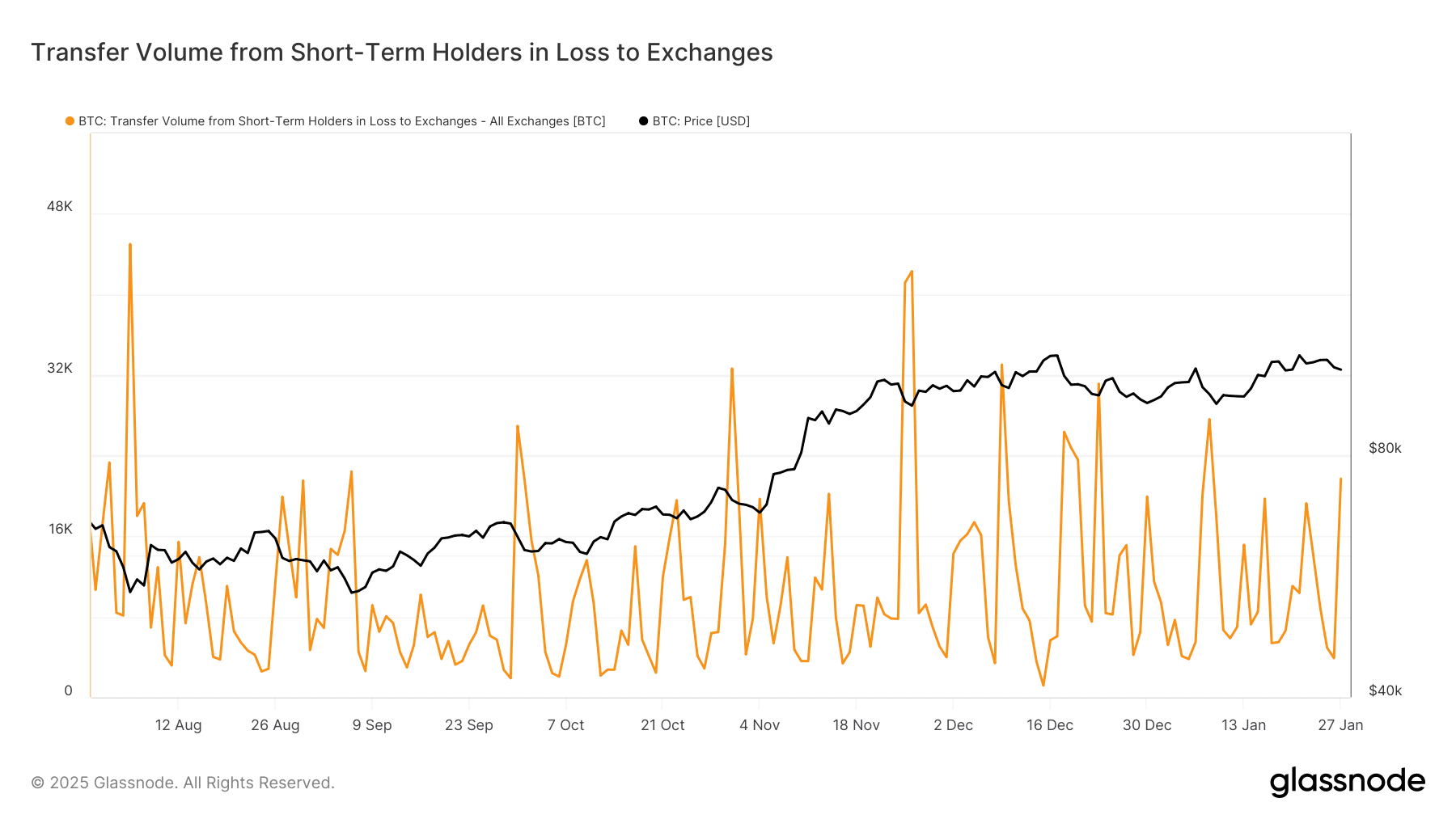

According to data from Glassnode, short-term holders—defined as addresses that have held their coins for less than 155 days—transferred an impressive over 21,000 BTC (valued at approximately $2.2 billion) to exchanges while facing losses. This movement coincided with a sharp decline in BTC’s price, which fell by as much as 4.7%, marking its largest drop in two weeks, as reported by CoinDesk Indexes.

This significant transfer to exchanges, often seen as a precursor to selling, represented the second-largest outflow this month. It appears that investors who purchased bitcoin when prices soared to near-record highs of around $108,000 at the beginning of the year were unsettled by the sudden plunge back into the five-digit range.

Behavior of Short-Term Holders

These short-term holders, which include active traders, new market entrants, and those with weaker hands, typically react sensitively to price fluctuations. They often capitulate during downturns; for instance, BTC’s price dipped to below $98,000 following the weekend announcement from the Chinese startup DeepSeek, which raised concerns about U.S. dominance in AI and technology.

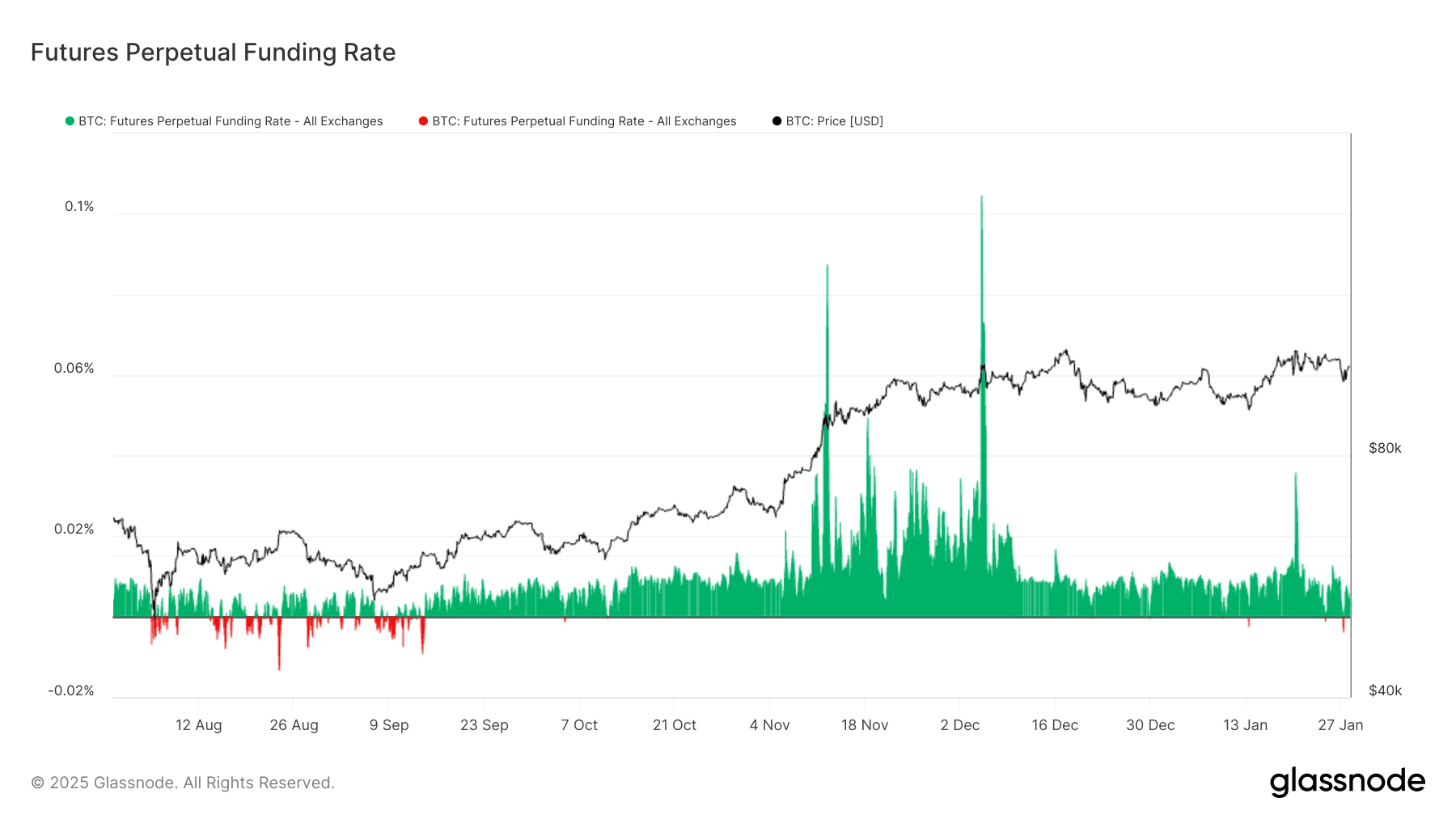

Other indicators in the market suggested a broader capitulation trend, often seen at local price bottoms. Notably, the perpetual funding rates for BTC turned negative, indicating a heightened interest in bearish bets. Historical patterns show that such reversals often occur when bitcoin reaches a local low, similar to events on January 13, when BTC fell below $90,000, and August 5, during the yen carry trade unwinding.

Institutional Activity and Futures Market Responses

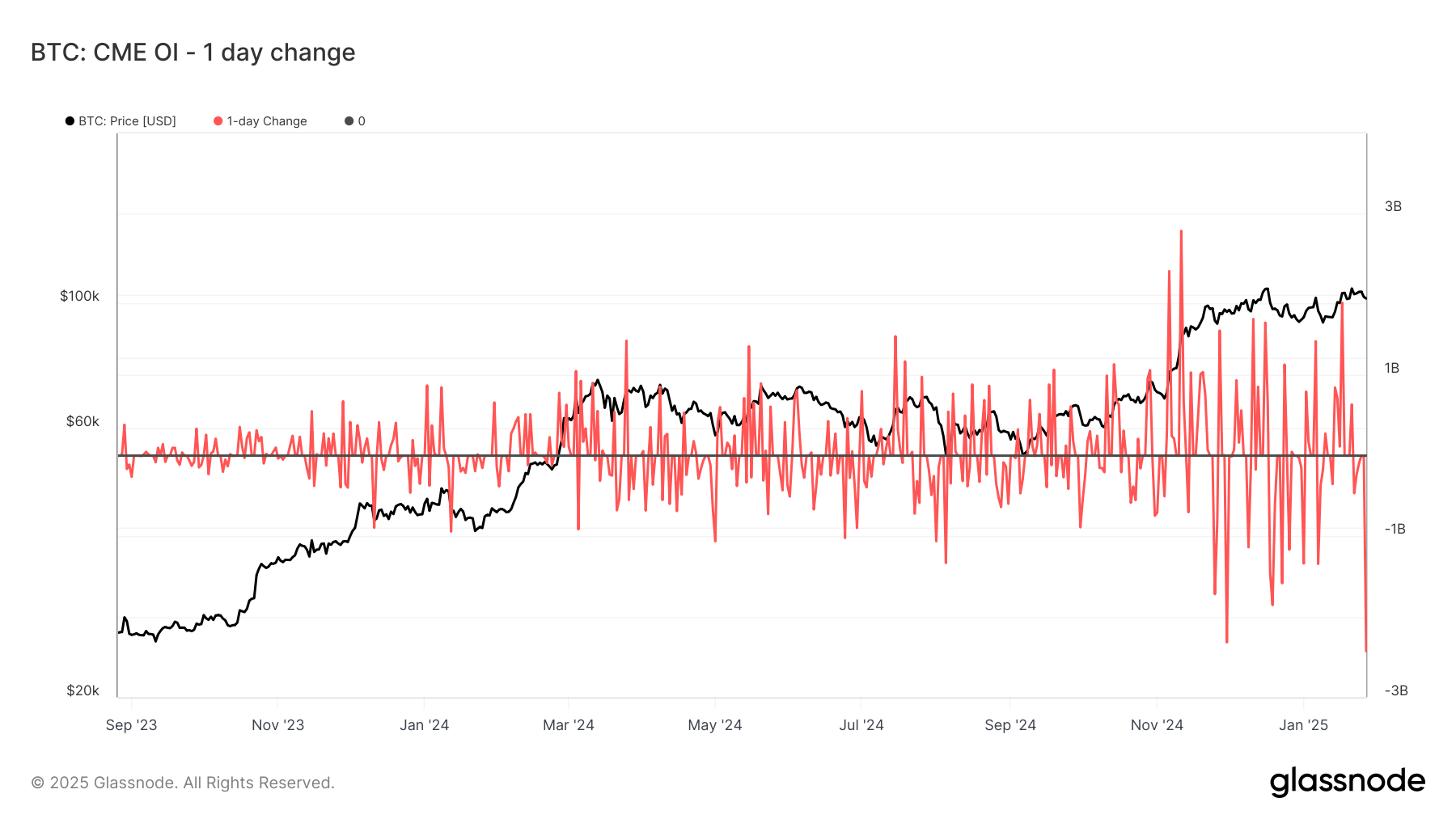

The de-risking behavior was also evident on the Chicago Mercantile Exchange, a key barometer for institutional trading. Here, a record drop in notional open interest (OI) was observed, which coincided with a double-digit decline in shares of chipmaker Nvidia (NVDA). Specifically, notional bitcoin OI dropped by a staggering $2.4 billion (equivalent to 17,000 BTC), leading to a decrease in the basis, as indicated by data from Glassnode.

Additionally, U.S. listed bitcoin exchange-traded funds (ETFs) experienced a significant outflow, totaling $457.6 million. This trend mirrors a similar outflow that occurred on January 13, as reported by Farside data, further highlighting the current sentiment in the bitcoin market.