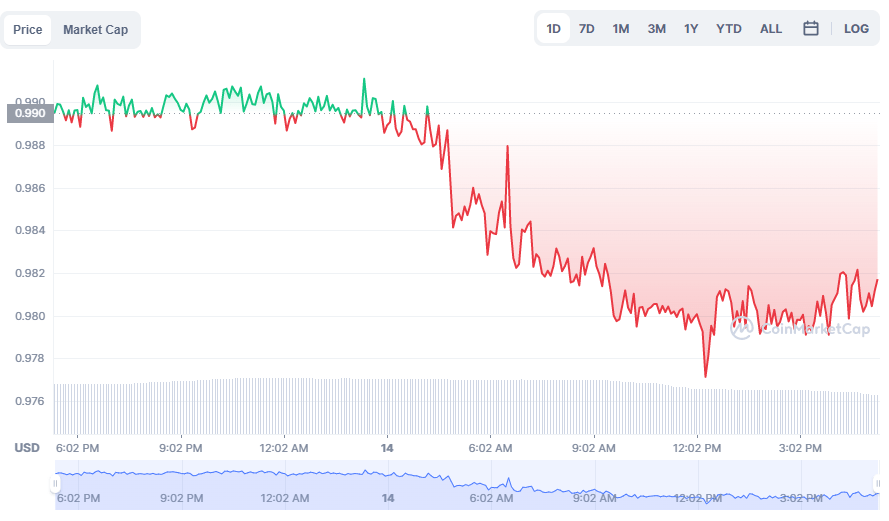

USDD, the algorithmic stablecoin of the TRON network, has been trading below the dollar stable for more than 24 hours. Despite the $2 billion cash injection, the price did not reach $1. The fact that USDD has a liquidity mechanic similar to LUNA-UST brings to mind the crash in May.

USDD price lost its stability, second LUNA-UST?

Just 40 days after launch, USDD is struggling to survive. The algorithmically supported stablecoin lost the dollar peg on Monday as the market dropped below $1 trillion for the first time since January 2021. As a response to price instability, the TRON DAO Reserve, an organization set up to keep USDD trading in dollar parity, backed it with $2 billion in cash to restore the USDD stable.

Funding rate of shorting #TRX on @binance is negative 500% APR. @trondaoreserve will deploy 2 billion USD to fight them. I don't think they can last for even 24 hours. Short squeeze is coming. pic.twitter.com/VRExM6UK70

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) June 13, 2022

short on Binance positions explode

Announced the decision to intervene by Tron founder Justin Sun. TRX takes on one of Binance’s largest volumes. Sun says that TRX from USDD stablecoin reserves was deliberately shorted. In a tweet on Monday morning, he said:

TRX’s short interest rate on Binance, minus 500% APR. Trondaoreserve will distribute 2 billion USD to fight them. I don’t think they can even last 24 hours.

At the time, USDD dropped just under a dollar and traded around $0.98. After more than 24 hours and more than $2 billion, it still hasn’t reached its fixed price.

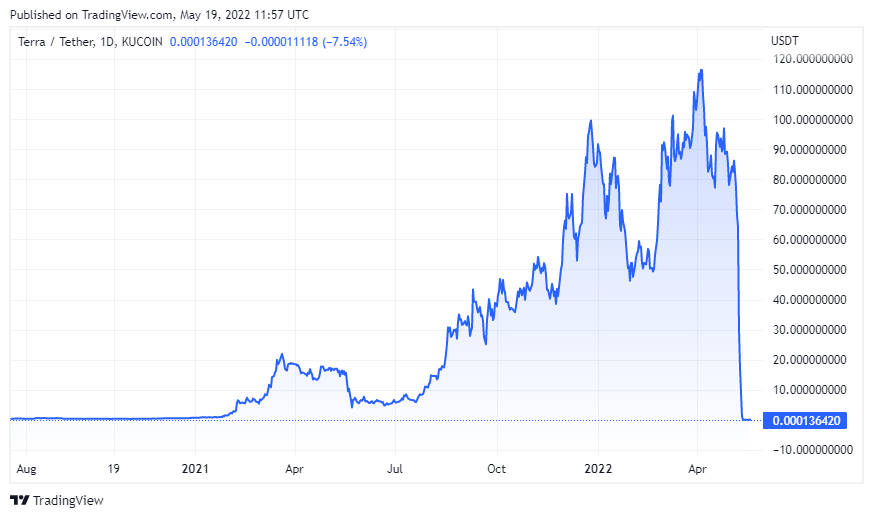

USDD uses an algorithmic mechanism similar to LUNA and UST

TRON stablecoin to maintain price stability in USDD It uses algorithmic mechanism. When the stablecoin is trading below $1, arbitrageurs can burn it for $1 worth of TRX. Conversely, when USDD is trading above $1, arbitrageurs can swap $1 of TRX for a USDD. In the process, more USDD is printed and as a result, the supply increases. It is worth noting that the algorithmic mechanism of USDD is very similar to that of the failed stablecoin TerraUSD, which entered a death spiral when it lost its dollar stable in early May and wiped out over $40 billion in value.

As arbitrageurs try to profit by exchanging 1 USDD for $1 worth of TRX, it puts tremendous selling pressure on TRX. TRX has dropped 16.7% since USDD started losing its stable value. As Sun stated in his tweet, the TRX funding rate on Binance is negative 500% APR. This means that many traders open short positions on the token to profit from a potential drop in value.

Compensation plans

TRON DAO Reserve plans to buy large quantities of TRX, distributing $2 billion, possibly to create a short squeeze. At the same time, it forces those missing in TRX to buy back the underlying TRX tokens, ultimately giving arbitrageurs more room to restore USDD. However, this strategy is incredibly risky. If there are more investors on the short side than the TRON DAO Reserve has to buy TRX, the token may continue to decline. If the price of

TRX fails to stabilize, the TRON DAO Reserve will need to deploy more reserve assets to help maintain USDD’s dollar peg. As we reported Kriptokoin.com , the DAO already has 10.8 billion TRX, 14,040 BTC, 140,000,000 USDT and 500,000,000 USDC reserves. This reserve provides a collateralization rate of approximately 248% for USDD 723,321,764 in circulation.