The cryptocurrency market has been hit hard by the latest moves from the US Securities and Exchange Commission. Naturally, Binance’s native token, Binance Coin (BNB), which the SEC targeted, was also one of the most affected altcoins. On the other hand, the increase in short positions in BNB before the SEC filed a lawsuit draws attention. This leads to ‘insider trading’ rumors.

Remarkable short increase in BNB before SEC’s move!

cryptocoin.com As you follow, the U.S. Securities and Exchange Commission (SEC) claims that Binance sold securities without proper registration. As a result, the lawsuit intensified the scrutiny surrounding Binance’s activities. It also raised concerns about the exchange’s compliance with regulatory requirements. In the lawsuit, the SEC labels some cryptocurrencies as ‘securities’. Following the SEC’s lawsuit, altcoins labeled as ‘securities’, including BNB, Binance’s native token, fell sharply.

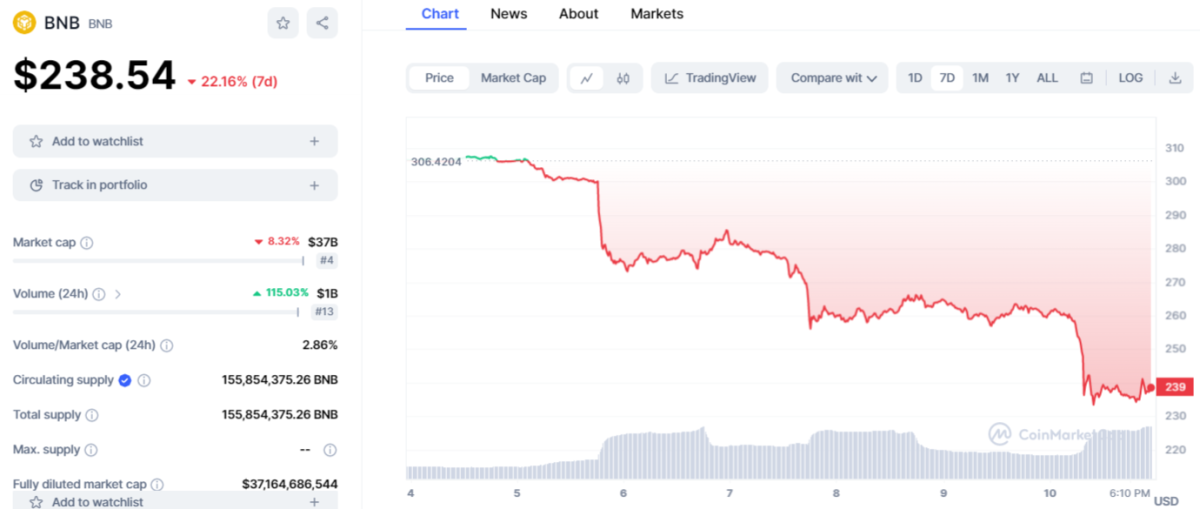

However, interesting details continue to emerge. Accordingly, there was an increase in short positions in the native token BNB before the SEC sued Binance. According to data from analytics platform Coinalyze, BNB short positions increased significantly on June 5th. Short positions rose from $306 million to $336 million during this period. This represents an increase of about 10%. Meanwhile, in the same time frame, the BNB price saw a drop of around 2%. However, after the hearing of the case, the decline deepened by about 8%. Such a pre-litigation sale aroused suspicions of ‘inside trading’. However, this is only a suspicion at the moment. BNB’s decline further deepened. At press time, the altcoin is down over 8% on a daily basis. On a weekly basis, BNB lost more than 22%.

BNB weekly price chart / Source: CoinMarketCap

BNB weekly price chart / Source: CoinMarketCapBinance saw a net outflow of $392 million during the day

Amid the ongoing legal battle with the US Securities and Exchange Commission (SEC), Binance CEO Changpeng Zhao (CZ) shared on Twitter his concerns about the net outflow of funds from the cryptocurrency exchange. CZ’s announcement came shortly after the SEC filed a lawsuit against Binance. CZ highlighted the difference between measuring net outflow and assets under management (AUM) in USD equivalent. He also drew attention to the impact of sharp price movements and arbitrage traders on fund transfers between exchanges.

According to our data, last 24hrs, @Binance net outflow is about $392m.

Our wallet addresses are public. Some 3rd party analytics measure Change in AUM (asset under management) in USD equivalent as outflow. This would include crypto price drops (which decrease AUM) as "outflow".…

— CZ 🔶 Binance (@cz_binance) June 10, 2023

CZ’s post revealed that Binance’s net outflow in the last 24 hours was approximately $392 million. However, the CEO stressed that net outflow should not be considered the only indicator of asset loss for the stock market. It covers various factors that can significantly affect the overall AUM, including crypto price drops. CZ argued that measuring outflows alone cannot provide a comprehensive understanding of Binance’s financial stability. Therefore, it aimed to correct misunderstandings by urging stakeholders to consider both inputs and outputs.