According to crypto analyst John Isige, an uptrend is likely for the Shiba Inu (SHIB) in the coming sessions. The analyst says SHIB is in a buy zone. However, “Should you take it from the bottom?” seeks an answer. Ripple, on the other hand, enjoyed the market turmoil and gained 10% in one day. According to analyst Filip L, the XRP price has a positive spillover effect from the currency war that is currently underway. We have compiled analysts’ analysis of SHIB and XRP for our readers.

“Shiba Inu started the whole token burning spree”

David Gokhshtein, founder of Gokhshtein media and a former US Congressional candidate, paid tribute to the Shiba Inu community for starting the burning spree in the crypto ecosystem. cryptocoin.comAccording to Gokhshtein, SHIB brought “all this burning frenzy” to life.

After the Shiba Inu retraced from its all-time high of $0.00008616, the community blamed its low price and its massive maximum supply for its failure to rally. They forced the team to allow a voluntary token burn. Worried investors believe that a drop in supply will trigger a price reversal. The Shiba Inu community has burned 60 billion tokens so far. Also, it still burns.

Is it time to buy the Shiba Inu?

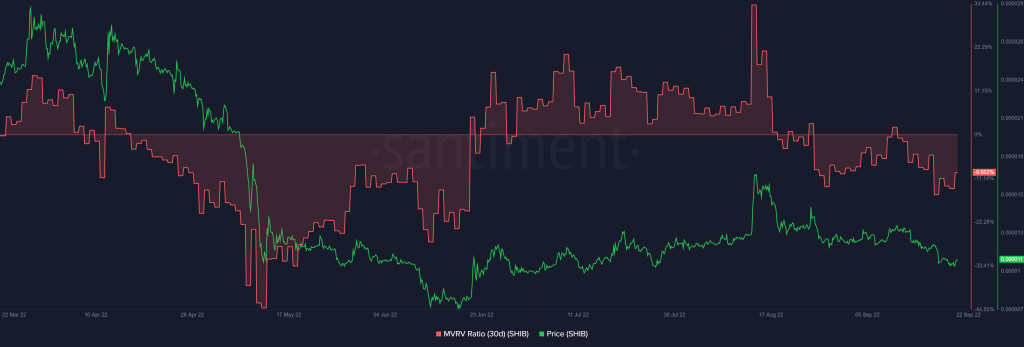

The token burn effort is unlikely to affect SHIB immediately, especially in the bear market. But its effect will be seen in the future. For now, SHIB price is more interested in holding the support above $0.00001040, and reclaiming the lost ground at least $0.00001800. The Stochastic oscillator on the daily chart shows that rates are already tipping the scales up. With a sustained breakout from the oversold zone, the index confirms the bullish potential of SHIB

SHIB daily chart

SHIB daily chartSHIB needs to successfully deal with the resistance at the middle border of the descending channel to break free of the strong bearish chains holding it back from recovery. However, until the SHIB breaks above the channel, traders will have to deal with more bearish uncertainty below $0.00001000.

Shiba Inu IOMAP diagram

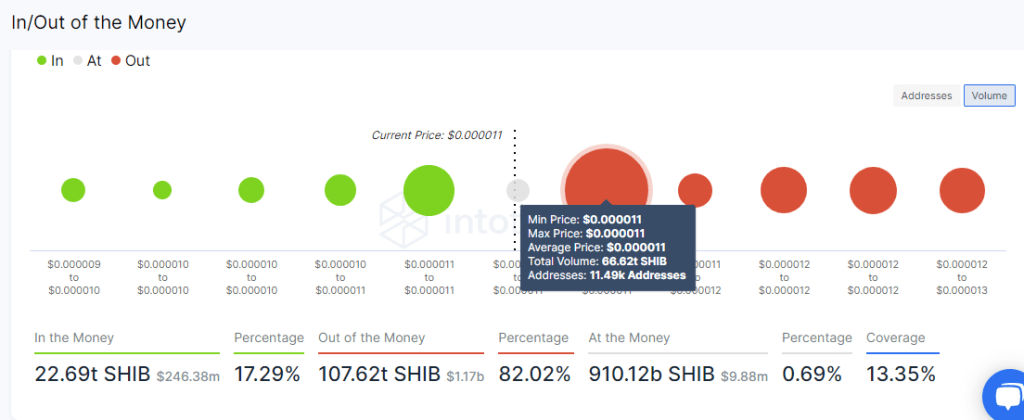

Shiba Inu IOMAP diagramIntoTheBlock’s on-chain IOMAP metric reveals heavy vendor congestion around $0.00001100. About 11,500 addresses purchased 66.62 trillion SHIB tokens in the range previously.

Strong resistance like this suggests that recovery will be limited as investors sell at their breakeven points. On the other hand, the absence of solid support areas casts doubt on SHIB, which is labeled as a floor price. Therefore, it is necessary to be careful until a continuous break occurs.

“Ripple may show its best performance for 2022”

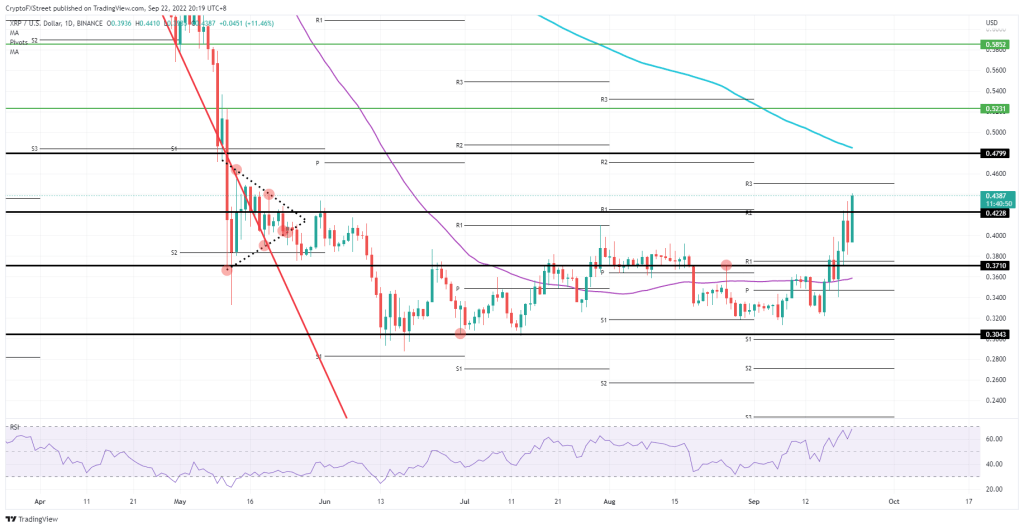

In Ripple price, the rally that sparked this morning continues. However, it is possible to print more than 20% of the earnings. Bulls in various trading sessions around the world are rushing to be a part of the breakout trade that first broke above $0.4228 and is poised to climb as high as $0.4799. The move comes after a shocking moment in the forex space, where the dollar weakened against several currencies, with the Swiss franc, both risky currencies putting huge bearish pressure on cryptocurrencies.

XRP daily chart

XRP daily chartTherefore, Ripple price has plenty of room to move suddenly. It also sees bulls harnessing this momentum as the Relative Strength Index rises. A possible second push to $0.4600 followed by $0.4799 is possible in the US trading session. That’s as far as the rally continues, at that point the 200-day Simple Moving Average will enter the scene to limit price action, along with the Relative Strength Index breaking the overbought barrier.

In these volatile markets, the risk is likely price action to peak and then fade to the downside. We’ve seen this before in the forex intervention of the BoJ, whose influence is diminishing every minute. Likewise, XRP’s rally is likely to run out of fuel. A full reversal of gains will be at risk for today if the rally returns to the opening level below $0.4000.