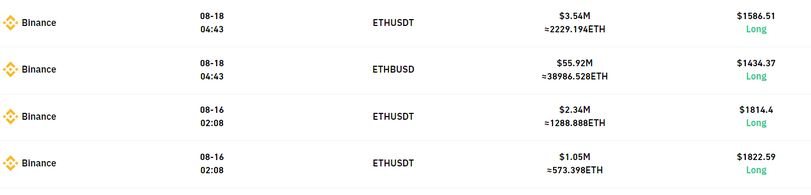

An unknown single trader, or a trading entity, lost $55 million on an ether trade against binance usd (BUSD) on crypto exchange Binance as crypto markets plunged suddenly late on Thursday, data shows.

The position was made up of 38,986.528 ether (ETH) and liquidated at the $1,434 price level. That was nearly 30% of all liquidated futures on Binance, the data shows.

The unusual amount for a single trader suggests a large firm, or a large ether holder, was hit hard in yesterday’s steep drop.

Large liquidations on ether trades on Binance. (Coinglass)

Ether dropped from $1,780 to as low as $1,560 within minutes, with trading volume surging from $6 billion to over $20 billion across exchanges.

The asset then quickly recovered some of those losses amid late reports of U.S. securities regulators planning to approve ether (ETH) futures ETFs for trading in the country. ETH traded at just over $1,690 in Asian evening hours on Friday – down 6% in the past 24 hours.

Such a price drop in ether came amid one of the largest futures liquidations in over a year – higher than the market impact of crypto exchange FTX’s collapse.

Data suggests highly leveraged longs, or bets on, higher prices were taken out in a textbook long squeeze event amid unsubstantiated rumors of SpaceX selling its bitcoin holdings. The company merely wrote down the book value of its holdings, which was interpreted by sales in parts of the market, leading to selling pressure.

Bitcoin fell 7% in the past 24 hours, registering its largest drop in recent months amid a period of low volatility. Meanwhile, xrp (XRP), doge (DOGE) and bitcoin cash (BCH) led losses among majors falling as much as 15%.