There are reports examining how smart money moves between Bitcoin, Ethereum and others. The latest report came from Coinshares. Let’s look at the details.

Strong inflows and trading volumes boost investment products

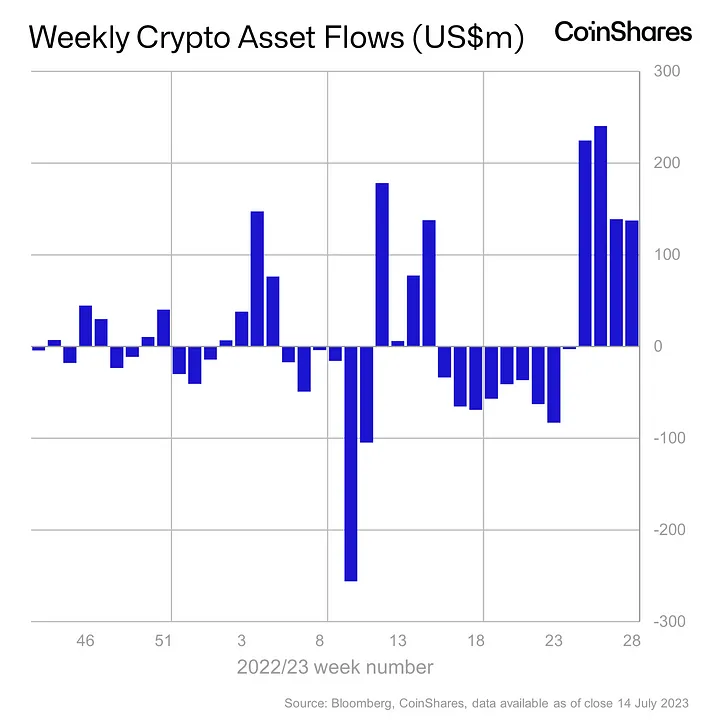

In the world of digital asset investment products, Bitcoin continues to attract the majority of entries. On the other hand, Ethereum is experiencing downsides despite the recent price increase. Over the past four weeks, there have been significant inflows into these investment products totaling $742 million. It also marks the biggest entry since Q4 2021.

Digital asset investment products generated $137 million in inflows last week, contributing to an impressive four-week total of $742 million. The transaction volumes of these products were well above the annual average. Accordingly, it reached $2.3 billion last week. This increase in volumes accounts for a significant portion of the overall crypto market. On the other hand, it accounts for 11% compared to the 2% average.

North America takes the lead in entries

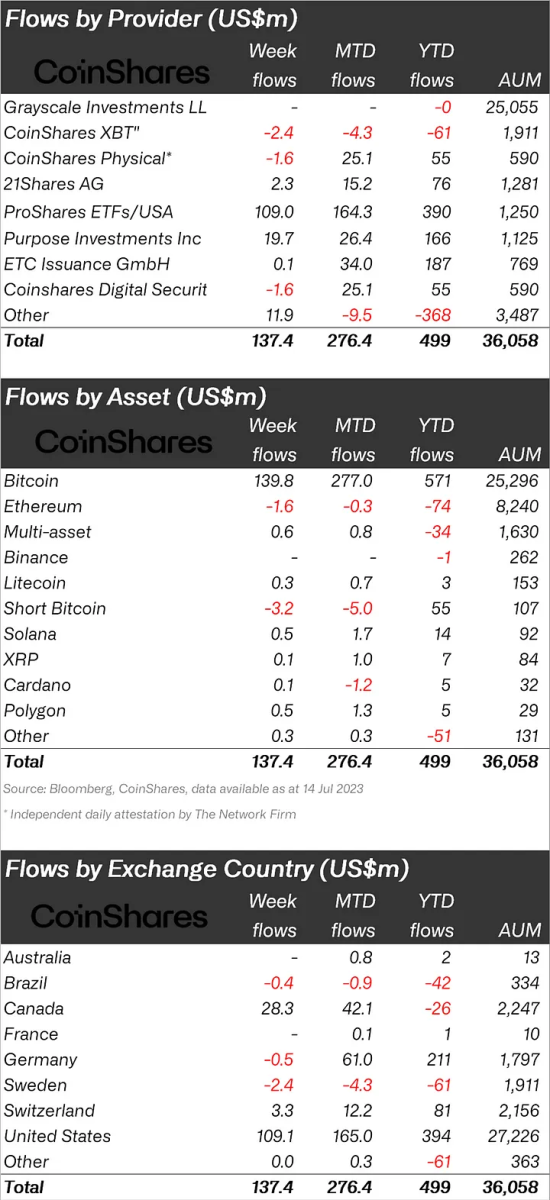

North America, particularly the United States and Canada, witnessed significant inflows of $109 million and $28 million, respectively. In Europe, on the other hand, there were small-scale exits. However, small-scale entries were seen in Switzerland as the only exception.

Bitcoin remains a focus for investors as it accounts for 99% of all entries, with a total of $140 million. However, there was an outflow of $ 3.2 million in short-focused Bitcoin investment products for the 12th week in a row. The combination of price increase and exits has caused total assets managed for short-focused bitcoin products to drop to just $55 million, from a peak of $198 million in April.

Ethereum crashed

Contrary to the recent price increase, Ethereum hit $2 million last week. As a result, it remains the highest exiting asset year-to-date. Other altcoins such as Solana, Polygon, and Litecoin have witnessed small inflows ranging from $0.3 million to $0.5 million. cryptocoin.com When we look at it as a whole, Bitcoin continues to increase inflows. However, Ethereum is running into difficulties.

Bitcoin continues to dominate the digital asset investment products market in attracting entries. On the other hand, Ethereum is struggling to generate investor interest despite price increases. The strong momentum and increasing trading volumes in these products demonstrate increased confidence among investors. As the market evolves, monitoring the entry patterns of leading cryptocurrencies will provide valuable insight into overall sentiment and potential investment opportunities.