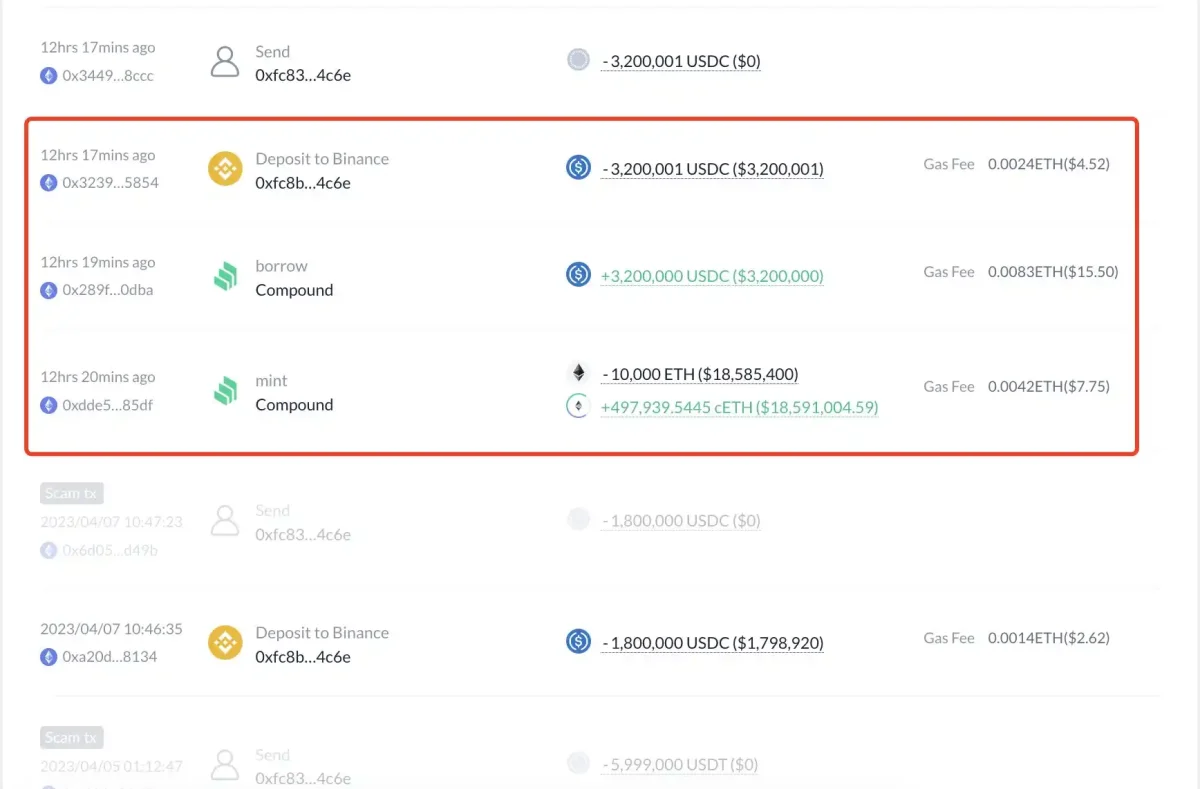

The smart money deposited 10,000 ETH on Compound, borrowed 3.2 million USDC and transferred it to Binance, the world’s largest cryptocurrency exchange. The smart money address labeled “Clairvoyant Labs” drew 1.7 million BLUR from OKX.

Invested ETH in smart money Compound and borrowed USDC

According to Lookonchain, a SmartMoney address deposited 10,000 ETH (approximately $18.6 million worth) in Compound (COMP) today and then borrowed 3.2 million USD in Coins (USDC) and transferred it to cryptocurrency exchange Binance.

According to Lookonchain’s long-term tracking data, the main way the address works is to sell ETH high and low. Also, the smart money address has been using it as a profit tool for a long time. Therefore, it is assumed that the 3.2 million USDC transferred to Binance will be used to purchase ETH.

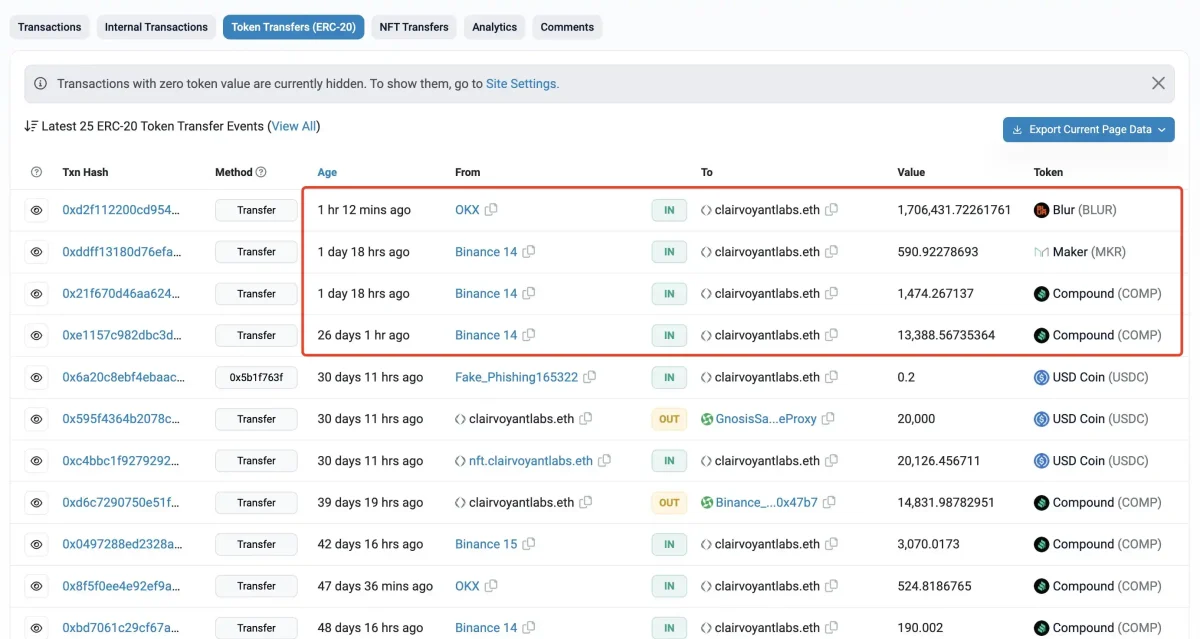

Clairvoyant Labs withdraws 1.7 million BLUR from OKX

As tracked by on-chain data analyst Yu Ashes, the smart money address labeled “Clairvoyant Labs” pulled 1.7 million BLUR from cryptocurrency exchange OKX to Blockchain during the day.

The rise and influence of Blur

cryptocoin.com As you follow, a key factor contributing to the perceived resilience of the Non Fungible Token (NFT) market was the emergence of Blur, an NFT trading platform, in late February that quickly overtook OpenSea as the leading market. However, Blur’s success has been driven by a rewards system that has convinced traders to abandon other platforms and enter fast, potentially pointless trades.

While the digital collectibles market rallied in February and March, totaling nearly $2 billion in total trade each month, this growth was mainly driven by the volume of Blur, which some experts see as a manipulated “washing trade.” Over the past week, Blur accounted for over 60% of all NFT trading volume. However, the platform’s tactic of attracting customers from other platforms and encouraging them to make surface trades may have ultimately dampened real market activity.

Some experts attribute the recent decline in NFT trading to an increase in gas fees, possibly due to the rise of meme coins like PEPE. In a recent Twitter thread, analytics firm SeaLaunch suggested several macro factors, including high gas fees and liquidity challenges around the US tax deadline. Others see these depressing numbers as proof that the long-awaited “bottom” has finally been reached in the crypto and NFT bear market. However, as the past year has shown, further declines are possible.