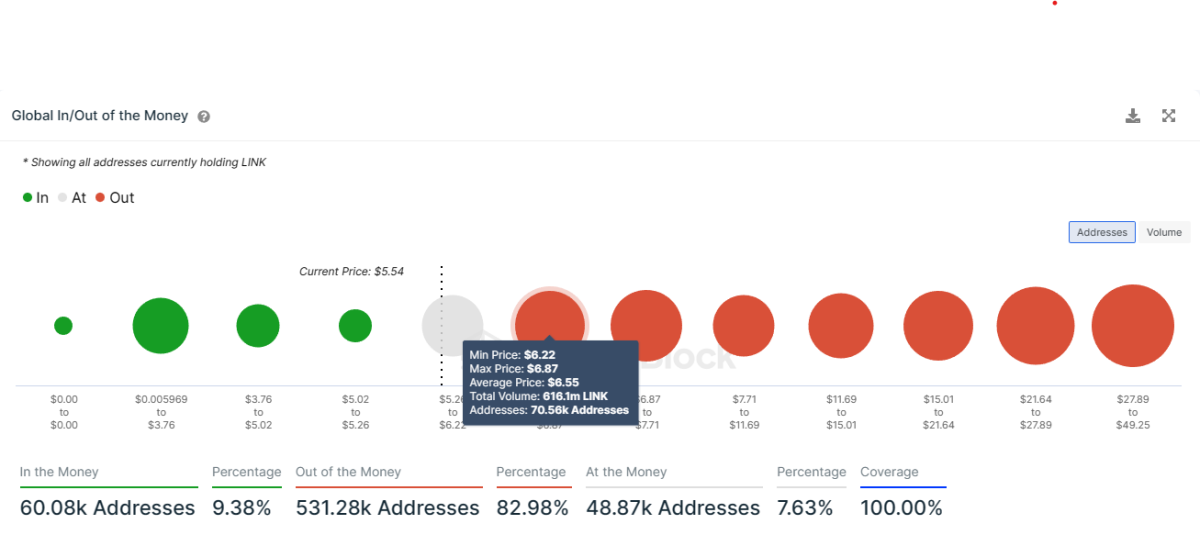

Currently, over 70,000 LINK traders are waiting for the price to rise another 20% to sell. Even in such a situation, only some of these investors will be able to close their positions ‘profitably’. Alongside this sell wall, the findings from Coinshares’ weekly fund flow report show that smart money is becoming more moderate against some altcoins.

Chainlink (LINK) rally instills hope: Calls on vendors

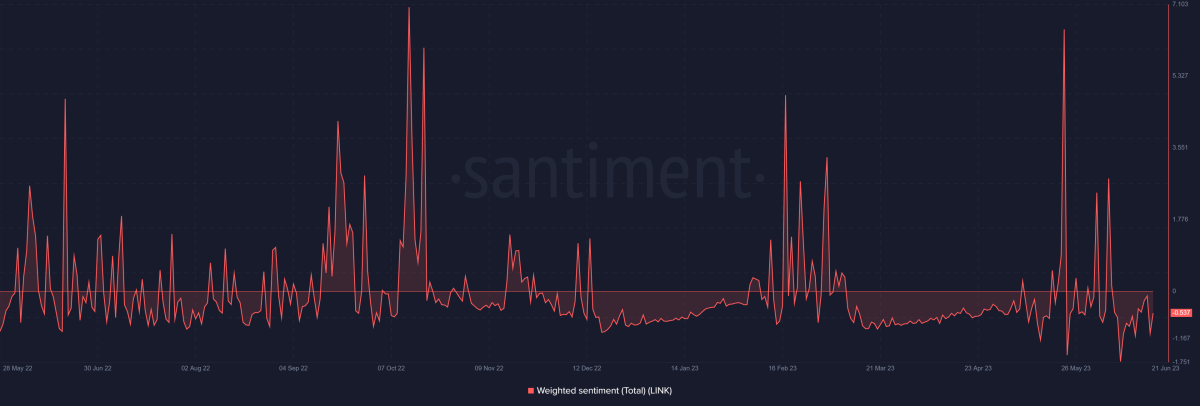

Chainlink price is currently trading at $5.56, up more than 8% over the past two days. Until the last rally, investors remained generally pessimistic, except for a few spikes at the beginning of June.

On the other hand, earlier last week, LINK holders sold more than 16 million tokens worth $88 million per day, trading at $5.20. This supply would be more valuable right now if they continued.

LINK bears come into play at this level

Chainlink price reversed its trajectory as of June 21. Therefore, if the altcoin manages to successfully break the $6.55 mark, the next wave of selling could occur. The reason behind this is the demand wall at this price level where 616 million LINK tokens were purchased by over 70,000 addresses. This supply, worth about $3.4 billion at the current price, will definitely be a trigger for profit booking.

However, LINK owners will have to be patient a little longer. Because $6.55 is more than 18% off. If the recovery slows, it will be significantly harder to regain this price level.

PEPE witnessed massive whale transaction as it rose 90%

Popular meme token PEPE is back in action today. It gained more than 90% on one note during the day. Meanwhile, in a transaction that caught Lookonchain’s radar, a gigantic whale bought 3.43 trillion PEPE coins. The same whale had been rich with PEPE before. He made a profit of $11.47 million from one transaction. But in another, he lost $741,000. cryptocoin.comwe have conveyed what levels analysts are now expecting in PEPE.

Whale"0x31f5" spent 4.54M $USDC and 150 $ETH ($287K) to buy 3.43T $PEPE at $0.000001406 in the past 8 hours.

The whale made ~$11.47M on $PEPE for the first time and lost ~$741K on $PEPE for the second time. pic.twitter.com/SeS8P7jaQ3

— Lookonchain (@lookonchain) June 22, 2023

The pursuit of smart money XRP

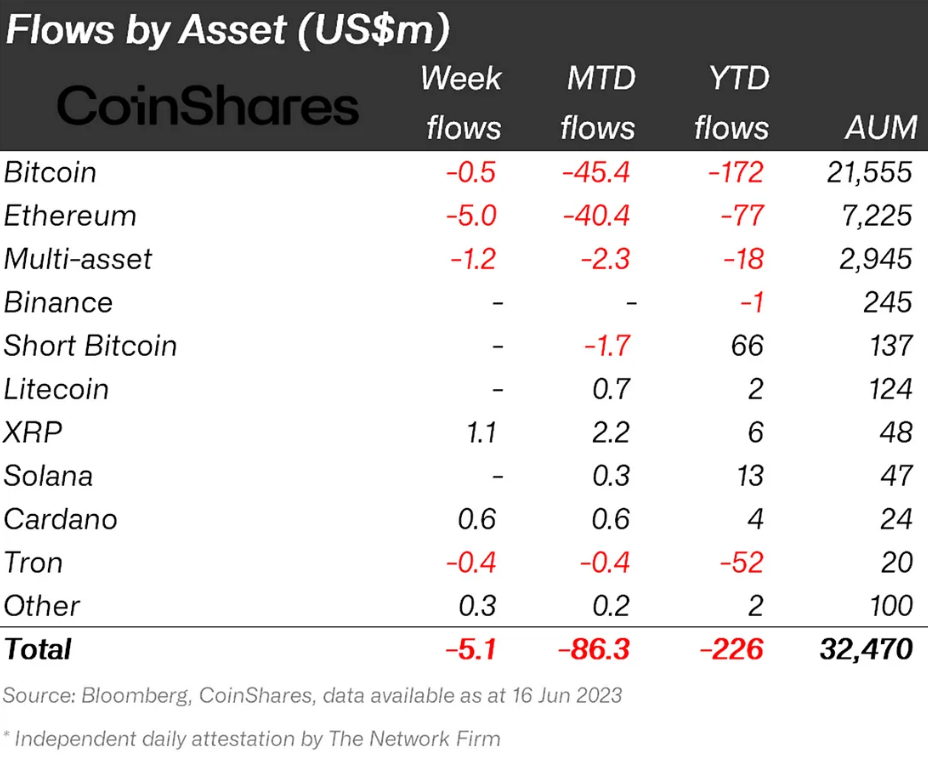

Findings from Coinshares’ weekly fund flow report show that XRP is among the limited altcoins that have seen positive entry this week. In the week ending June 16, the crypto market observed a recession in terms of exits from institutional investors for the first time in eight weeks. Despite still recording the exit, XRP has emerged as the most preferred altcoin. It generated $1.1 million in entry against other cryptocurrencies.

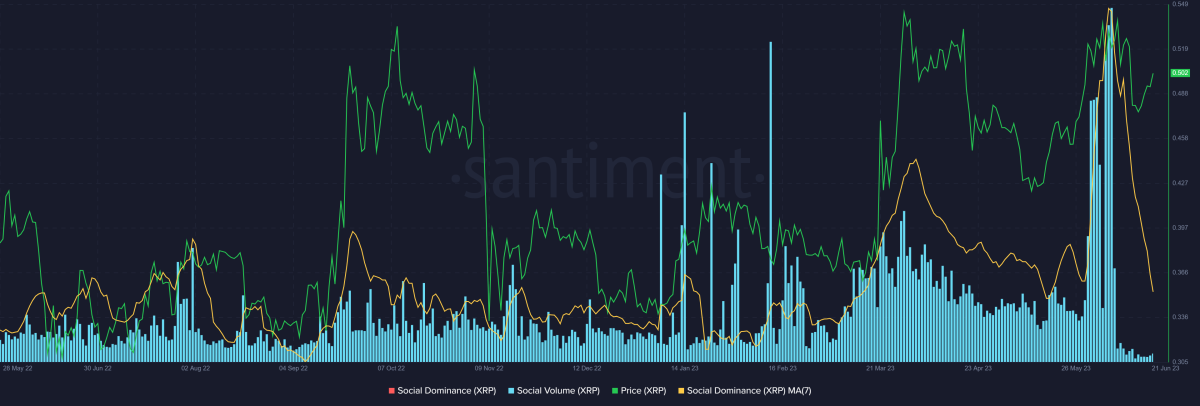

In terms of price, XRP has emerged from the two-month downtrend. The altcoin has crossed the key psychological level of $0.50. Earlier today it hit a high of $0.5276. The next target is XRP’s local high at $0.6558.

Also, XRP was at its highest, managing more than 3.7% of all crypto social interest. So for every 100 crypto-related queries, XRP alone was responsible for almost 4 of them.

The only way this interest can be rekindled is if the SEC’s lawsuit against Ripple ends in Ripple’s favour. This triggers a bullish wave in individual investors, pulling the XRP price up again. Meanwhile, cryptocoin.comAs we have reported, multiple experts say that the final decision will be made very soon.