Traders who take advantage of the latest developments around TrueUSD (TUSD) are taking advantage of the situation by borrowing large amounts from Aave. According to on-chain data, they have started a strategy of borrowing and selling immediately on the altcoin.

Altcoin hunters watch for opportunities around TUSD

On-chain data shows that an Ethereum user deposited 7.5 million USDC as collateral on Aave’s V2 lending platform. The trader then borrowed another stablecoin, 4 million TUSD, with this fund. It immediately converted it back to USDC. This strategy is often used to short a particular altcoin. The targeting of TUSD builds on the recent developments around Prime Trust.

Earlier this month, the company behind TUSD made an announcement regarding the suspension of issuing new TUSD through Prime Trust. Subsequently, the Financial Institutions Division (FID) of the Nevada Department of Commerce and Industry issued a cease and desist order against Prime Trust. The latest development was that Prime Trust abruptly suspended withdrawals on June 20…

Announcement:

TUSD mints via Prime Trust are paused for further notification.

Thanks for your understanding and we are sorry for any inconvenience. Please contact [email protected] for any further questions.

— TrueUSD (@tusdio) June 10, 2023

cryptocoin.com As we have reported, BitGo’s canceled Prime Trust purchase agreement was followed by the decision to suspend transactions. In response, TrueUSD announced that its respective operations were not affected. In an announcement, he stated that they are not exposed to the Prime Trust. It also confirmed that they have multiple USD rails for printing TrueUSD.

PrimeTrust has suspended all deposits of fiat and digital assets. #TrueUSD (#TUSD) is not affected by this situation. We have no exposure to Prime Trust and maintain multiple USD rails for minting and redemption. Rest assured, all your funds are safe with TUSD.

— TrueUSD (@tusdio) June 22, 2023

Impact of TUSD on BTC rally

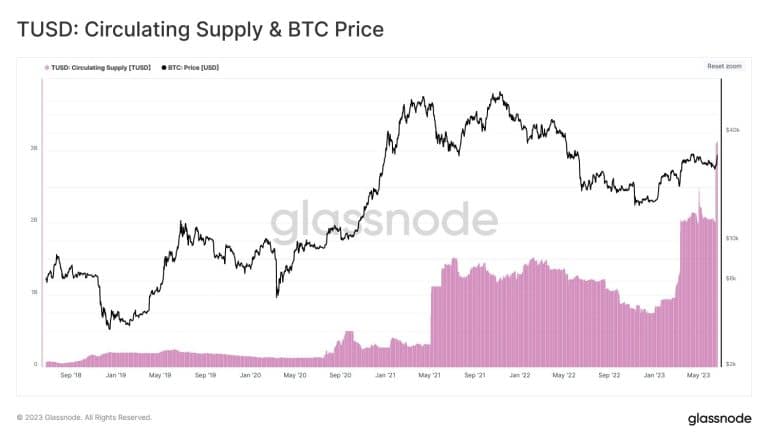

Also, the data shows the impact of TUSD on Bitcoin’s rally as supply increases are in line with Bitcoin’s price increases. Data from CryptoViz revealed that the circulating supply of TUSD has witnessed significant increases in excess of $1 billion on just three different occasions since 2018. These events took place in May 2021, February 2023 and June 2023.

Interestingly, after each surge, Bitcoin started a rally in a relatively short period of time.

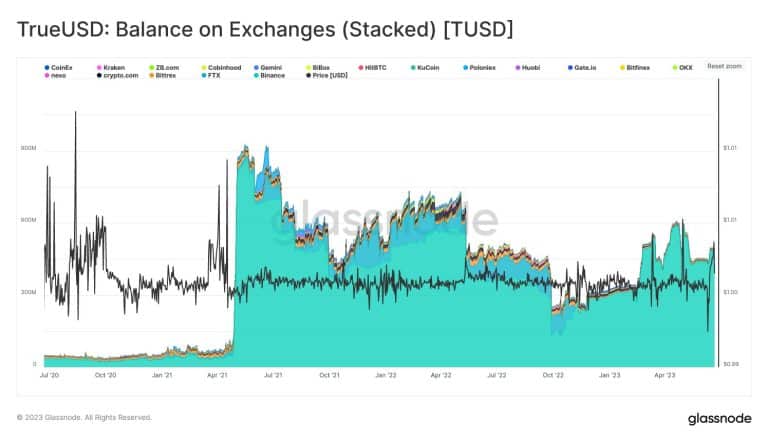

Currently, Tron accounts for 76.45% of the total TUSD supply. Ethereum follows Tron with a share of 22.5%. A closer look at the distribution of TUSD supply among different exchanges highlights Binance’s overwhelming dominance.

Analysis of the trading volume of the top three BTC spot pairs also revealed an interesting trend. BTC/TUSD volume has surpassed that of BTC/USDT, showing the increasing dominance of TUSD as a trading pair.

CryptoQuant CEO Ki Young Ju suggested that TUSD follows a similar trajectory to USDT. TUSD no longer functions as a direct ramp for converting cryptocurrencies to fiat. However, it is still possible to raise TUSD to other cryptocurrencies on various exchanges.