Whale watching bots have detected anomalous whale activity around several altcoins along with SHIB. The purchases of smart money come when prices approach critical supports.

Smart money boosts SHIB savings ahead of upcoming news

Shiba Inu whales are back on the market this week with a $9 million purchase. The Santiment report reveals that whales holding between 10 and 100 billion SHIB have accumulated a staggering 1.11 trillion SHIB since June 4.

As of today, the total SHIB reserve of this class of whales is worth approximately $265.73 million. Whales hold a total of 32.49 trillion SHIB.

SHIB price pricing for upcoming Shibarium launch

The increased volume of whales may be linked to the upcoming launch of the Tier-2 Shibarium network. cryptocoin.comAs you follow, SHIB developers have launched a testnet bridge connecting Shibarium to Ethereum.

This bridge facilitates token transfers between the two Blockchains. Meanwhile, the first indicators from Shibarium’s testnet were also promising. While there has been a small drop in daily transaction numbers since mid-July, Puppyscan data shows over 33 million transactions, 17 million addresses and 1.89 million blocks. All these positive developments helped SHIB, which at one point slip out of the top 20, return to 14th place.

On the radar of whales at PEPE

Pepe (PEPE), another meme token that has been on the whales’ radar, has seen multi-million dollar purchases from several whales. According to LookOnChain, this week several whales bought 1.56 trillion Pepes for 1,100 ETH. The value of the acquisition in fiat was approximately $2.06 million.

The first whale named “Yougetnothing.eth” spent 600 ETH or $1.12 million for 874 billion PEPE, while another whale named “0x4631” spent 500 ETH or $936,000 for 685 billion PEPE.

2 whales bought 1.56T $PEPE with 1,100 $ETH($2.06M) today.

yougetnothing.eth spent 600 $ETH($1.12M) to buy 874B $PEPE at $0.000001286 ~12 hrs ago.

0x4631 spent 500 $ETH($936K) to buy 685B $PEPE at $0.000001366 ~6 hrs ago. pic.twitter.com/DQx3biCSh2

— Lookonchain (@lookonchain) July 27, 2023

Meanwhile, PEPE price has increased by over 6% on the daily timeframe. Despite this momentum, IntoTheBlock data shows that profit holders are down by 8.22%. Currently, only 36% of Pepe investors are in profit, 57% are in loss, and 8% are even. Additionally, whale transactions fell 2.34% on the broader picture.

Whale interest in PEPE is supported by speculation that Dogecoin (DOGE) will be integrated into X. It is also possible that the acquisition will drive the Evil Pepe memecoin wave. Evil Pepe is a new crypto project that has earned $640,000 in pre-sales in just over a week.

Back in Ethereum (ETH) with SHIB and PEPE

Recently, Ethereum (ETH) has seen a boom in block trading activity, with more than 137,000 blocks purchased, reaching a notional value of over $250 million. This enormous amount represented 55% of the total volume of the day. This is an important ratio that attracts the attention of both market analysts and participants alike.

If these block purchases continue, we could see an upside surge in Ethereum’s price. This significant move in the options market potentially catalyzes further bullish activity. Also, despite recent market volatility, long-term confidence in Ethereum’s potential remains strong.

ETH continued to see block trade today, with 137,000 block calls traded with a notional value of over $250 million, accounting for 55% of the day's total volume.

The volume was concentrated in end of year Dec29 OTM calls and was dominated by naked buying, with another small… pic.twitter.com/czCAyaTmw8— Greeks.live (@GreeksLive) July 28, 2023

Smart money does not ignore Bitcoin either

Recent reports from CryptoQuant show that whales continue to accumulate BTC while the price remains flat. Citing three data points in its latest weekly report, CryptoQuant concluded that whales holding 1,000 to 10,000 Bitcoins are accumulating more BTC this year. The whales continued to accumulate around $30,000.

3 data points pointing to whale accumulation for BTC

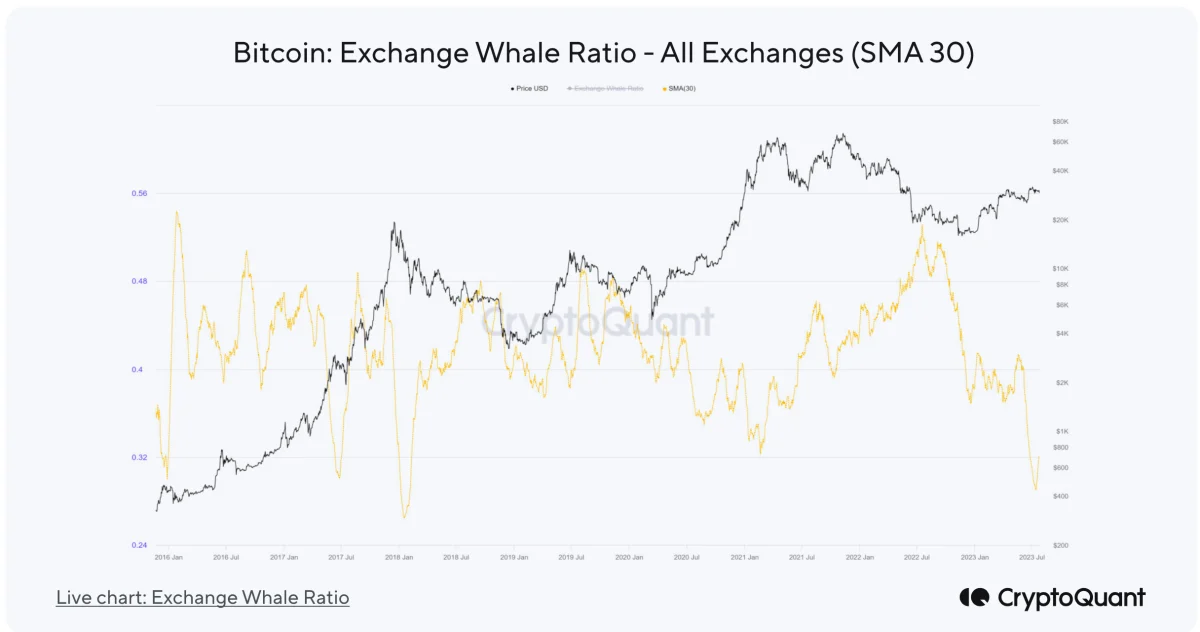

The first data point, the Bitcoin exchange whale rate, shows the entries into an exchange by whales on a given day. CryptoQuant reports that Bitcoin’s currency whale rate has reached a 5-year low on all exchanges using the simple moving average (SMA 30) in the past 30 days. The report also shows that the top 10 entries to the exchanges are noticeably small compared to the total entries.

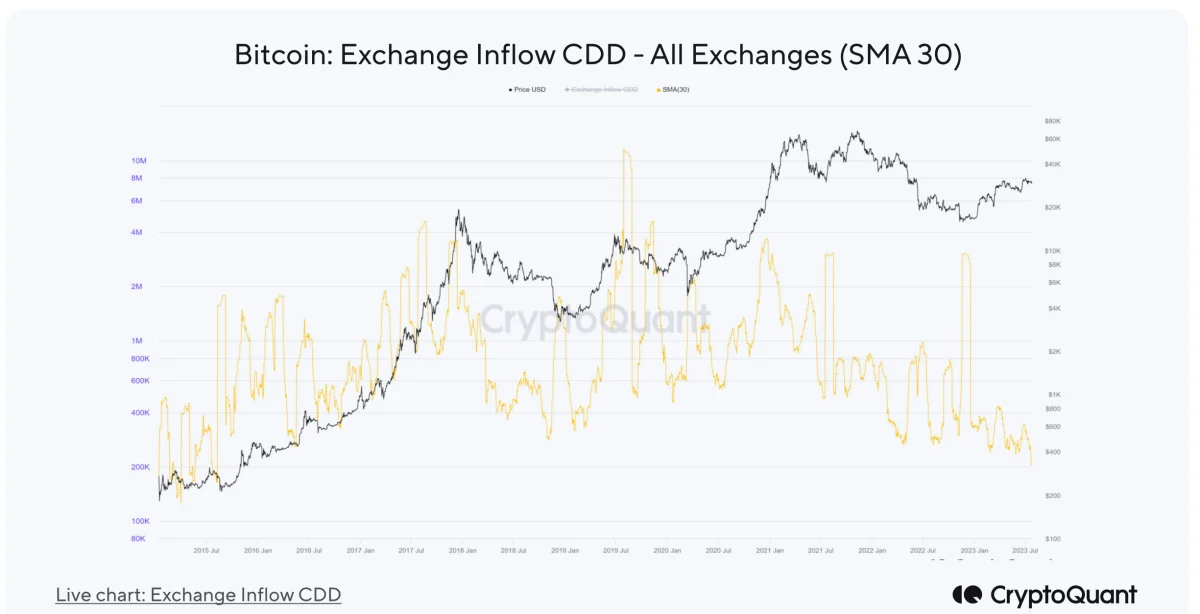

The second data point, destroyed currency-in-coin days (CDD), measures how long Bitcoin was held at an address before it was last moved. CryptoQuant notes that Bitcoin’s stock market CDD has reached an 8-year low on the SMA 30 basis. This shows that inflows from long-term investors to the stock markets have been at historically low levels. In other words, whales are not actively moving their BTC to exchanges for sale purposes.

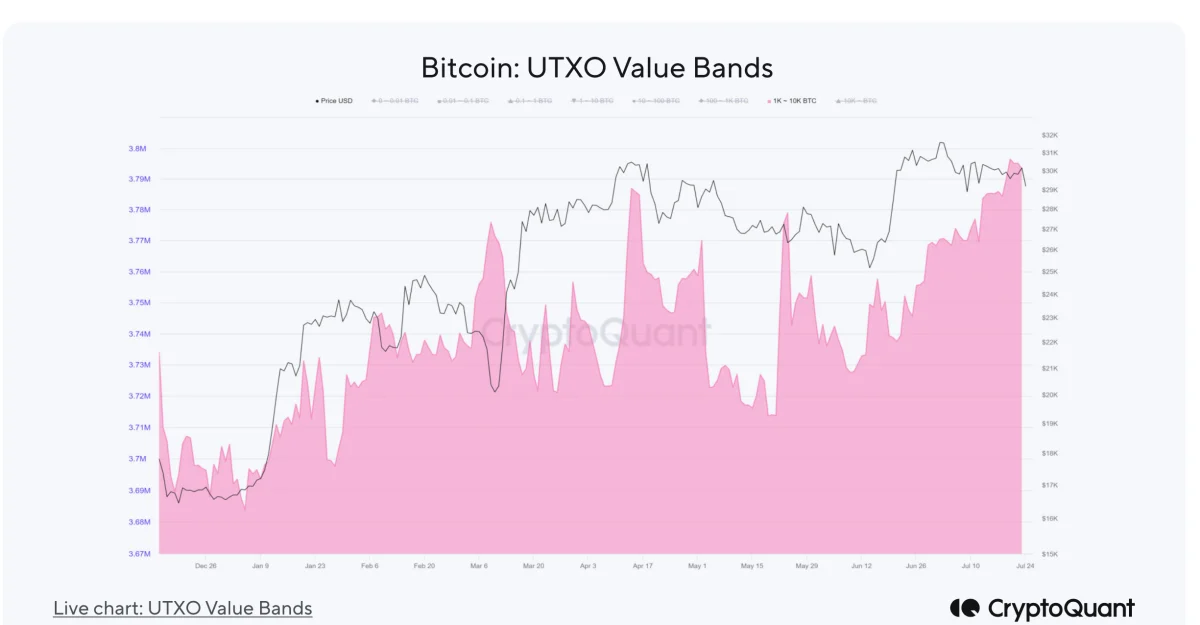

The 3rd data point unspent transaction throughput (UTXO) value bands represent unspent BTC amounts at different addresses. “You can think of UTXO as a box containing some Bitcoin,” said Mikołaj Zakrzowski, research analyst at CryptoQuant. Each UTXO points to only one public address. For example, the amount of BTC you see in your wallet is actually multiple UTXOs representing your public address. Together they make up the number you see as the ‘balance’ in your wallet when added up.”

CryptoQuant says Bitcoin’s 1,000 to 10,000 Bitcoin UTXO value band is rising. The firm adds that this means that whales holding 1,000 to 10,000 Bitcoins are accumulating more BTC.