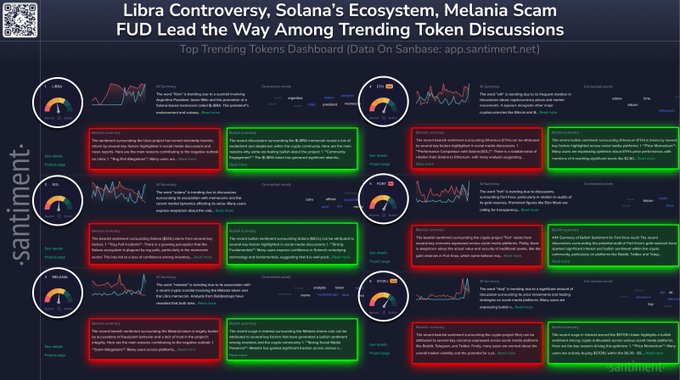

Solana -based breast Coin Lıbra associates Argentine President Javier MilEi with allegations of fraud after its promotion and collapse. Analysts warn that breast coins dilute liquidity and want to focus on the foundations of Solana. According to analysts, Solana’s ecosystem can fuel a rally, especially with its potential ETF approvals.

The breast coin craze put Solana in trouble!

Solana breast coins are now faced with a hard spotlight. Because the scandals containing Lıbra and Melania tokens put Blockchain’s investor funds at a serious risk. These events, solana breast coin market ‘Pump-And Sump’ plans to raise the questions by raising questions about investor confidence.

Source: centimeter

Source: centimeterThe price of Lıbra, a Token, who is said to be linked to Argentine President Javier Milei, rose after Milei praised this token. He even released an solana -based token to get a guide. Then, almost instantly, LIBRA collapsed and sweeping investors. Argentine lawyers now claim that Milei is fraudulent by suggesting token.

LIBRA AND MELLANIA: A complex network

Blockchain analysts in Bubbleaps also added a bomb to the controversy: LIBRA’s connection with the name of the former First Lady Melania Trump. Research showed that both toks came from the same team. This news caused everyone to wonder if the Inside Trading and Solana could really trust the breast coin market. Traders seriously ask if these projects have only Pump-and-Dump plans.

Since the days of Pump.fun, many projects in Solana have seen more than 80-90 %losses. Some investors think that solana means weakened, while others see it as a chance to load it to the left at lower prices.

Despite the breast coin problems solana (left) is still a safe investment?

Market analysts are concerned that breast coins will disrupt liquidity and make Solana to maintain a strong price rally. However, experienced investors point out that the purchases made when they were calm usually come before the big breaks and especially if an ETF approval brings back attention, it is potentially paved the way for a recovery.

Network resistance even in previous mishaps, such as FTX collapse that pulled the left down from the summit. An analyst, “The power of a currency is not measured by the highest levels, but by how it is based on the lowest levels. Solana survived the worse. It will rise again. ” he said. There is a big decision that investors should make with transaction volumes exceeding $ 7 billion, opening large token locks and changing liquidity trends: chasing the next breast coin pump or investing in the long -term power of the left.