Significant Liquidations as Bitcoin Dips Below $100,000

In a turbulent turn of events, bullish bets on rising cryptocurrency prices have suffered a staggering loss of approximately $770 million in just the past 24 hours. This downturn was triggered by Bitcoin’s slide below the $100,000 mark, causing major cryptocurrencies to rapidly lose momentum at the start of the week. Among the hardest hit were Solana’s SOL and Dogecoin (DOGE), both of which experienced declines exceeding 10% in value. Other notable cryptocurrencies, including Ether (ETH), BNB Chain’s BNB, XRP (XRP), and Cardano’s ADA, also faced losses of up to 9%.

The overall cryptocurrency market capitalization witnessed a significant drop of 8.5% as of Monday afternoon in Asia. Tokens outside the top twenty, spanning various sectors, similarly exhibited distress, with memecoin Pepe (PEPE), the layer 1 blockchain Aptos (APT), Gate.io’s GATE, and the AI agent creation platform Virtuals (VIRTUALS) plummeting by as much as 18%.

In a rare positive note, Jupiter’s JUP managed to record a 3.5% gain over the last 24 hours. This increase came in the wake of a strategic decision to buy back tokens from the open market, funded by the fees generated on its trading platform. This move could potentially translate into hundreds of millions in net buying volumes over the course of a year.

Bitcoin itself dipped below $99,000 early on Monday as traders opted to take profits ahead of the first U.S. Federal Open Market Committee (FOMC) meeting of the year. This decline mirrored losses in U.S. stock futures, which fell as traders processed new information regarding the capabilities and costs associated with China-based DeepSeek, thereby challenging the narrative largely driven by OpenAI.

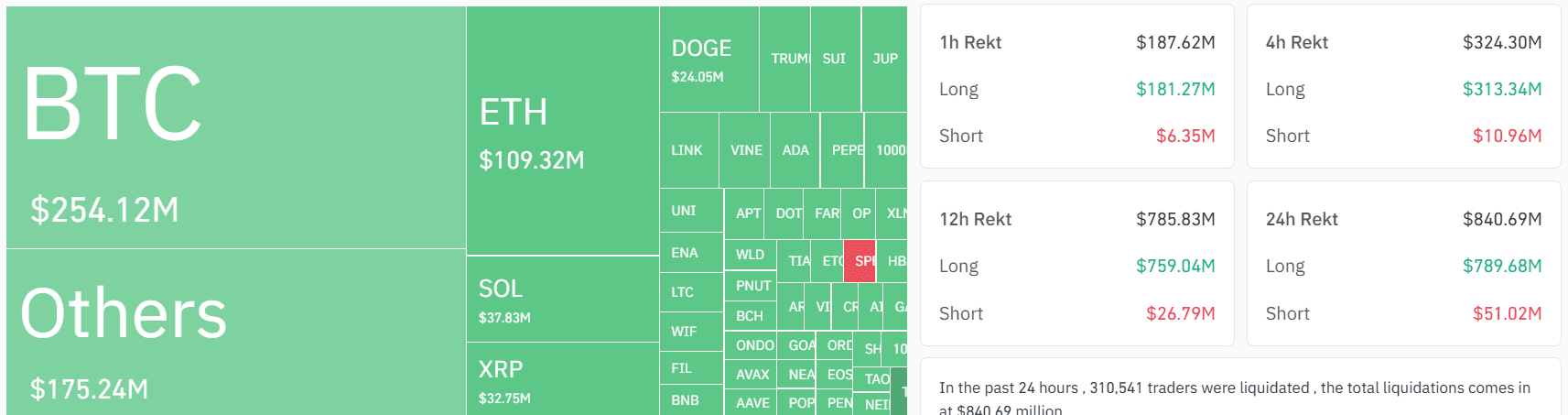

The futures markets reflected these losses starkly, with traders of Bitcoin-tracked products incurring losses of $238 million within the same 24-hour timeframe, predominantly during early European and Asian afternoon sessions. Cumulative losses for SOL and DOGE bets reached around $50 million, while altcoin-tracked products faced losses of $138 million. Ether-tracked futures also lost about $84 million, according to data from Coinglass.

The largest single liquidation order was recorded on HTX, a tether-margined Bitcoin trade valued at $98.4 million. Liquidation occurs when a trader lacks sufficient funds to maintain a leveraged position. The extreme volatility of the cryptocurrency market makes such liquidations commonplace; however, significant events like Monday’s can provide critical insights into market sentiment and positioning.

Liquidations can serve as indicators of an overstretched market, suggesting that a price correction has taken place. Additionally, price-chart areas characterized by high liquidation volumes may function as support or resistance levels, where price could reverse due to the absence of further selling pressure from liquidated positions. If the market continues to decline, traders holding short positions might interpret this as validation, potentially escalating their bets. On the other hand, contrarian traders may view heavy liquidation as a buying opportunity, anticipating a price recovery once the momentum of the sell-off diminishes.