Solana (left) has lost 13 percent in the last 30 days and remains below $ 200. The left, which had previously caught a strong momentum, worried investors with its recent decline signals. Technical indicators indicate that critical resistors should be broken for the recovery of the price.

Solana Price Analysis: What do the technical indicators say?

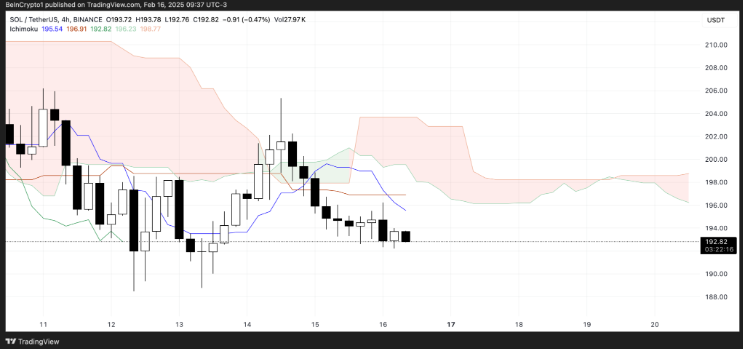

Solana’s Ichimoku Cloud indicator confirms a short -term decline tendency. The price is traded under the cloud and the weak momentum signals are remarkable. The blue transformation line is located under the brown basic line. This shows that short -term weakness can continue.

Unless above $ 200, the sales pressure on Solana will continue. If the resistance of $ 209 is broken, the price is possible to rise up to $ 219 and even to $ 244. However, if the $ 187 support level is lost, the SOL has a risk of decreasing up to $ 175.

Solana community: usage areas and discussions

Solana is on the agenda with breast coin projects recently. The controversial breast Coin named LIBRA was released and then the Pump-DUMP allegations created question marks on Solana’s reliability. The community argues that some Solana applications can victimize users.

Popular artist Gino Borri claimed that some projects in the Solana ecosystem have reduced the user value. On the other hand, helius CEO Mert Mumtaz argues that this is the result of a large -scale use of Solana. He says that speculation will always exist in the crypto world and these problems may be reduced with better regulation mechanisms.

Price estimation: $ 209 level critical

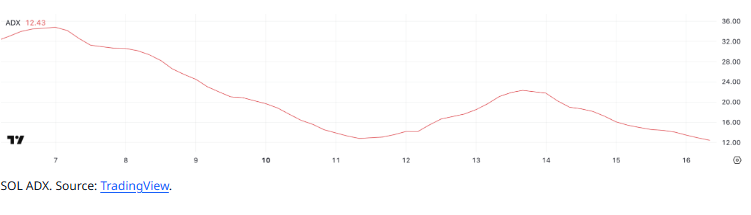

In order to recover the price of Solana, it needs to be above the $ 198 cloud resistance. The ADX indicator shows that the trend power is weak and that the current decline trend has not yet reversed. The ADX value is 12.4, which indicates that the trend power is low.

In order to begin the rise, price movements must be supported with high volume. ADX’s exceeding 20 levels may signal the trend change. Otherwise, the left price is likely to have further decrease or consolidation. Investors need to follow these critical levels closely. Solana’s direction in the coming days will depend on market conditions and investor demand.

To be aware of last -minute developments Twitter ‘in, Facebook ‘ Instagram follow and follow Telegram And Youtube Join our channel!