Solana (left) price fell today. Moreover, it is at risk of loss because the data indicates that the use of user interest in Solana’s defi ecosystem is reduced. Crypto analyst Nancy Lubale, Sol says he can see a harsh decline.

Solana TVL has declined to the lowest level of four months!

According to the fashion show, there was a decrease in total value (TVL) locked in the defi applications before the SOL’s current price drop. Solana’s TVL has been tending to decline since mid -January. This metric decreased from 12.1 billion dollars on January 19 to $ 6.63 billion with a 45.5 %decrease on March 11. TVL is currently 41 %below the January 19 summit with 7 billion dollars on 17 March.

Solana total value was locked. Source: fashion show

Solana total value was locked. Source: fashion showThis decrease in TVL took place with the decline in the price of the left, which fell 56 %in the same period. Various layer-2 protocols such as Jito and Raydium have decreased by 30 %and 32 %in TVL in the last 30 days. The decline in TV reflects the diminishing interest of investors. It is also a sign that Solana has difficulty in attracting new users despite low traction costs.

On-Chain activities are also declining!

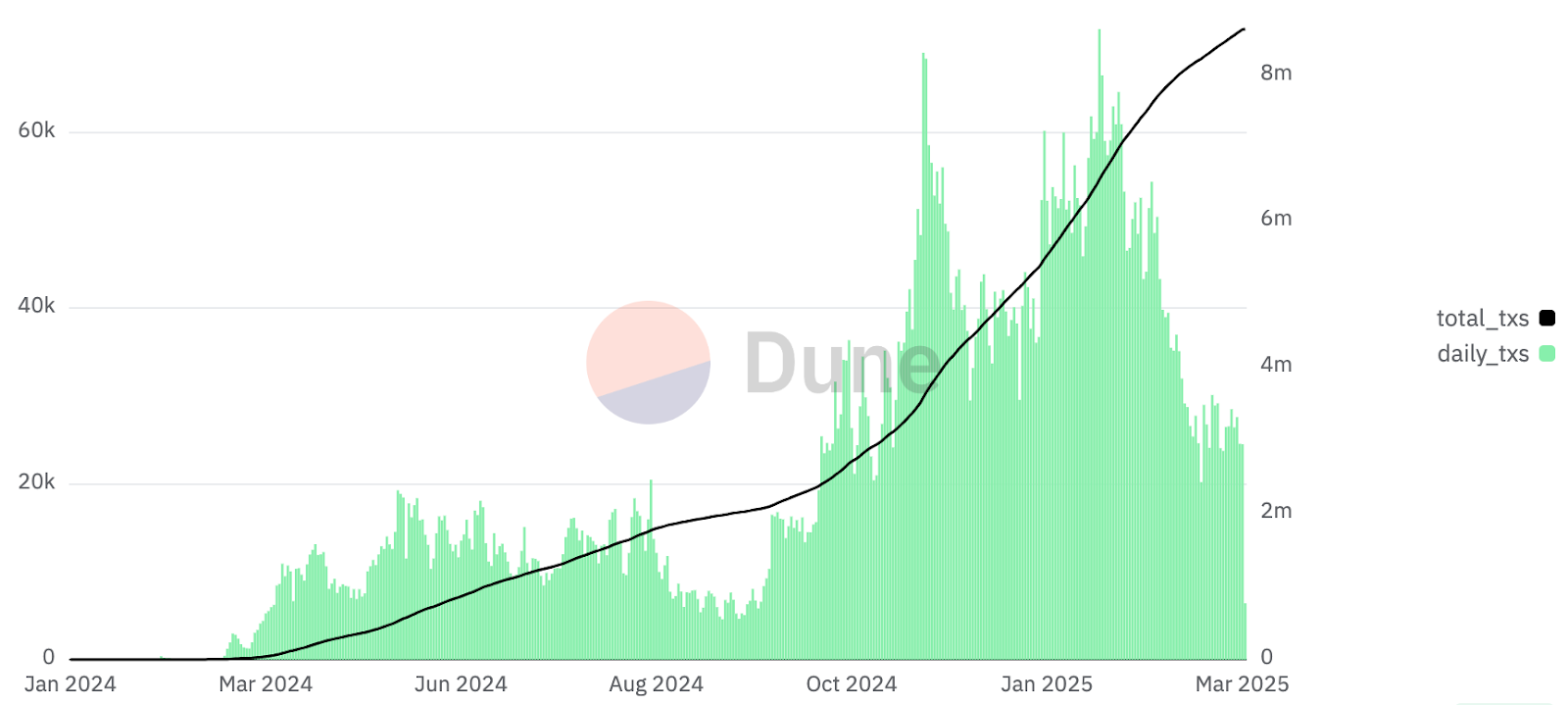

According to data provided by Dune Dashboard Pump.fun, Solana’s price decrease is also supported by the decline in on-Chain activities in the Solana ecosystem. Before SOL’s price drop on March 17, there was a sharp decrease in the number of network transactions. The amount of daily transaction in Solana Blockchain fell from 71,738 to 24,505 on 17 March, the highest level of all time on January 23, as shown in the graph below.

Solana’s deployed process performance graph. Source: pump.fun

Solana’s deployed process performance graph. Source: pump.funThis shows that network activities are reduced and the income from wages has fallen. Therefore, it partially explains the ongoing correction by negatively affecting the price of the left.

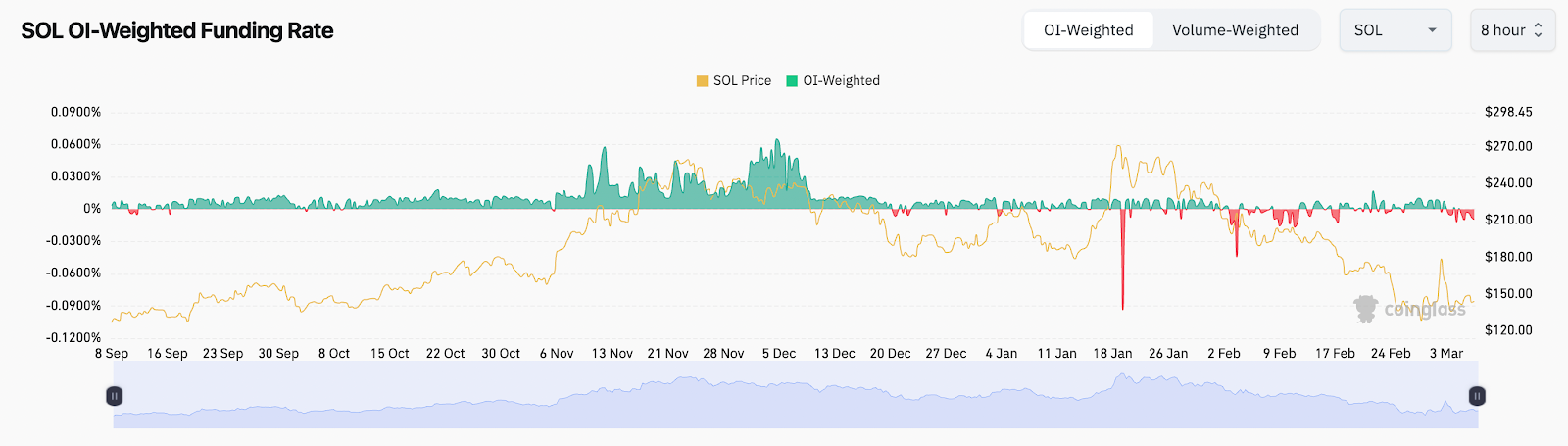

Solana funding rates continue to remain negative

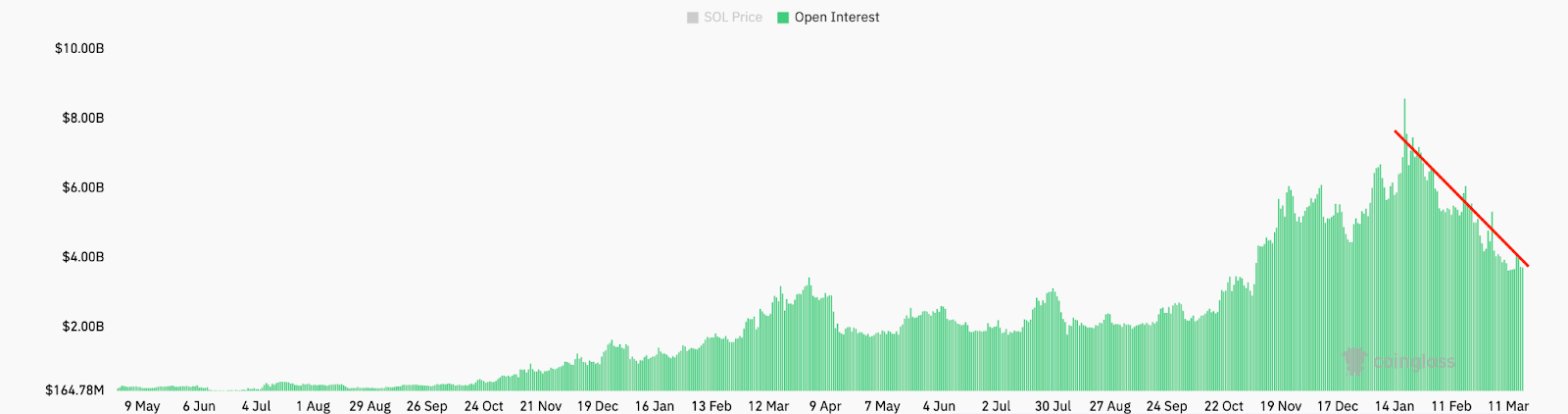

Solana’s open interest (OI) decreases and the funding rates are negative, which gives an idea of why the price of the left is forced. Solana’s open position in the futures market declined from the $ 8.57 billion local summit on 17 January to $ 4.03 billion as of March 17. Measures the total number of unpaid term transaction contracts, and the decrease indicates that more investors come out of the position.

Left term transaction open interest. Source: coinglass

The decreasing OI typically means decreasing speculative demand and slowing downward price acceleration. The SOL’s weekly funding rates continued to remain negative with 0.10 %on March 17, four months after the peak with 1.37 %. Negative funding means that it pays long to keep the positions of the shorts open. OI decrease and negative funding rates show the lack of confidence in SOL’s short -term price movement.

Left OI weighted funding ratio. Source: coinglass

Left Price Estimation: Solana price may drop 35 %further!

The SOL is traded below 56 %of $ 294, which is the highest level of all time, established on January 19th. In addition, graphic techniques show that there are more space in the next few weeks.

Altcoin is traded above $ 120, but the bulls failed to increase the price above $ 135. If the price drops below $ 120, the left may decline to the $ 110 range. This is a critical support to be considered. Because a break and closing under it can start a movement downwards for $ 100 and then to $ 80. Such a movement will mean a decrease of 35 %from the current price.

Left/USD daily graphics. Source: TradingView

Left/USD daily graphics. Source: TradingViewHowever, a positive deviation from RSI shows that the bulls accumulate the left at lower levels. A break and closure above the psychological level of $ 140 will indicate that sales pressure is reduced. Solana may rise from $ 171 to a simple 50 -day simple moving average, which is expected to make a strong defense of bears.

The opinions and estimates in the article belong to the analyst and are not definitely investment advice. Kriptokoin.comWe recommend that you do your own research before investing.