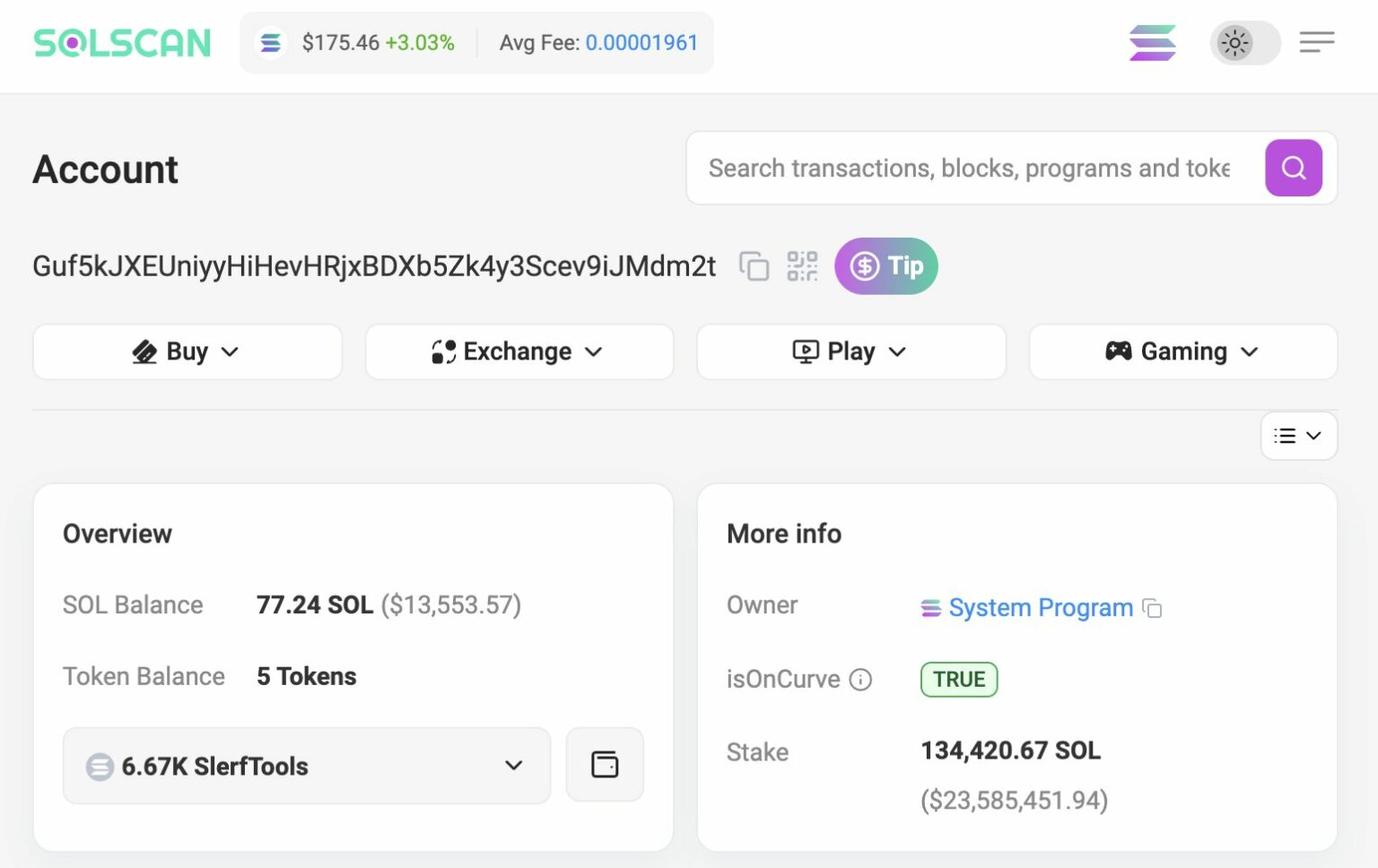

In the last three days, a whale directed to Stinging by pulling 47,154 left (about $ 7.98 million) from Binance. In total, 134,482 left (approximately 23.58 million dollars) were stacted.

This reveals the increasing interest of investors to Stinging. In particular, the charm of breast coins with high volatility may have directed investors to Stinging, which offers more stable return.

Growing Solana Stinging Pool guarantees the network

Solana Stinging provides the security of the network as well as providing a regular return to investors. Therefore, it stands out as a long -term investment strategy in the uncertainty environment in the markets.

Kriptokoin.comAs we have mentioned, Pantera Capital estimates that we can probably see a new solana ETF approval in 2025.

On the other hand, the increase in stinging activities can support price stability by reducing the circulatory supply of the SOL. However, if many investors decide to unstake at the same time, sales pressure may increase and may cause a decrease in the price of the left.

This tendency shows that investors focus on longer -term earnings instead of short -term speculative transactions.

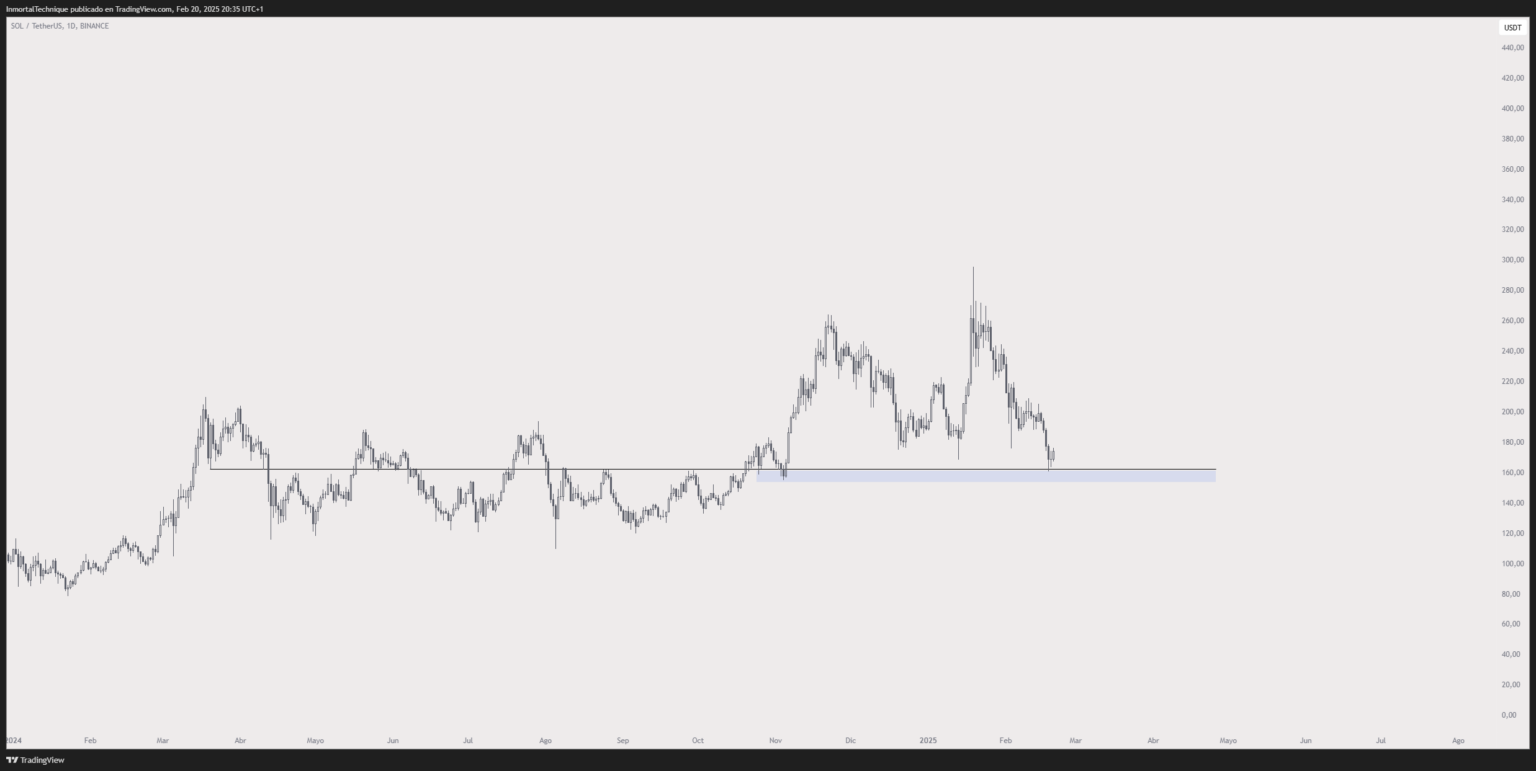

Has the left price reached the bottom level?

Analysis of Solana’s price movements show that the level of $ 120 is an important support zone. This level has served as support and resistance last year and continued to be a critical price point in the short term.

The upcoming token lock expansions (unlock) are not expected to cause sharp movements on the price. Instead, the price is thought to remain constant around $ 120 or can react upward from this level.

If the left price sweeps the liquidity below $ 120 and clings to this level, recovery may be experienced after key expansions and confirming that this level is a strong support.

However, if the $ 120 level is broken due to intensive sales pressure, the price of the SOL may testing the new bottom levels of the year and decrease to below $ 100.

To be aware of last -minute developments Twitter ‘in, Facebook ‘ Instagram follow and follow Telegram And Youtube Join our channel!