Whales Make Bearish Bets on Solana’s SOL Token Ahead of Significant Unlock

Deribit, a leading platform for cryptocurrency options trading, has seen a surge in activity surrounding Solana’s SOL token. This uptick comes as wealthy investors, often referred to as “whales,” are placing bearish bets following a notable decline in the token’s price. This trend is particularly pronounced with an impending multi-billion dollar token unlock on the horizon.

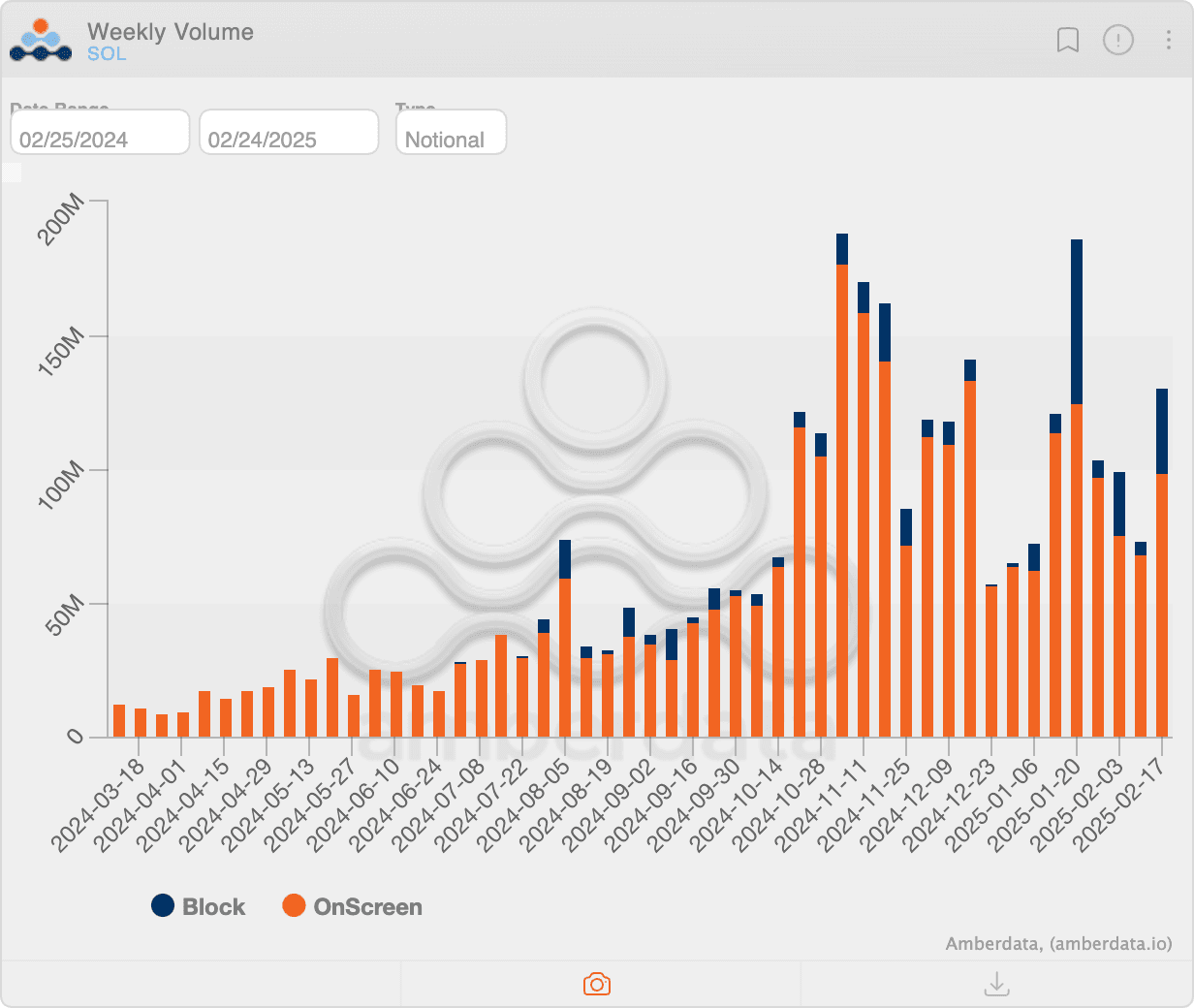

Last week, SOL block trades on Deribit reached an impressive total of $32.39 million in notional value, accounting for nearly 25% of the platform’s overall options activity, which sat at $130.74 million. The rest of the trading was comprised of screen trades, as reported by Amberdata. This marks the second-highest ratio of block trades to total activity recorded thus far.

A “block trade” in options involves a substantial, privately negotiated transaction between two parties, involving a large volume of contracts. Typically associated with whale activity, these trades are conducted over-the-counter, outside the standard order book, before being recorded on the exchange. This process helps to minimize any significant impact on market prices.

Options contracts are financial derivatives that grant the buyer the right, but not the obligation, to buy or sell an underlying asset—in this case, SOL—at a predetermined price either on or before a specified date. A call option allows the holder to purchase the asset, whereas a put option gives them the right to sell. On Deribit, which dominates the global crypto options market with over 85% of the total activity, each options contract corresponds to 1 SOL.

Notably, the recent spike in SOL block trades has shown a marked preference for put options, which traders often use to hedge against or capitalize on potential price drops. According to Greg Magadini, director of derivatives at Amberdata, “Nearly 80% of the block-trade volume was concentrated in put contracts, which is significantly higher compared to 40% for Bitcoin (BTC) and 37.5% for Ethereum (ETH) during the same period.”

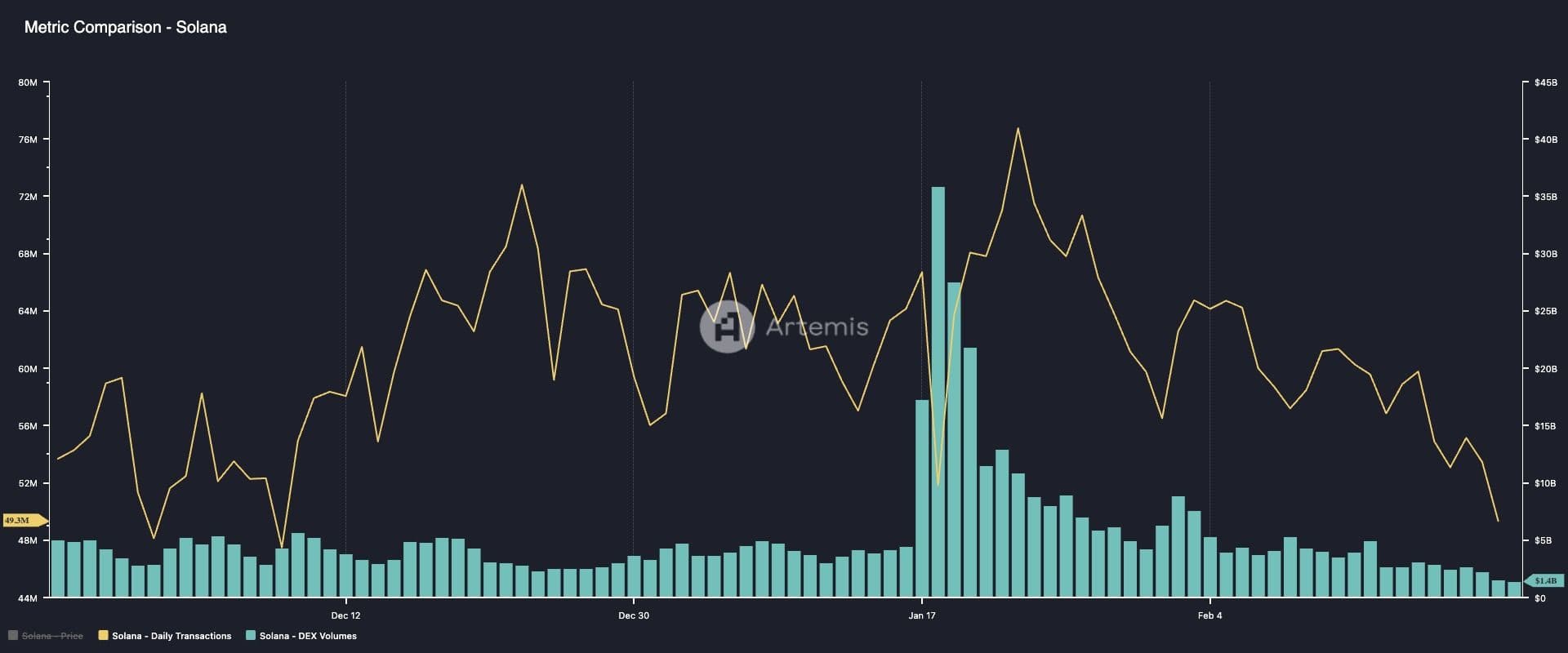

As whale interest in put options grows, the outlook for SOL appears increasingly bearish, especially after a dramatic 46% price decline, bringing it down to $160 in just over five weeks. The Solana blockchain, which gained popularity as a hub for memecoin trading last year, saw its activity peak with the launch of the TRUMP token on January 17, just three days prior to Donald Trump’s inauguration as President of the United States.

Since that time, however, daily transactions on Solana and cumulative daily volumes on Solana-based decentralized exchanges have sharply decreased, as indicated by data from Artemis. This decline has weakened the bullish narrative surrounding SOL.

Furthermore, the impending SOL token unlock on January 1 poses a considerable challenge. Lin Chen, Deribit’s Head of Asia Business Development, noted that “Solana (SOL) will undergo a significant token unlock event on March 1, releasing 11.2 million SOL tokens, which are valued at approximately $2.07 billion. This amount represents 2.29% of the total supply. A large portion of this unlock is attributed to the FTX estate and a foundation sale.”

Chen elaborated that this substantial unlock could induce market volatility, as it equates to nearly 59% of SOL’s daily spot trading volume. Consequently, it is expected that many traders will engage in hedging through put options in anticipation of a potential prolonged decline in SOL’s price. “Many traders would also seize this opportunity to long volatility to generate favorable yields,” Chen added.