Stablecoins need stricter regulation than other altcoin projects, as they have the potential to undermine financial stability, according to a report by the Bank of Korea (BoK) on Monday. Here are the details.

These altcoin projects could undermine financial stability

Bank of Korea argues that stablecoins should be studied separately from other cryptocurrencies. According to the presented report, stablecoins have the potential to undermine financial stability. BoK’s report reflects the concerns of jurisdictions around the world that are preparing proposals to regulate stablecoins.

The report argues that stablecoin issuers should have minimal capital and reserve assets in order to minimize the possibility of transferring the risks of digital assets to the payment and settlement system. Bank of Korea also said that crypto-asset businesses must be registered, authorized to operate, and subject to regular external audits.

The report stated that the issuance structure of cryptocurrency should be regulated by a special law as the market system is different from securities and fiat currencies, making it difficult to respond to current regulations. The country’s politicians are trying to establish a comprehensive regulatory framework for crypto assets. As we reported on Cryptokoin.com, the May collapse of South Korean stablecoin issuer Terraform Labs prompted the country’s policymakers and lawmakers to scrutinize the local crypto industry.

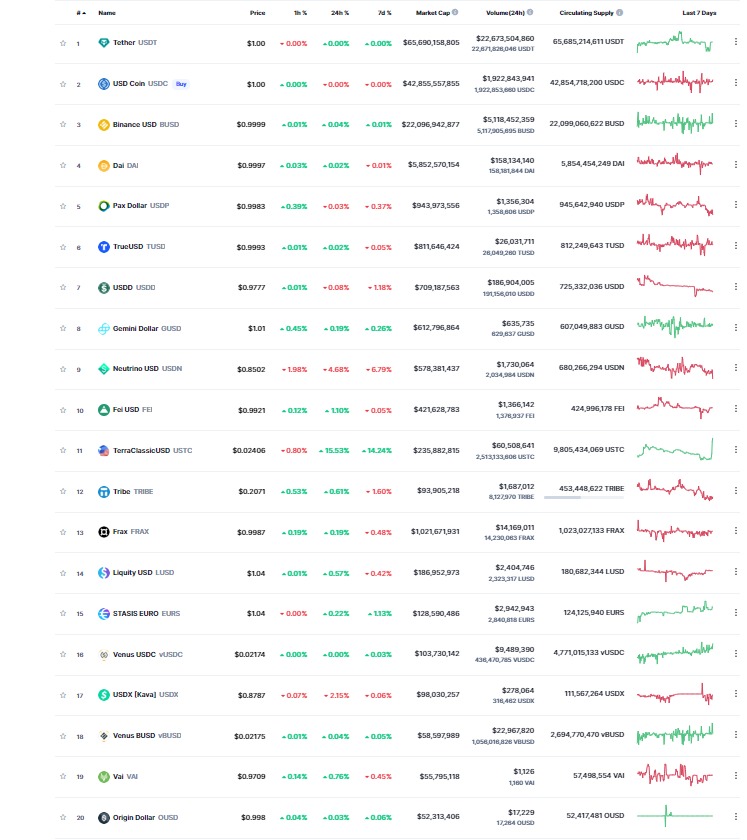

Tether (USDC) maintains its lead as the most used stablecoin

In the developing crypto money market, the coins indexed to any fiat currency that do not have price movement volatility are stablecoins. The first stablecoin is USDT(Tether) and was launched in 2014. When we look at the market volume, we can see that the most used stable coin project is USDT (Tether). Just behind it, USDC (Usd Coin) comes in second place. The price volatility of stable coins should remain constant, so assets with a fixed value should be used for the price index. Although the stablecoin index is generally based on the US dollar, there are stablecoins indexed to other assets such as euro and gold in the crypto money market. Or there are stablecoins indexed to crypto assets such as DAI.

After Tether and USDC, among the best stablecoins by market cap; Binance USD, Dai, Paxdollar, TrueUSD, USDD and Gemimi Dollar are available. Although it is generally the same currency as the currency that stablecoins are indexed to, sometimes minor fluctuations may occur. The reason for this is the price volatility in the market. Apart from stable coins indexed to fiat assets, there are stable coins that are not indexed to any value. These stablecoins are called unsecured stablecoins or algorithmic stablecoins.