Funds stuck in the stock market with FTX’s bankruptcy are estimated to be between $1 and $2 billion. In addition to the damage it caused to the stock markets and the market, this crisis also undermined the confidence of investors. New reports show that South Korean crypto investors continue to accumulate despite this. Dogecoin and XRP are among the most bought.

South Korean crypto investors continue to accumulate Dogecoin despite bankruptcies

A new survey reveals that despite the bankruptcy of FTX, nearly one in five South Koreans still invest in cryptocurrencies. According to the survey, 18.2% of the 2,000 people ranging from 20 to 69 said they currently hold cryptocurrencies. Bitcoin ranks first among the cryptocurrencies most preferred by South Korean investors. The results are as follows:

- Bitcoin (BTC) is the number one choice of 46.1% of crypto investors.

- Ethereum (ETH) is in second place with 25.9%.

- XRP was the third most popular pick with 24.5%. It just lags behind Ethereum with just a small difference.

- Almost 17% of investors said they prefer to invest in Dogecoin (DOGE).

Meanwhile, more than 10% of respondents stated that they have dealt with cryptocurrencies in the past but are not currently investing. Almost 72% say they have never bought any cryptocurrency. More than a quarter of those who said they had invested in crypto were in their thirties. 23 percent are between the ages of 40-49. Just under 20% were in their twenties. Almost 6 out of 10 people said they spent less than $746 on cryptocurrencies. 12 percent say they spend more than $7,460.

Trading volumes on local exchanges continue to fall

South Korea’s leading crypto exchange Upbit recorded its highest annual 24-hour trading volume on March 31 this year, with nearly $10.3 billion in transactions, according to data from CoinGecko. That figure then dropped to just over $1 billion in a 24-hour average in mid-November. The cryptocurrency market took a hit from LUNA and FTX, causing this volume loss. South Korean stock markets have so far emerged relatively unscathed from the collapse of FTX. cryptocoin.comWe have covered the latest developments from FTX in this article.

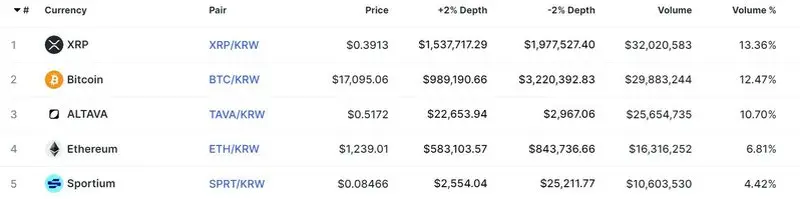

Most traded cryptocurrencies in the last 24 hours on Upbit

Most traded cryptocurrencies in the last 24 hours on UpbitSouth Korea pressed the button for regulations

Regulators emphasized the need to have the regulatory framework at the meeting of the South Korean National Assembly based on the collapse of FTX. The report stated that the meeting was held as an emergency with the collapse of Terra and then FTX. South Korean government officials are currently drafting the Digital Asset Base Law, a comprehensive regulatory framework. The bill is expected to be completed next year. The law will consist of 13 crypto legislative proposals currently before the National Assembly.