The stablecoin market is on track to shrink for the 14th consecutive month, a sign of capital draining from the digital asset space, and a troubling trend for the recovery of cryptocurrency prices.

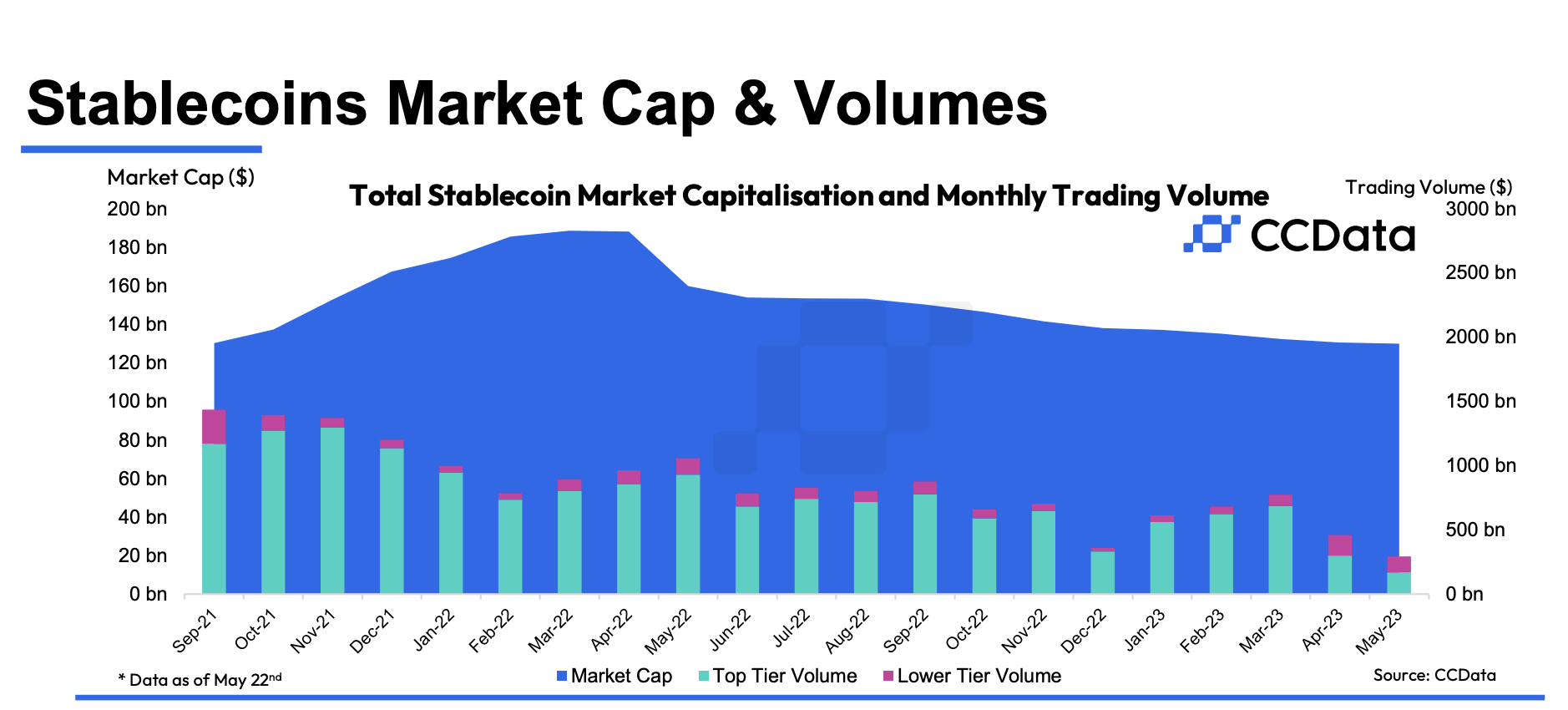

The total market capitalization of stablecoins dropped to $130 billion in May, falling to the lowest level since September 2021, digital asset data firm CCData noted Tuesday in a market report. The stablecoin market has been in a continuous decline since March 2022, per CCData.

Stablecoins are a subset of cryptocurrencies that peg their price to an external asset, predominantly to the U.S. dollar. They are key plumbing for the digital asset universe, playing a vital role in facilitating cryptocurrency trading and bridging government-issued fiat currencies with blockchain-based markets.

(CCData)

Analysts argue that the contraction of the stablecoin market poses headwinds for cryptocurrency prices, as it signals deteriorating liquidity.

“Stablecoins are the liquidity of the crypto ecosystem. The more liquidity, the more ability for investment and speculation,” Tom Dunleavy, macro analyst said in a note to CoinDesk. “The continued reduction, despite the growing number of applications, says to me we are still not out of the woods for this secular bear market.”

Banking giant JPMorgan wrote last week in a report that cryptocurrency prices are unlikely to enjoy a sustained recovery until the stablecoin market stops shrinking. A report from global investment bank Goldman Sachs said earlier this year that the stablecoin shrinkage is equivalent to a sort of quantitative tightening for the crypto market, an indication of declining liquidity and leverage.

Trading with stablecoins also plummeted 40.6% this month to $460 billion in volume on centralized exchanges, according to the CCData report. This is the lowest monthly volume since December 2022.

“The drop in trading volume comes with major crypto assets staying range-bound and failing to break key support and resistance levels,” the report said.

TrueUSD (TUSD) stablecoin has defied the market-wide slump, with its trading volume increasing to $29 billion so far this month, per CCData. TUSD has overtaken USDC and BUSD, two struggling competitors, making it the second most traded stablecoin on centralized exchanges for the first time.

TUSD resurgence stems from Binance, the world’s dominant crypto exchange by trading volume, promoting the token’s use on the platform by waiving trading fees for buying and selling bitcoin (BTC) with it.