Stablecoins are rapidly flocking to exchanges. Often this indicates a positive position as a signal of an increase. So what’s actually going on? Let’s take a look at our article.

Stablecoins have seen an increase in their supply lately

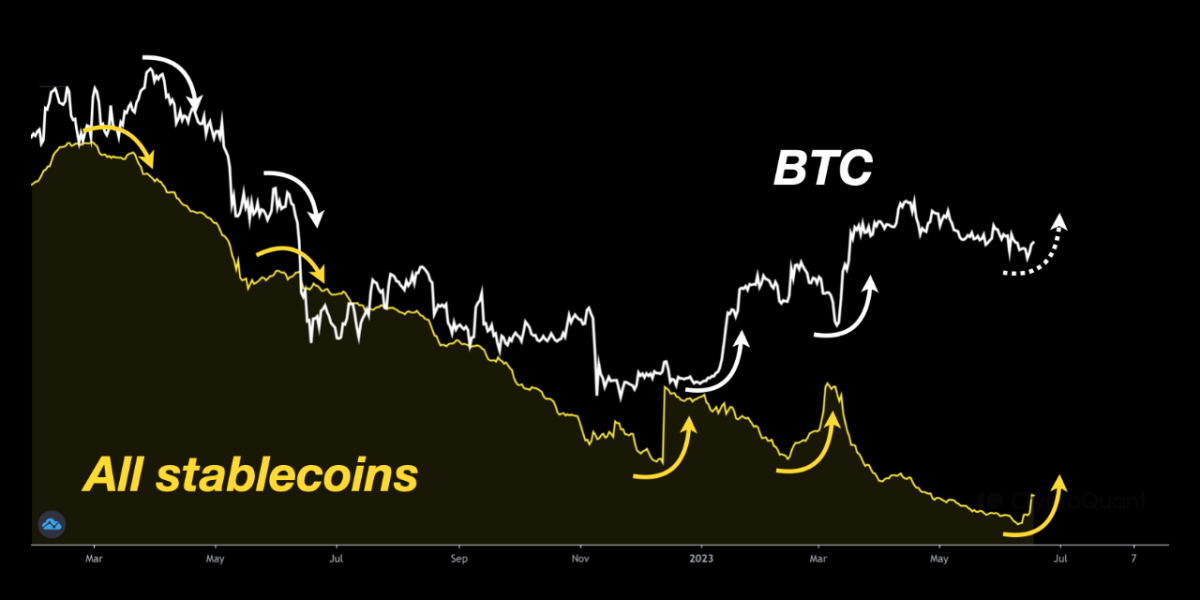

On-chain data shows that the supply of stablecoins has increased recently. This is a potentially bullish sign for Bitcoin. Every increase in the supply of stablecoins since late 2022 has been accompanied by an increase in Bitcoin price. The key criterion here is naturally the total circulating supply of all stablecoins.

When the value of this indicator rises, it means that capital is currently entering the exchanges as more tokens are printed. On the other hand, the drop means that investors are using these fiat currencies for currencies like the dollar or shifting them to other cryptocurrencies like Bitcoin.

Avoiding volatility

Generally, investors use stablecoins when they want to avoid the volatility associated with most coins in the industry. Therefore, when the supply of stablecoins increases, it could also be a sign that investors are possibly withdrawing from volatile markets. When such investors finally feel that the prices are right to return to other assets, they exchange stablecoins for the ones they want. Naturally, this may create bullish pressure on the price of the cryptocurrency they invest in. Now here’s a graph showing the trend in the total circulating supply of stablecoins over the past year and a half:

As the chart above shows, the total circulating supply of stablecoins had started to move in an overall downtrend when Bitcoin hit the top of the bull market. This decrease in the supply of these tokens marked the exit of capital from the market as BTC and other coins also lost value along with this downtrend.

meaning for bitcoin

But in late 2022, the indicator finally deviated briefly from the downward trajectory as its value recorded a sharp increase. Interestingly, not long after this spike occurred, the Bitcoin price began to observe its rise. This increase in the supply of stablecoins is a sign that a capital injection is taking place in the market. As stablecoins were converted to other coins, the market got its fuel for the rally. In March of this year, when the rally paused and Bitcoin price plummeted, the metric rose once again. He also hinted that investors may have withdrawn their BTC to exchanges.

On the other hand, when Bitcoin fell below $20,000, the supply of stablecoins fell once again. This indicated that its holders were potentially returning to Bitcoin. From the chart, it can be seen that the indicator has recently gone up again. Let’s take into account that all these increases in the metric have meant bullish for BTC in recent months. It is possible that this new flow of capital could fuel the asset this time as well. cryptocoin.comLooking at it as a whole, Bitcoin was trading around $26,400, up 2% on a weekly basis.