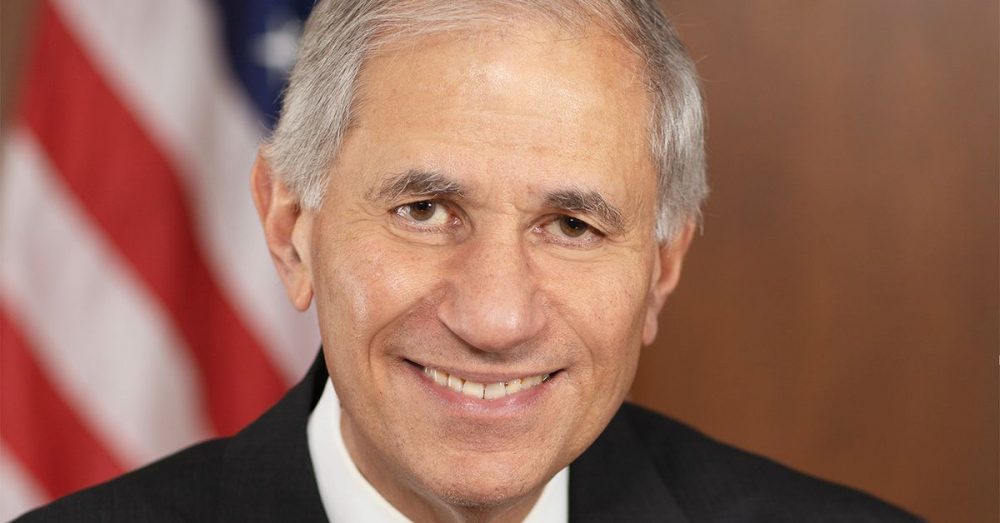

Stablecoins could have such a profound effect on the established banking system that U.S. regulators need to require that the digital tokens fit in without disrupting it, said Martin Gruenberg, the acting chairman of the Federal Deposit Insurance Corp. (FDIC), in remarks set for delivery at a Brookings Institution event on Thursday.

Gruenberg’s agency is among the U.S. banking watchdogs that will have significant influence over how stablecoins are regulated, and the FDIC has also had to weigh in with recent sanctions against firms – such as FTX US – that have made claims misrepresenting how FDIC deposit insurance backstops their operations. As U.S. banks have increasingly sought to offer crypto services, including maintaining custody of customer’s digital assets, Gruenberg said that his agency has been cautious about allowing regulated lenders to engage.

The FDIC has also had some say over the federal government’s initial approach to stablecoins, which Gruenberg said will need to work in tandem with the Federal Reserve’s future FedNow real-time payments system, which is set to launch next year. Stablecoins – tokens tied to steady assets such as the dollar that are used to trade in and out of more volatile cryptocurrencies – also need to complement “the potential future development” of a U.S. central bank digital currency (CBDC), he said.

“The development of a payment stablecoin could fundamentally alter the landscape of banking,” Gruenberg said in his remarks. Payment stablecoins could change how credit is extended within banking, “possibly leading to forms of credit disintermediation that could harm the viability of many U.S. banks and potentially create a foundation for a new type of shadow banking.”

He said Congress likely needs to intervene with new laws, because “there are clear limits to our authority, especially in certain areas of consumer protection as well as the provision of wallets and other related services by non-bank entities.”