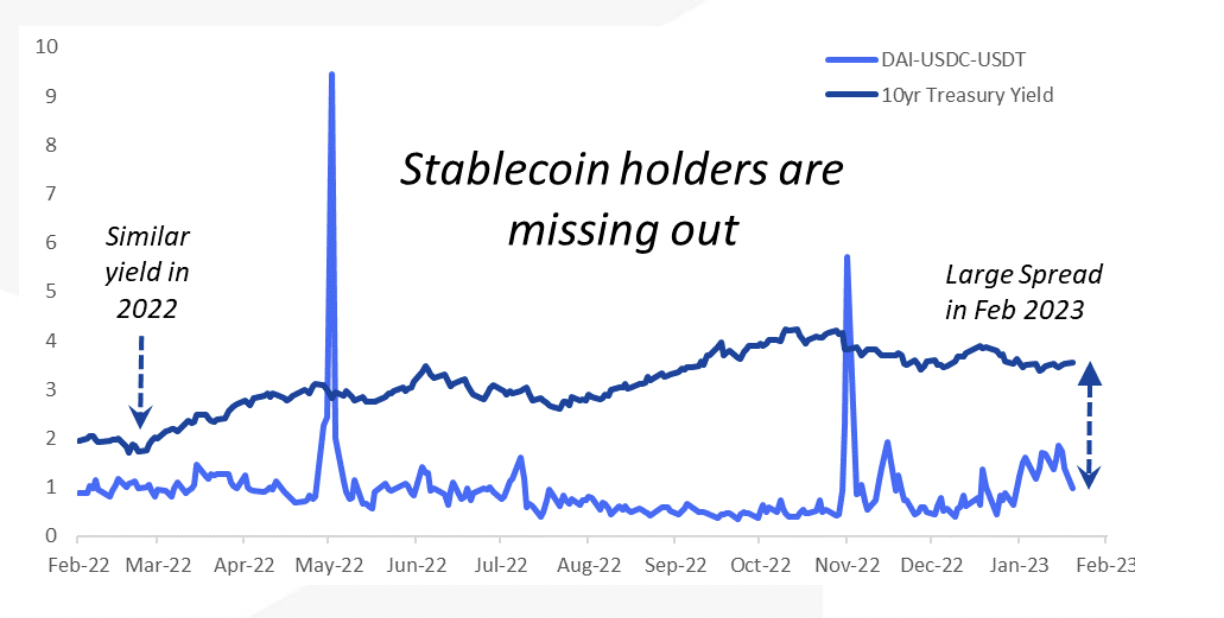

The difference between the returns received by depositing stablecoins on decentralized exchange Curve’s 3pool and the yield from U.S. government bonds continues to widen, highlighting the growing attractiveness of traditional fixed-income markets.

Curve’s 3pool is a liquidity base pool that provides crypto traders a capital-efficient means of swapping between the top three stablecoins – USDT, USDC and DAI.

3pool, also known as Tri-pool, started as a decentralized finance (DeFi) savings bank account during the 2021 bull run. Large traders parked their stablecoin holdings on the pool in return for an annualized percentage yield (APY). The APY comprises a share in trading fees and supplemental fee income via Curve’s governance token CRV.

At press time, the seven-day moving average of 3pool’s APY stood at 0.98%, or 250 basis points less than 10-year U.S. Treasury yield, which stood at 3.54%, according to data sourced from DeFiLlama and crypto services provider Matrixport.

“A year ago, the spread between treasury yields and stablecoins was negligible. Investors were indifferent in ‘parking’ their assets in either ‘low’ yield product. There was no opportunity cost,” said Matrixport’s head of strategy and research, Markus Thielen.

The 10-year yield has nearly doubled year-on-year, thanks to the Federal Reserve’s aggressive liquidity tightening cycle. The central bank has raised the benchmark interest rate by 425 basis points to 4.25% in less than a year with interest rates expected to further rise to nearly 5% later this year.

Meanwhile, DeFI yield’s have crashed from their lofty double digits range in early 2021 as the liquidity-powered crypto bull market started running out of steam in mid-2022.

The spread between APY offered by Curve’ 3 pool consisting of USDT, USDC and DAI and U.S. Treasury yields. (Matrixport Technologies, DeFiLlama) (Matrixport Technologies, DeFi Llama)

The dollar-pegged stablecoins and Treasury yields offered nearly similar yields at the beginning of 2022. At the time, analysts were optimistic that the Fed rate hikes would boost demand for all assets linked to the greenback, including stablecoins.

However, since August 2022, stablecoin yields have dropped relative to treasury yields, disapproving of the strategy of parking money into stablecoins.

The gap is unlikely to narrow in favor of stablecoins anytime soon, considering the Fed plans to lift the benchmark rate above 5% this year and keep it there for some time.

Prospects for the global economy are improving, according to the latest forecast by the International Monetary Fund (IMF). The optimistic growth expectations are likely to keep longer-duration bond yields elevated.