Staked ether (stETH), a token from the Lido protocol that’s supposed to trade at a price close to ether (ETH), has been changing hands at a sustained discount since the collapse of the Terra network – possibly a signal that liquidity has dried up in crypto markets.

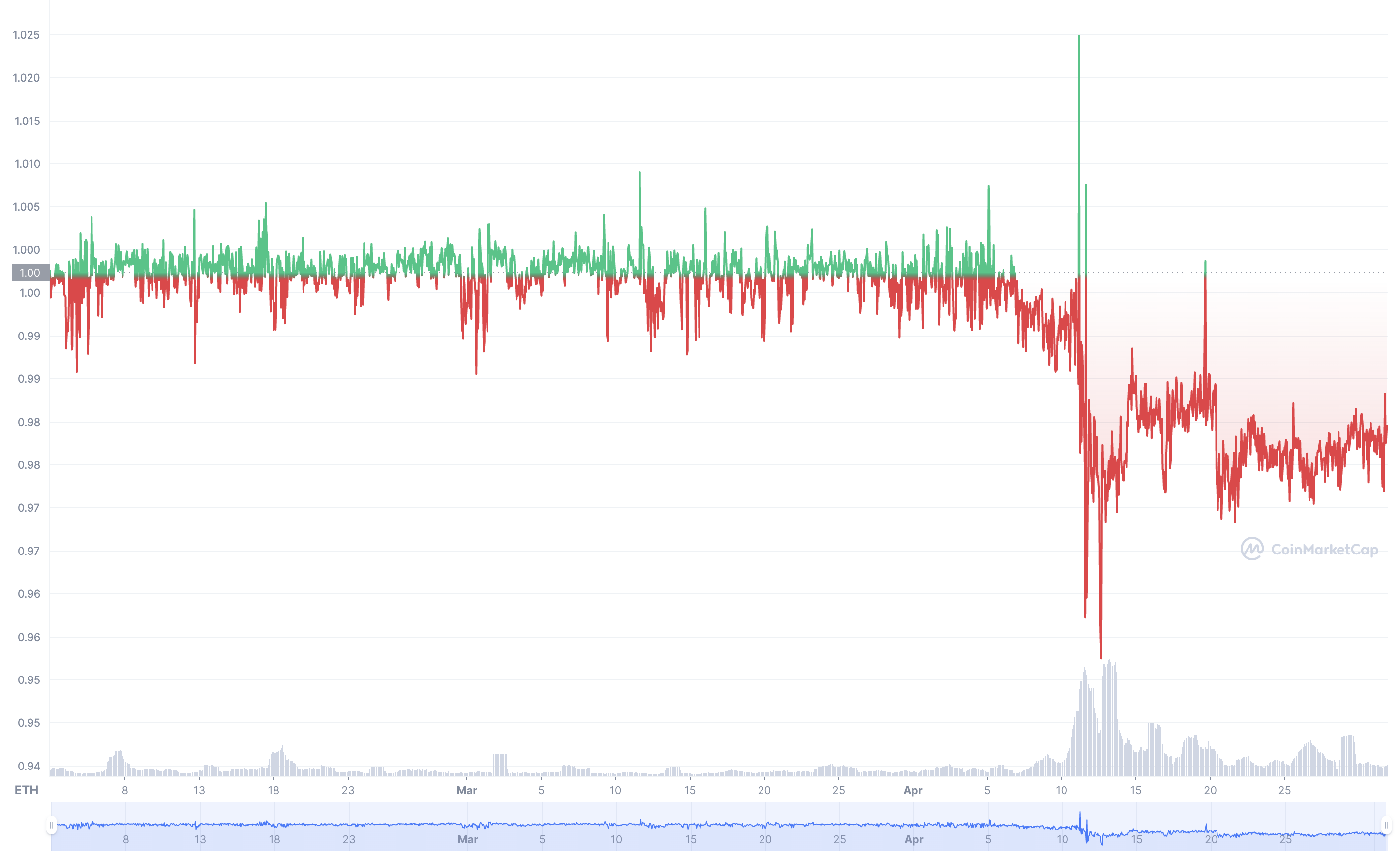

Data shows that staked ether and ether traded at parity up until May 7, when Terra’s stablecoin, UST, started to wobble from its $1 peg. Since then, stETH has been unable to recover to the full ETH price. On May 12, when UST dropped to 7 cents, stETH-ETH exchange ratio fell to as low as 0.955, and ever since then, staked ether has traded at a discount of 2-3%.

The discount is a result of an “illiquidity frenzy” that UST’s implosion set off in an already tightening macro environment, as Terra enthusiasts realized they were overexposed and began selling other coins out of panic, Fundstrat analyst Walter Teng told CoinDesk in a Telegram chat.

“At this point, there’s no new money coming into crypto,” Teng said.

After UST’s crash, “everyone is testing, everyone wants to catch another emperor without clothes. In stETH’s case, shorters are betting against the ETH Merge succeeding, a liquidity event for stETH,” he said.

Staked ether on Lido trades at a discount, compared with spot ether since May 7, the day when UST first lost its peg. (CoinMarketCap)

Ethereum’s transition to proof-of-stake, also called “the Merge,” is scheduled for August after many delays. If it is delayed again or doesn’t succeed, stETH holders would be stuck with their investment, and so it makes sense that they might demand compensation now for bearing that risk.

Liquidity crunch

A good indication for liquidity becoming scarce on the crypto market is the overall market capitalization of stablecoins – the main source of liquidity for crypto traders and considered to be a safe haven from volatility – sinking as people panicked and pulled out money from cryptocurrencies in May.

On top of that, the Federal Reserve is hiking interest rates and reducing its balance sheet, tightening conditions in money markets and lending while investors sell risky assets such as equities and crypto in a bid for safety.

Ethereum is making a transition to a consensus mechanism where stakers validate transactions and propose new blocks from proof-of-work where so-called miners run machines using electricity.

Lido is a decentralized finance application that allows ETH holders to put up tokens to validate transactions to earn a yield. Investors receive the staked ether token at a one-to-one ratio and can use it as lending collateral or across supported trading pools.

The caveat is that holders cannot “unstake” – redeem and sell – their staked ether until the Merge happens.

As a result, the staked ether’s lower prices is a result of an “illiquidity discount” during a time of turmoil when traders prize investments that can be easily sold.

Dustin Teander, an analyst at the blockchain data platform Messari, said that “there aren’t a ton of natural incentives at the moment for getting back to price parity.” He added that Lido voted to issue new rewards to the Curve pool to support the price parity, and it appears to be working as the discount inched toward 2%.

Lido is crucial for ether because it holds 91% of all liquid staked ether in its staking pools and manages about $7.8 billion in ether altogether, according to data platform DefiLlama.

Danny Ryan, a researcher at the Ethereum Foundation, wrote Wednesday that liquid staking derivative platforms such as Lido pose unique risks to Ethereum if they grow too large and may lead to the “cartelization” of the ether staking market.

A Goldman Sachs report said earlier in May that the staked ether price discount in the wake of the Terra collapse might indicate that the interconnections in decentralized finance increase systemic risk.

Ether (ETH) exchanged hands at $1,815 at press time, while Lido staked ether (stETH) was trading at $1,785, according to crypto price tracker CoinGecko. The stETH-ETH conversion rate stood at 0.977.

Read more about

Save a Seat Now

BTC$30,294.94

BTC$30,294.94

0.30%

ETH$1,827.03

ETH$1,827.03

0.81%

LUNA$0.009612

LUNA$0.009612

62.62%

BNB$305.42

BNB$305.42

1.15%

XRP$0.399324

XRP$0.399324

0.92%

View All Prices

Sign up for Crypto for Advisors, our weekly newsletter defining crypto, digital assets and the future of finance.