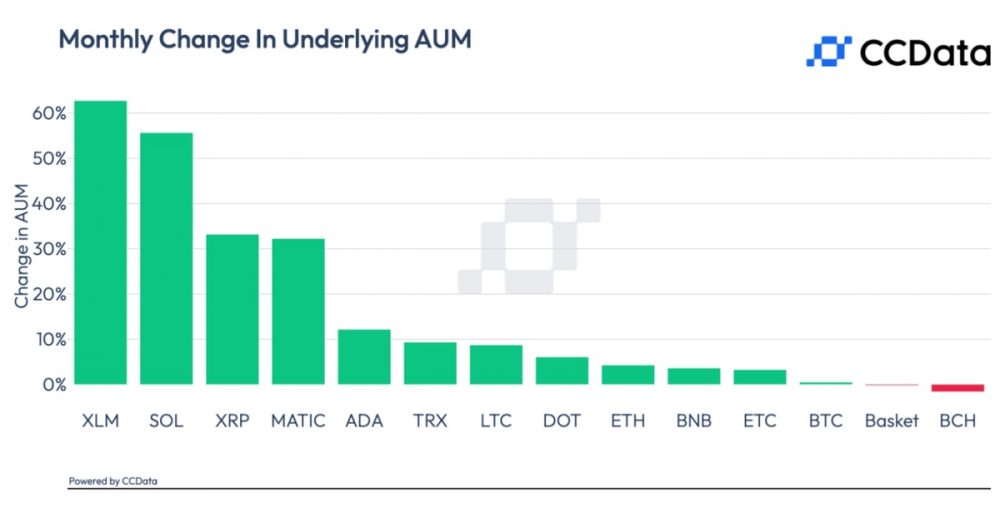

Assets under management (AUM) for investment funds linked to Stellar’s XLM, Ripple’s XRP and Solana’s SOL surged higher in July, according to a report from CCData.

Most of the AUM boost came on July 14, one day after a U.S. judge ruled the sale of XRP tokens on exchanges did not constitute investment contracts.

The decision led to sharp price gains across the crypto sector, particularly for XRP itself as well as other altcoins, XLM and SOL among them.

AUM for XLM-based products increased by 62.7% to $17.3 million. Among those funds is Grayscale’s Stellar Lumens Trust (XLM), whose premium to net asset value surged to 330%, said CCData.

XRP-based products recorded a 33.2% increase in AUM in July to $65.7 million, and SOL-based products saw a 55.7% increase in AUM to $87.8 million, said the report.

“Sentiment surrounding XLM has been positive over the past month, bolstered by the advancement of its partnership with USDC’s Circle and strategic collaborations with entities such as MoneyGram,” said Hosam Mahmoud, research analyst at CCData, in a note to CoinDesk.