What’s going on with the stock market tokens, which are gradually falling into the background after the strict policy of the regulators, the technical problems caused by the platform and the news flow?

Recently, many crypto exchanges have come to the fore with their platform tokens. Technical problems in some exchanges and strict regulatory controls created various problems in others. The dangers may be increasing for stock market tokens that have dropped more than other altcoins. So what were these events? How was it reflected in the tokens of the relevant crypto exchanges?

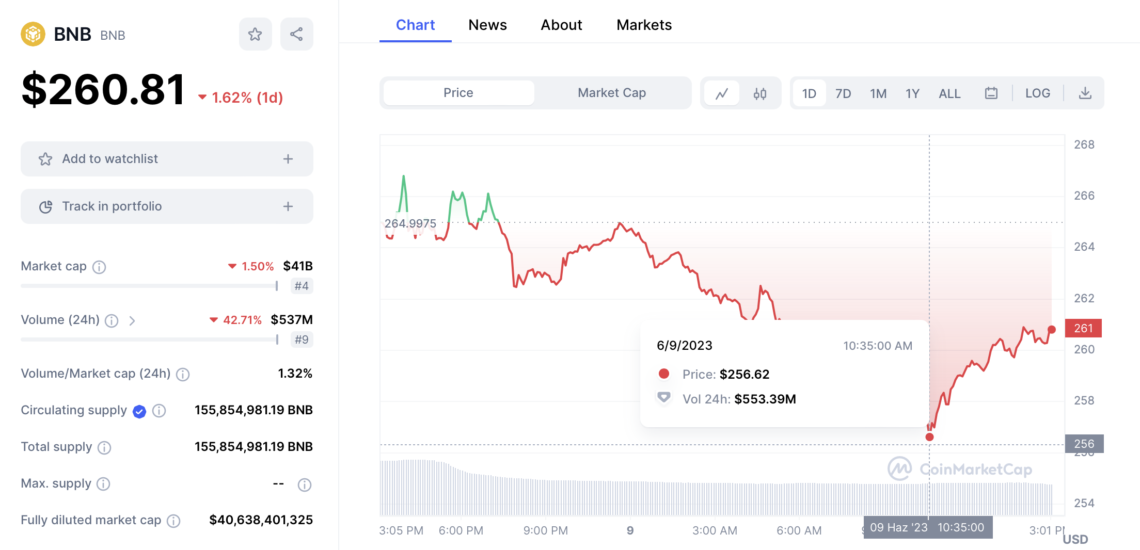

SEC Sues Binance: BNB Hits 5-Month Low

U.S. Securities and Exchange Commission ( SEC), for violating the Securities Act to Binance sued. The Binance exchange, which is actively used by most crypto investors, was blacklisted with this event. SEC has sued many crypto exchanges so far. But this is the first time he has faced Binance so harshly. Users, who started to withdraw their investments quickly from the Binance exchange, led to a decline in cryptocurrencies.

BNB was the first to be affected by the onset of the Binance crisis. BNB, which came from $317 to $254, dropped close to 18 percent. Testing these levels for the first time since January, BNB caused concern not only in the stock market, but also in the crypto world. When we look at the event from a different perspective, when BNB was at these levels last time, BTC was at $ 17,100.

As of writing the news, BTC is trading at $ 26,632. Over a 5-month period, BTC has increased by 54 percent. But there was no price change in BNB. This reveals that investors continue to hold BTC and make heavy sales in BNB.

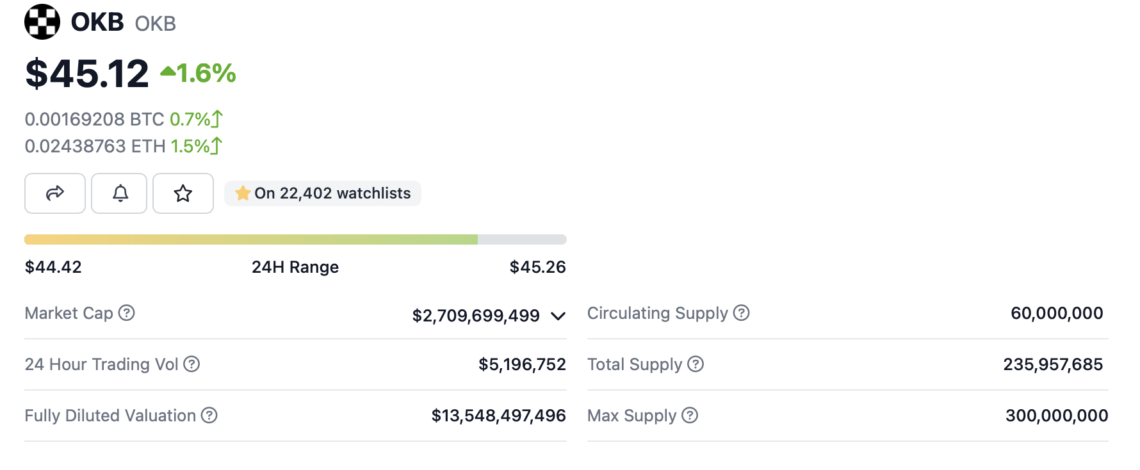

Data Imbalance in OKEX Reflected on Exchange Token

Volatility peaked in OKEX, the jersey sponsor of Manchester City, which made it to the Champions League Final. Due to Manchester City, the number of investors holding OKEX’s own token, OKB, in their wallet is increasing every hour. This situation brought the speed of data change in the stock market to the top. As the final approached, the momentary big changes in the stock market paved the way for the volume imbalance, especially in the price of OKB.

With a trading volume of $5,196 million in the last 24 hours, OKEX has overtaken many crypto exchanges in terms of trading volume. Discussions have already started in OKB, which has seen huge price changes due to the fact that there is so little time left for the Champions League Final. Football lovers and crypto investors who express their opinions on social media platforms also express that they are not satisfied with the activity in OCD.

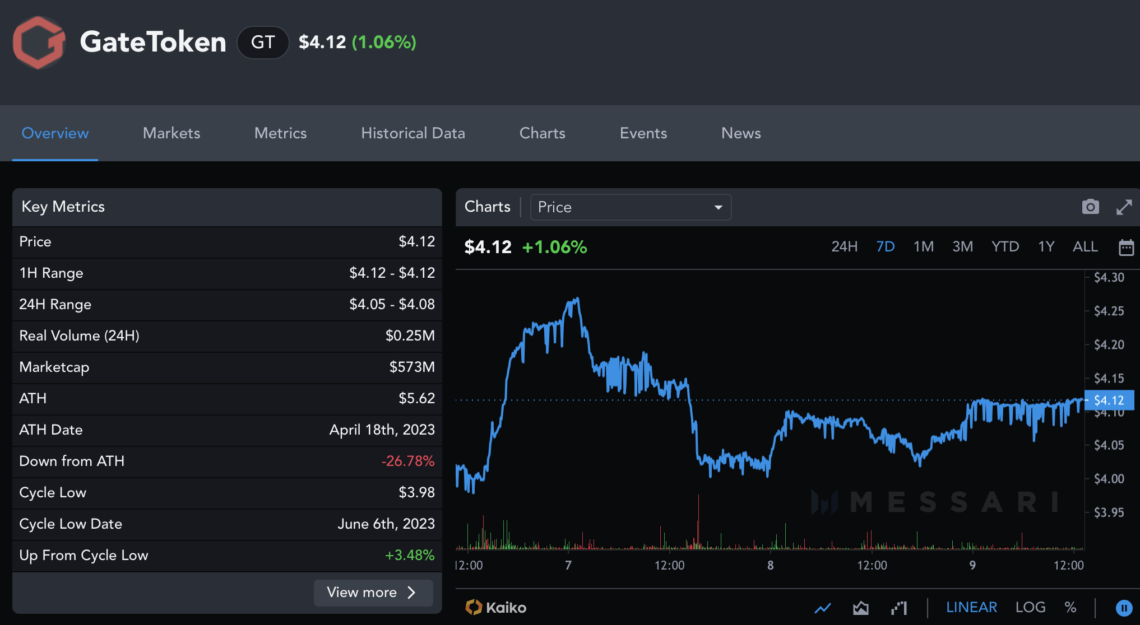

Liquidity Rumors About Gateio Drop 30 Percent GT Token

GateioRumors of liquidity problems circulating in the market about in GT Token30 percent ‘brought a great fall .Gate.io, which is circulating in the market about itself liquidityHe denied the allegations by making a statement on social media about his problems.

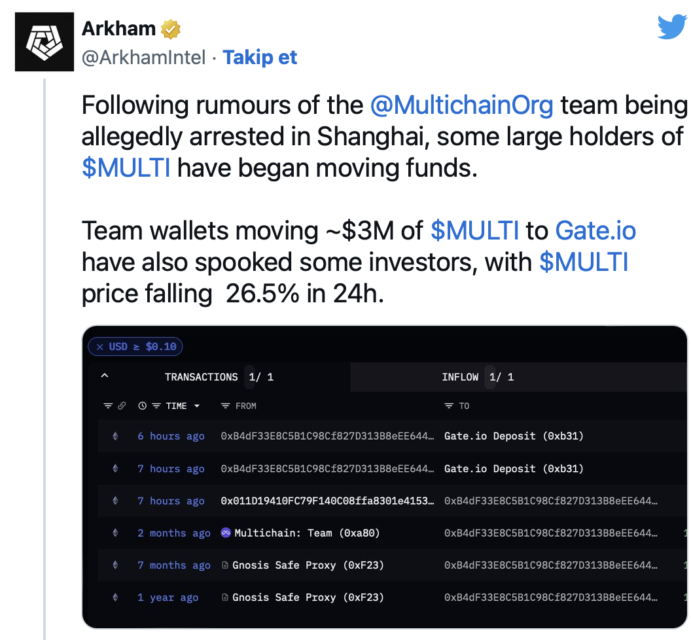

These claims stemmed from the claims that the exchange was integrated with a protocol called Multichain and therefore had payment problems. Gate.iostated that crypto trade-related transactions continue as normal and they continue their platform building activities in Hong Kong at full speed.

In addition, sharing analytical data Arkham Intelligence published a report on Gate.io on May 24 showing the massive inflow of Multichain tokens. After these events, which became increasingly complex, it was thought that the reason for this was related to the rumors that the Multichain team was arrested.

Technical Problems and Allegations of Lack of Liquidity at MEXC Global

MEXC Global was claimed as another exchange that had problems with liquidity. Many users of MEXC Global, which has recently come to the fore with technical problems and lack of liquidity, took a step back. Increasing exits from the stock market affected most of the data negatively. The exchange’s token, MX Token (MX), dropped 15 percent by testing $2.98 from $3.50.

Making statements on the website and social media platforms, MEXC Global stated that the stock market does not need liquidity and there is no situation for investors to panic. If MEXC Global, which comes to the fore in this way from time to time, experiences technical and liquidity problems in real terms, MX Token (MX) may be greatly affected by this situation.