While the crypto markets fluctuate, the famous investor Arthur Hayes predicts that Donald Trump’s policies will carry the price of Bitcoin to $ 1 million. However, Hayes, waiting for more decreases in the short term, warns investors.

Bitcoin price decreases

Since February 25, Bitcoin has not been able to stay above $ 90,000. Stating that the BTC, which is still traded around $ 82,684, could fall further in the short term, Hayes says that the market conditions have not yet supported a huge rise.

According to Hayes, not only the crypto money market, but also financial markets in general are going through a difficult process. Stating that the US stock exchanges are still close to historical summits, the investor thinks that Bitcoin’s current signals indicate a liquidity crisis.

Hayes foresees that the price of Bitcoin can fall up to 70,000 dollars and says that the market will revive again after this level.

What does Trump policies mean for Bitcoin?

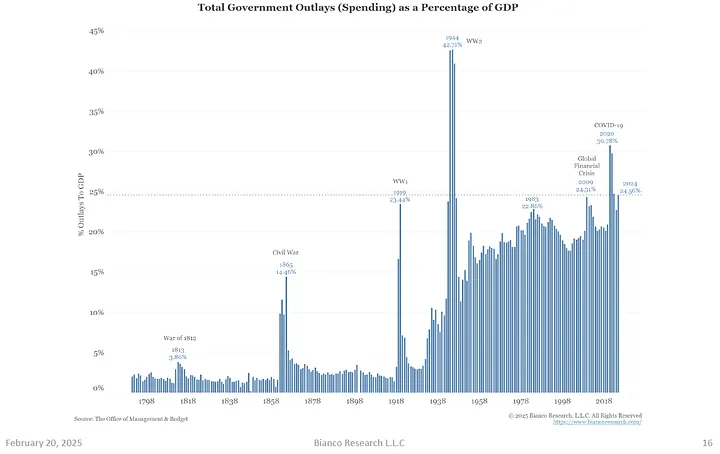

Arthur Hayes thinks Trump’s economic policies will be positive for Bitcoin in the long run. In particular, deductions in government expenditures and loosening financial policies can lead to more dollars to the market.

The Government Efficiency Department (DOGE), which played an important role in Trump’s economic management and under the leadership of Elon Musk, focuses on reducing public expenditures. However, according to Hayes, these policies may bring the risk of a stagnation with the shrinkage of the government.

At this point, the US Federal Bank (FED) may have to go to interest rate cut and a new monetary expansion may be entered. This may cause the dollar to depreciate and investors to turn to alternative assets such as Bitcoin.

How will BTC price reach $ 1 million?

According to Hayes, the changes in the monetary policy of the Trump administration may carry Bitcoin to $ 250,000 first and then to $ 1 million before the presidential period ends.

In his statements in January, Hayes defends similar views and expects investors to turn to decentralized assets such as Bitcoin for escape from the deed dollar.

If Trump’s economic policies really trigger a stagnation and provide more liquidity to the market by reducing Fed interest rates, it seems likely to be the most profitable asset from this process.

To be aware of last -minute developments Twitter ‘in, Facebook ‘ Instagram follow and follow Telegram And Youtube Join our channel!