Senior analysts such as Mike McGlone, Budd White, and Tim Enneking have made predictions for Bitcoin. Technical and fundamental broad analysis gives an idea about the latest state of the market.

“Bitcoin is trading ‘extremely discounted’”

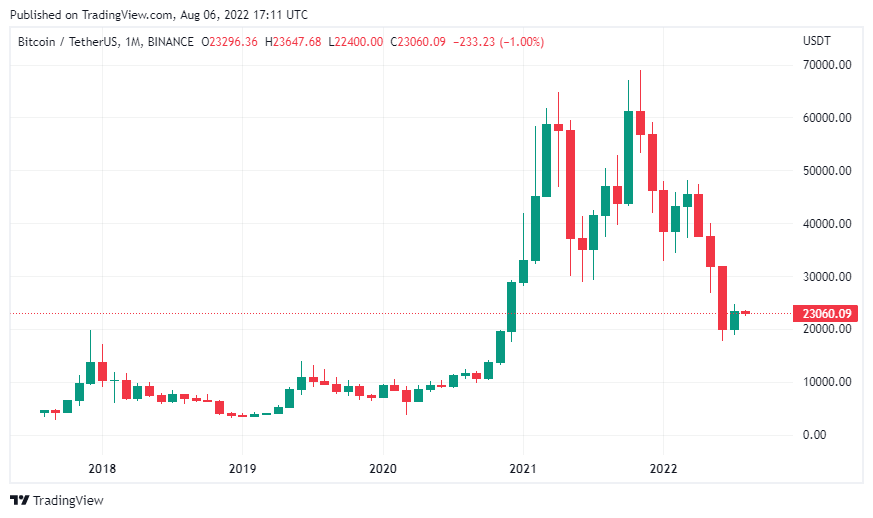

According to senior analyst Mike McGlone, Bitcoin is currently trading at a significant discount. McGlone relies on a few observations in making his claim. He also referred to technical analysis by focusing on a particular indicator. Crypto has hit its lowest level ever compared to its 100-week moving average in July,” he said, describing it as “an extreme discount within a persistent bull market.”

The Bloomberg analyst also highlights the importance of stocks that repeatedly show significant correlations with BTC:

As a result, there are few forces in the markets stronger than when the stock market crashed as high as in 1H.

Mike McGlone also draws attention to the key role played by the Fed, which made aggressive rate increases in 2022

According to McGlone, this development will potentially provide headwinds for risky assets like cryptocurrencies and stocks, by increasing the returns paid by low-risk securities and making them more attractive. According to McGlone’s recent analysis:

Fighting the Fed has been my mantra for risky assets since late last year. Bitcoin and cryptos were a major part of the 2021 rush and thus the 2022 flush, but I see Bitcoin and Ethereum coming to the fore.

McGlone presents a positive picture of the future of Bitcoin:

Bitcoin is on its way to becoming a global digital collateral in a world that is going this way, and Ethereum is the most widely traded crypto. It is the primary driver of the digital revolution, as evidenced by making dollar tokens possible.

Budd White: Bitcoin is incredibly oversold

This statement comes from Budd White, co-founder and chief product officer of the crypto software company:

I still hold the view that Bitcoin is not only incredibly oversold, but also in a major accumulation zone. With every price increase with Bitcoin, both the market cap and the utility value are growing… If you look at the MVRV value of Bitcoin, this shows that the market value of BTC has decreased to its true utility value.

Budd White’s forecasts are based on bankruptcy news in May and June. The expert adds that Bitcoin still has strong support:

It also shows me that the number of forced sellers remaining in the market is relatively small due to the massive liquidations we’ve had in recent months due to Terra, Three Arrows and others. Therefore, Bitcoin seems to have a pretty solid base at or around $18,000.

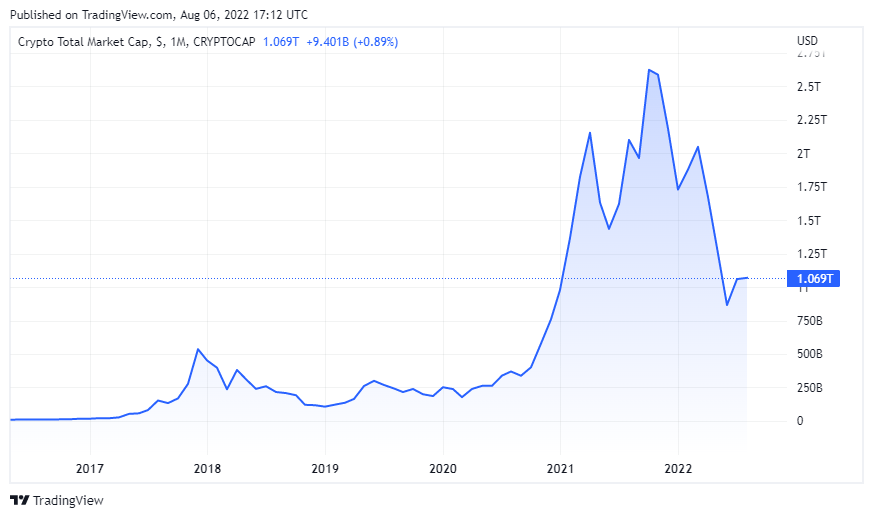

How durable is the cryptocurrency market?

Despite having strong support, White noted that Bitcoin has been “hovering” near $23,000 recently:

Note that so far, crypto prices can change quickly and dramatically – much higher than expected despite an emerging employment report. Markets seem to be pricing in more aggressive monetary tightening by the Fed as a result of these rising numbers. Stocks fell and yields soared. And again, Bitcoin just hangs in the air.

Bloomberg analyst Mike McGlone drew attention to the consolidation between Bitcoin and stocks. White has this to say about it:

I’m not saying we’re experiencing Bitcoin’s divergence from stocks. We can definitely experience another drop in terms of Bitcoin price. But this relative strength tells me that the bulk of the Bitcoin sale may be lagging behind. And to avoid any external shocks to the markets – such as credit markets that are on the verge of breaking out – I think investors still look at Bitcoin as a reasonable buy at these levels.

Potential disadvantages

While White was talking about Bitcoin’s recent price elasticity, Tim Enneking, managing director of Digital Capital Management, noted that Bitcoin could once again drop below $18,000, which it previously reached in June:

Bitcoin (BTC), although not entirely convincing, is a nice transition from the last resistance $20,000 (until July 15) to support (tested once on July 26-27 after that date and definitely up since then). made. While this is a nice move, it has been rather slow and apparently uncertain, especially given the summer recession.

As for the technical levels, Enneking shares his scenario for $50,000:

As a result, most people are keeping their bets on whether BTC will attempt to retest the June 18 low at $17.6k. Looking forward, I would expect shifts more generally, some positive movement, and no retest of the recent low. Whether to retest $20,000 is a 50-50 bid.

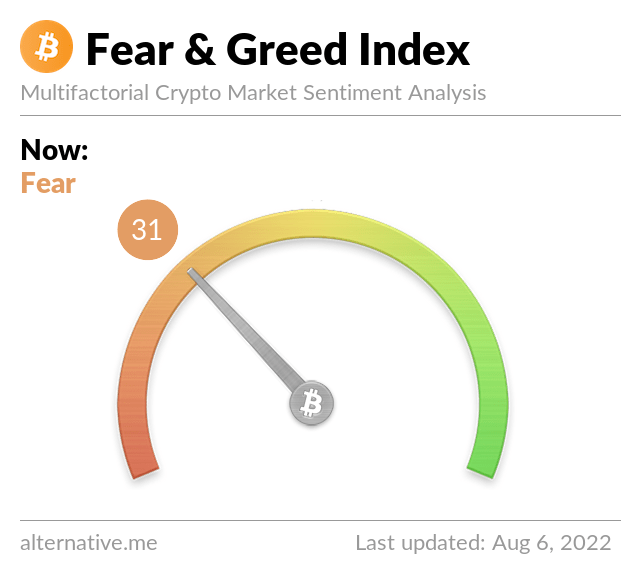

Sentiment is changing for bitcoin and altcoins

According to the Fear and Greed Index, the investor mindset has been steadily strengthening over the past few weeks. This index has been following a steady, uptrend since June 19 showing “Extreme Fear”. It has also been ranked 20 or higher since July 18.

On the other hand, Armando Aguilar, an independent cryptocurrency analyst, commented on how this measure has changed in recent weeks:

The Fear and Greed Index rebounded from the lows of the 20s after the massive collapse of some protocols and crypto service providers. Investors are back to buying crypto and the fear indicator is heading towards the yellow/buy zone. Historically, the market has seen price momentum when the index hit the mid-30s.

uncertain appearance

Finally, Aguilar continues to offer a broader analysis by assessing the big picture:

There are still lurking macroeconomic and geopolitical pressures, so if stocks take a hit and investors withdraw from risky assets, BTC could hit previous lows. Still, given the current environment and if Bitcoin can break the upper resistance levels, it could experience some positive price momentum.