Expressing that he has been waiting for a global recession for a long time, Robert Kiyosaki says that only Bitcoin and these assets will be the savior in the ‘sudden collapse’.

Robert Kiyosaki urges buying Bitcoin as “insurance against corruption”

The author of ‘Rich Dad, Poor Dad’ warns of a potential major recession in the US. In his latest tweets, he once again expressed his views on the matter. Kiyosaki says that only a limited number of assets will be the savior in a crisis environment.

At this point, he urged his followers to invest in gold, silver and Bitcoin (BTC) as the optimum insurance policy against recession. According to the investment expert, “Soft landing? Or is it a hard landing? I call it collapse. I hope I’m wrong, but that’s my belief. Corruption is high and leaders are corrupt. Buy gold, silver, Bitcoin. They are still the best insurance against corruption and incompetence.”

SOFT LANDiNG? HARD LANDING? Or CRASH LANDING? I say crash landing. I hope I am wrong yet that is what I believe. Corruption is high & leaders corrupt. Buy gokd, silver, Bitcoin. Still best insurance against corruption & incompetence,

— Robert Kiyosaki (@theRealKiyosaki) May 18, 2023

Finance writer issues multiple warnings of global economic collapse

He recently described the US dollar as “toilet paper” and “fake money”. According to Kiyosaki, the US economy is on the verge of a major collapse. cryptocoin.comWe have given numerous statements on this subject.

On top of that, it has long warned of the devastating effects of rising systemic inflation, rising oil costs, and the government’s push for greener energy policies on the American middle class. Kiyosaki relies on Bitcoin, gold and silver to counter the economic downturn.

Annual volatility pattern offers interesting insights into Bitcoin

While Robert Kiyosaki says that Bitcoin will be a ‘saviour’, the leader crypto is having a hard time in terms of price. Since he lost $30,000, a shortage of insufficient liquidity began to emerge.

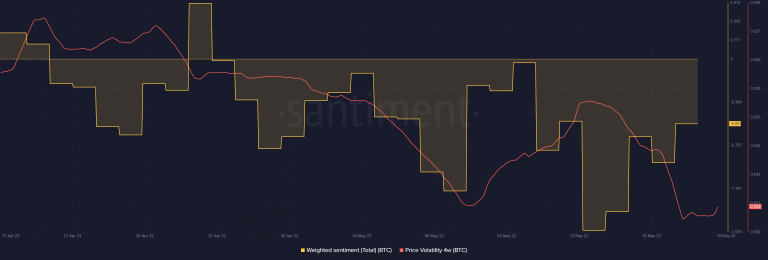

Bitcoin’s performance over the past seven days has also highlighted the low volatility along with the liquidity tightness. Recent data suggests that whales sense the heat as they are fed by the liquidity provided by the smaller accounts.

Liquidity on both sides of #Bitcoin price is so thin that whales have to either break up their market orders into smaller order sizes to minimize slippage or wait for pockets of liquidity before smashing buttons.

Cranked the Volume Percentile filter way down to see how and… pic.twitter.com/dpXddCKgiX

— Material Indicators (@MI_Algos) May 16, 2023

The above data reflecting current market conditions was supported by low volatility. This brings us to the next important pancake. According to a recent IntoTheBlock analysis, Bitcoin’s volatility levels as of May 18 have been in a historically significant range.

The analysis also revealed that the volatility metric was below 40%. This time, it was the eighth time this low in the last 5 years.

$BTC volatility reaches historically significant lows.

📉60-day annualized volatility has fallen below 40% for the 8th time in the past 5 years

💰On average $BTC vol remains below this level for 5 weeks and results in a 46% price gain

⚠️However, 3 crashes of 50% have followed… pic.twitter.com/TW8NozgIqE— IntoTheBlock (@intotheblock) May 18, 2023

Is the bull next? Or will the bear market continue?

Analysis of Bitcoin’s price action between May – July 2020, 2021 and 2022 has revealed something worth noting. In each of those years, there was a drop in volatility in those three months. This was followed by a remarkable rally. So far, things have turned out somewhat similar this year, given the low volatility at the moment.

On the other hand, investor sentiment has been on a generally downward trajectory over the past four weeks. The same IntoTheBlock analysis revealed that low volatility below 40% lasted on average for about five weeks, after which there was a 50% drop in three similar cases.

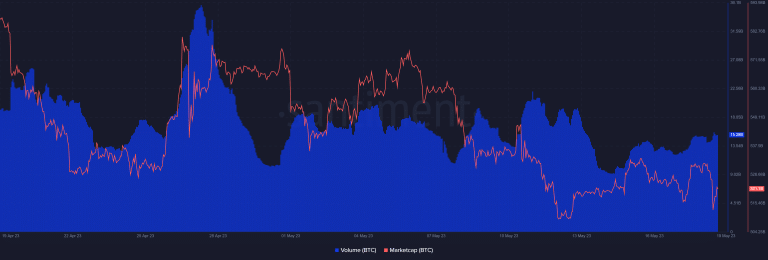

If BTC does indeed drop 50% from the current level, the next level could be in the $13,500 region. However, there are many things that determine the price outcome of Bitcoin. For example, BTC was still experiencing bullish volumes, which means there is still some confidence in the market. On-chain volume has increased slightly over the past four days.

Meanwhile, $780 million worth of Bitcoin options expire today. In this article, we have included how it can affect the price.