Jurrien Timmer, director of asset investment giant Fidelity, made a surprising prediction about the cryptocurrency market.

Jurrien Timmer says the Fed will lead the cryptocurrency market

The global macro director of Fidelity Investments included positive predictions about the markets on Twitter yesterday. Global markets have been under pressure for some time due to tightening policies. Timmer expects the latest Fed to loosen its policy from successive rate hikes. Ultimately, this shift will be the trigger for the relief the markets need. In the words of Timmer:

With global financial markets under pressure, the Fed could theoretically change direction (tightening less than expected) at any time. This could provide some much-needed relief to the markets.

With global financial markets under pressure, the Fed could theoretically pivot at any time (by tightening less than expected). That could provide some much-needed relief for the P/E model. /2

— Jurrien Timmer (@TimmerFidelity) October 4, 2022

According to the New York Times, the US’s gross national debt has exceeded $31 trillion for the first time. A serious financial turning point is emerging as the country’s long-term financial outlook becomes more pessimistic. Referring to the S&P 500 chart, Timmer claims that the current market situation has a positive side. Bitcoin and the S&P 500 were highly correlated throughout the year. However, Bitcoin investments are optimistic that there will be a return in October. BTC already had the opportunity to hit $20,000 in the first days of October. But some analysts say it’s a bull trap and yen bottoms are imminent. cryptocoin.comWe have discussed the current analysis in this article.

How much investment has the cryptocurrency market received this week?

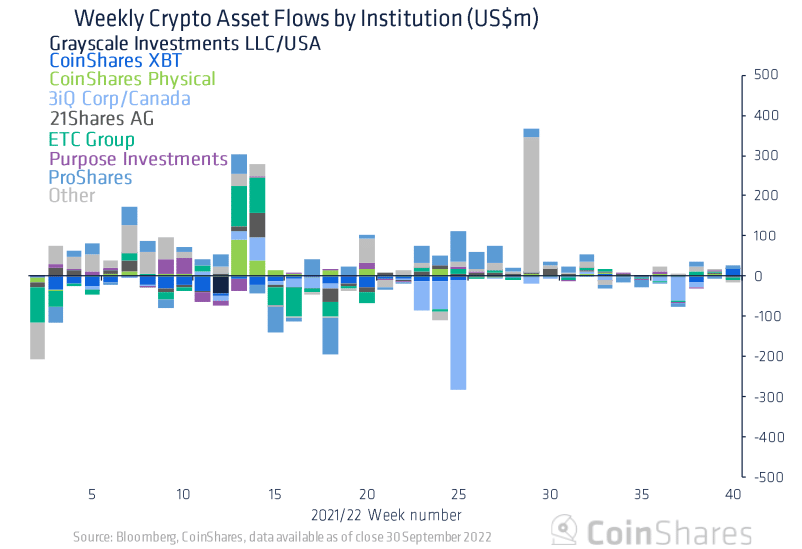

A new report by CoinShares marked the third consecutive week with declining inflows in investment products since last week. With a relatively low inflow of $10.3 million, James Butterfill, Head of Research at CoinShares, concluded that institutional sentiment towards investments is currently hesitant.

Coinshares XBT generated the highest inflow with $16.4 million in investment provided by them. Interestingly, Grayscale, which has the most assets under management (AUM), had a net of 0 flows for the week. Popular Bitcoin ETP provider 21Shares has set a barrier to entries contributed by other providers. CoinShares found that it registered an outflow of $3.6 million.

Since the beginning of 2022, ProShares’ investment products have generated the most inflows. Right now it’s almost $300 million. That equates to just over $708 million he currently has under management.

How about Bitcoin and the cryptocurrency market?

Bitcoin, the largest cryptocurrency by market capitalization, rose as much as 6% on Tuesday to $20,479, its highest level since September 27. This increase was in line with broader gains in US equities. Additionally, other cryptocurrencies such as Dogecoin, XRP, and Elrond have also flourished. At the time of writing, the price of Bitcoin was at $20,088, barely increasing from the previous day.