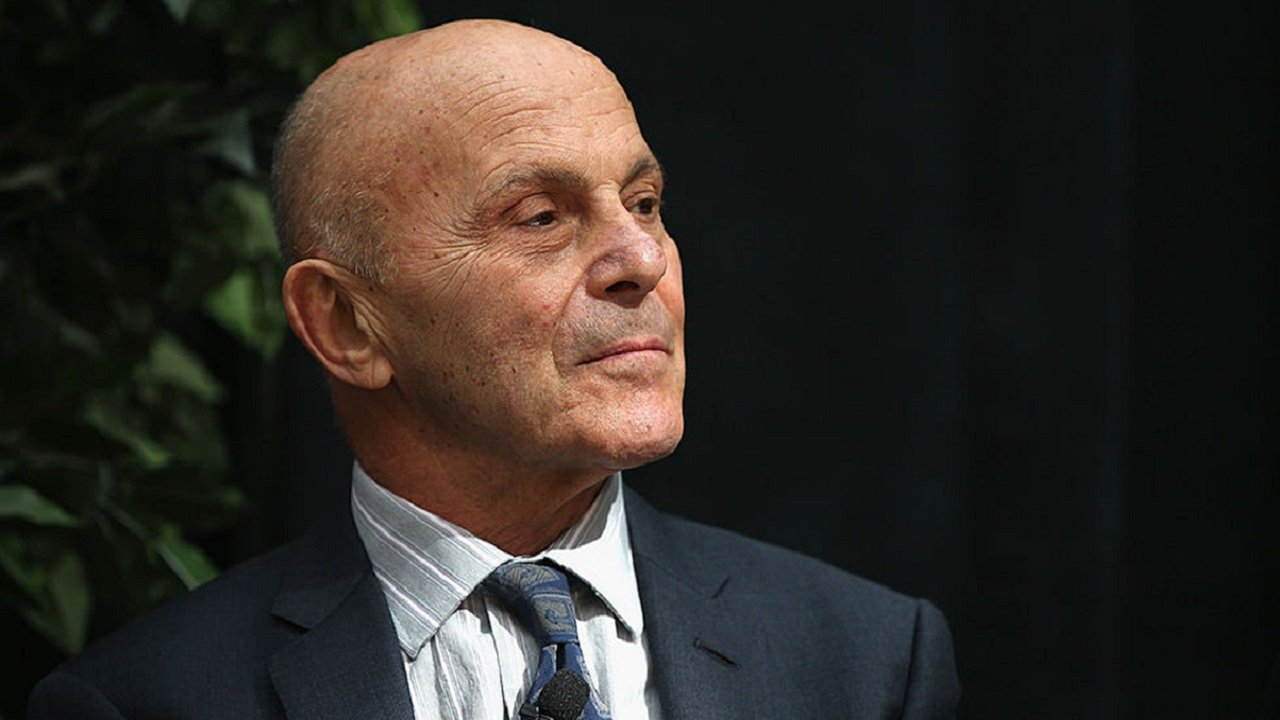

Nobel laureate in economics Eugene Fama shared his views on the leading crypto Bitcoin and the ‘safe haven’ gold. Fama claims that the true value of Bitcoin is zero. He also says that gold is a ‘terrible’ inflation hedge.

“Gold is terrible inflation protection; Bitcoin has no real value!”

Eugene Fama won the 2013 Nobel Prize for his work on asset pricing, portfolio theory, and the efficient market hypothesis. University of Chicago Finance Professor Eugene Fama says Bitcoin and gold are bad as long-term investments. The economist explains:

This is a situation where the market does not understand that Bitcoin has no value. Right now, I guess even scammers don’t trade and hold it. They’ll probably take action. Then they will quickly give up for something else. Because it’s too risky.

Fama notes that when it comes to gold, it has a ‘highly volatile price’. He states that it is a terrible hedge against inflation, as the price of goods and services is very volatile relative to prices.

Inflation and the US dollar

cryptocoin.com As you follow, headline inflation in the USA was 8.5% in June. Thus, the USA saw the second highest level in 40 years. Eugene Fama says inflation worries him a lot. In this context, the economist makes the following assessment:

To combat inflation, in the old days, the Fed would shrink its reserve supply. But now he thinks he can do this by raising the interest rate on reserves, making people less willing to hold other assets or do something else. However, the question is, how high should that interest rate be?

“Even if the Fed raises interest rates, we don’t know if it will work to stabilize inflation,” Fama says. Because, he notes, this regime has never existed before. He also adds that if he were in the place of Fed Chairman Jerome Powell, he would “find another job.”

Efficient Markets Hypothesis?

The efficient market hypothesis (EMH) is closely related to Fama, who won the Nobel Prize in part for her work in this area. EMH claims that on average it is not possible to beat the market, as all available information has already been priced in. Fama explains it this way:

The main conclusion that EMH shows for investors is that it is impossible to beat the market. So basically, passive investing is the way forward.

Fama also points out that insider trading could weaken EMH. In this context, he adds the warning that the markets are not efficient due to insider traders. The economist also touches on the effects of EMH on managed funds and technical analysis. He comments on these:

When you look at active admins, everyone claims to have private information, and most don’t. As for technical analysis, I don’t mean to be insulting, but basically I think it’s a hopeless activity.