Crypto analyst Konstantin Kaiser is looking for more gains on MIOTA. Analyst Ibrahim Ajibade shares his GRT price forecast. According to crypto analyst Yashu Gola, PEPE price action points to a potential 70 percent drop.

MIOTA got rejected at Fibonacci level!

On Tuesday, MIOTA tested the 0.5 level of the Fibonacci retracement from the local top at $0.2740. The token hit a price point of $0.2266 but has since fallen by over 12%. Fibonacci’s 200-day Exponential Moving Average (EMA) with resistance at 0.5 is located at $0.2295. Finally, the golden ratio resistance, which is the 0.618 Fibonacci level, is located at $0.2349. For IOTA to rise again, the token needs to make a stable daily close above these resistances.

IOTA price chart / Source TradingView

IOTA price chart / Source TradingViewcryptocoin.com As you follow, the price of MIOTA has dropped a little. However, it is currently hovering around the support zone of the 0.236 Fibonacci level at $0.1958. However, both the 10-day EMA and the 50-day EMA have support at $0.1966. After consolidating around these support zones, it is possible for the token to make another move to break the resistance area.

IOTA price / Source TradingView

IOTA price / Source TradingViewGRT price prediction: Target slips to $0.18

Given the bullish activity among whale traders, it is possible for GRT to rise to $0.18 in the coming days. However, IntoTheBlock’s Global In/Out of The Money Around Price (GIOM) data shows that GRT will face its first major resistance around $0.15. As highlighted below, 13,220 investors who bought 638 million GRT at an average price of $0.15 could create a sell wall. However, if the bullish momentum continues in line with expectations, a further drop towards $0.18 is possible.

The Graph GIOM data, May 2023 / Source IntoTheBlock

The Graph GIOM data, May 2023 / Source IntoTheBlockOn the other hand, the bullish prediction will be invalidated if GRT unexpectedly drops below the critical $0.10 support zone. However, 9,740 investors purchasing 1.52 billion GRT at an average price of $0.10 will likely avoid the decline. If it breaks above this support level, a pullback towards $0.08 is likely. However, the probability of this situation is not high.

PEPE shows a classic comeback pattern!

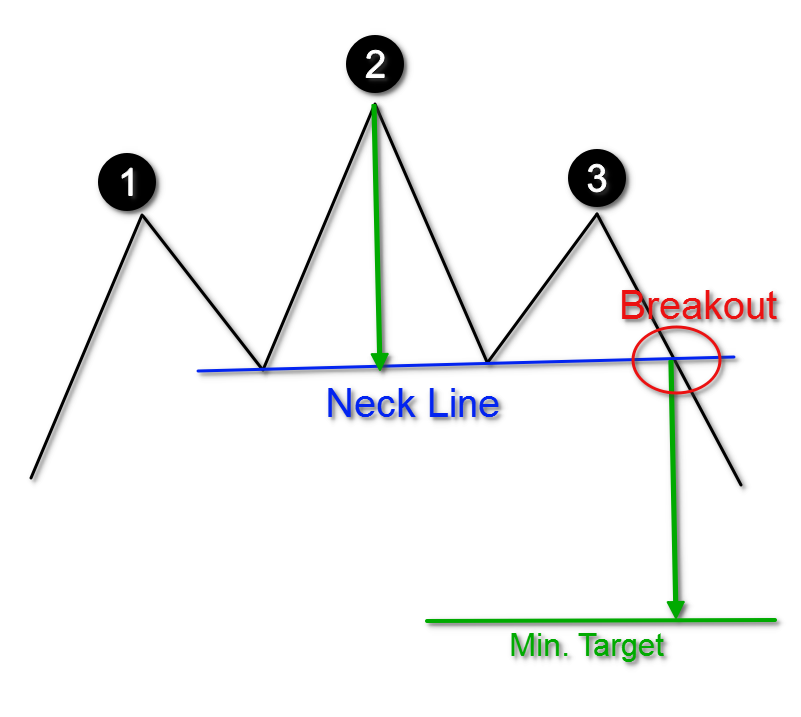

Technically speaking, it is possible that PepeCoin will see a sharp drop from its current levels. At the heart of this bearish look is the classic head and shoulders (H&S) pattern. Analysts using technical analysis see the H&S pattern as a bearish indicator for those unfamiliar with it. It occurs when price forms three peaks above a common neckline support. These are the middle crest, called the “head”, higher than the other two, called the “left shoulder” and the “right shoulder”.

Head and shoulder distribution / Source: Forex Academy

Head and shoulder distribution / Source: Forex AcademyThe H&S pattern dissolves after the price drops below the neckline. Meanwhile, as a technical analysis rule, traders measure the pattern’s bearish target by adding the maximum distance between the head and neckline to the breakout point. On May 22, PEPE broke below the H&S neckline at around $0.00000156. That puts its downside target around $0.00000041 in June, about 70% lower from current price levels.

PEPE 4-hour price chart / Source: TradingView

PEPE 4-hour price chart / Source: TradingViewMeanwhile, PEPE is likely to test $0.00000082 for a recovery in June. In this case, it is possible that the H&S malfunction ends halfway. This level, which is about 30% down from current price levels, acted as support at the beginning of May. It also coincides with the 0.786 Fibonacci line of PEPE. On the other hand, if PEPE price retraces the H&S neckline as support, the failure scenario will risk being invalidated.