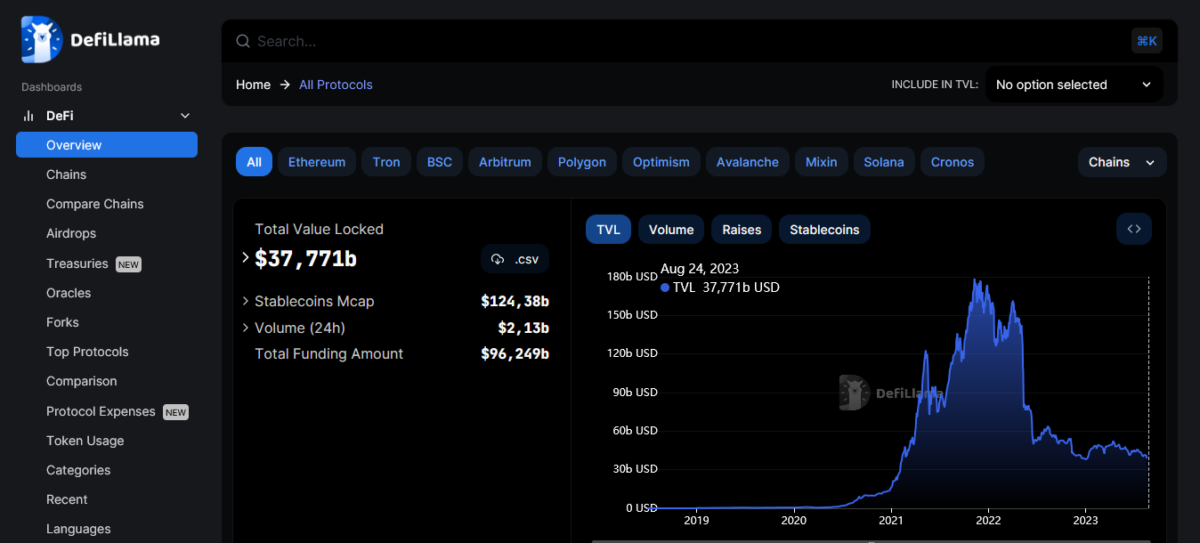

A little over a year ago, there were differences for the decentralized finance (DeFi) ecosystem. Accordingly, it boasted a staggering $150 billion worth of cryptocurrency locked in its various protocols. But DeFiLlama’s latest data paints a different picture. Accordingly, it reveals that the total value locked (TVL) has dropped to approximately $37.7 billion.

Factors behind the decline in DeFi TVL

This drop is notable as it even fell below TVL, which was nearly $43 billion just after FTX’s collapse last year. Currently, the majority of assets in DeFi protocols are in one place. Accordingly, the liquid staking protocol, which has a significant TVL of 14 billion dollars, is concentrated in Lido. By contrast, decentralized stablecoin issuer MakerDAO has the second largest TVL at $5.1 billion.

Experts in the industry attribute this decline to different reasons. Among these reasons are the decline in trading volume, ongoing concerns about asset security due to vulnerabilities. There are also various factors such as hacks and exploits targeting vulnerable protocols.

Market changes and TVL decline in DeFi space

Crypto Coin Show CEO Ashton Addison highlighted the close link between the TVL drop and the drop in crypto asset prices. He highlighted the impact of Ethereum falling from around $4,800 to $1,600. It also caused a significant drop in the staked ETH value. Addison explained that inflated TVL figures during the 2021 bull run are linked to unrealistic return bids on low-liquidity coins.

Barney Mannerings, co-founder of Vega Protocol, echoes this sentiment. Accordingly, he states that previously high returns are artificially inflated and unsustainable. Mannerings emphasizes that real returns in the DeFi space depend on transaction fees. He also states that the decrease in trading volume has led to lower returns. He emphasizes that safer investment options are preferred due to increasing risk-free interest rates and economic uncertainty.

Security concerns affect trust

Mannerings also highlights the impact of vulnerabilities and breaches in the DeFi industry. There is a critical state of vulnerability in Balancer’s v2 pools. There are also recent events such as an exploit on Curve that resulted in a loss of $70 million. These have raised concerns about platform security and user trust.

Despite these challenges, Mannerings remains optimistic about the future of DeFi. It highlights positive growth in the derivatives and real-world assets sectors. He also states that this could potentially trigger the next DeFi bull run. He also highlights that since the beginning of the year, real-world assets have grown from about $50 million to over $1 billion.

Allocating funds

It is very important to distinguish between on-chain funds and funds within DeFi protocols. Akash Mahendra, director of the Haven1 Foundation, emphasized that while DeFi TVL is declining, on-chain holdings of assets such as stablecoins and sETH are significantly beyond 2021 levels.

As a result, the DeFi ecosystem is affected by market changes. It also faces challenges stemming from security concerns and changing investor preferences. Despite these obstacles, industry experts are hopeful. They expect the industry to grow and develop, especially with the impact of potential catalysts such as real-world assets and derivatives.