Over the past week, some altcoin projects have seen big drops. The drops seem to be concentrated in exchange tokens, especially after the FTX exchange went bankrupt. Here are the details and analyst Valdrin Tahiri’s predictions for the 5 most falling altcoins this week…

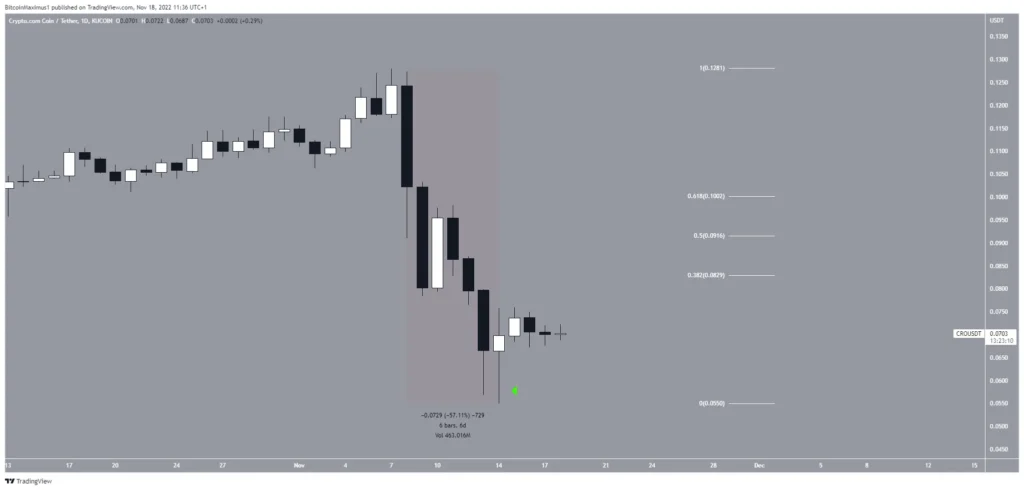

Crypto.com’s altcoin project CRO drops 25 percent

cryptocoin.com As we reported earlier, the collapse of FTX has reduced confidence in other centralized exchanges. Some investors have started selling their exchange tokens. One of them is the CRO of Crypto.com exchange. The CRO price started a sharp decline on November 8. It fell 57 percent to as low as $0.05 on Nov. 14 in just six days.

The CRO then jumped into a long bottom wick. However, he has not yet started a rally. If a pullback occurs, the primary resistance would be $0.08 and $0.09. These are the 0.382 and 0.5 Fib retracement resistance levels, respectively.

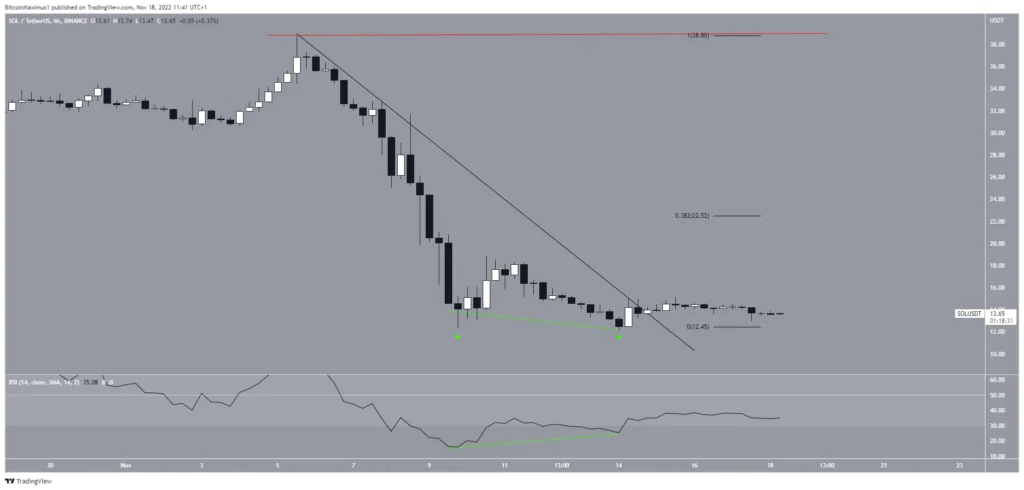

SOL price failed to rise

The SOL token, which is down 21 percent on a weekly basis, is the native token of the Solana network. Due to its relevance to FTX, the SOL price has fallen below a descending resistance line since November 5th. The altcoin dropped to $12.37 on Nov. After a slight bounce, SOL price is back to the same level. According to the analyst, it formed a double bottom formation. Besides being considered a bullish pattern, the double bottom coupled with the bullish divergence on the RSI.

Shortly after, the SOL price broke out of the descending resistance line. However, Solana price failed to initiate any upward movement. In such a case, the main resistance area would be $22.52 formed by the 0.382 Fib retracement resistance level. Conversely, a drop below the November 9 low of $12.37 indicates that lower prices are ready.

CSPR rises on long-term support

CSPR price, which is down 21 percent this week, has been rising with a rising support line since June 16. The line has been verified four times, most recently on November 17. However, there are no signs of a bullish reversal in place yet. While the RSI is oversold, it has yet to form any bullish divergence despite the small bounce in the last 24 hours. As a result, the direction of the trend is uncertain. A breakout of the CSPR price from the support area, either up or down, determines the trend. In case of a bounce, the nearest area of resistance is $0.38.

What’s next for Huobi’s altcoin project HT?

HT has lost value since November 3rd. The bearish action caused the coin to drop to $3.7 on November 13. This was the lowest level of the year. It seems like it caused a breakout from the $4.30 horizontal support area that has been present since July. However, HT price bounced and reclaimed the $4.30 area, forming a long lower wick. Now, the next resistance is at $5.40. On the other hand, if HT breaks through the $4.30 horizontal support area, the decline could accelerate.

MANA breaks out of long-term support level

MANA has fallen below a descending resistance line since reaching its all-time high of $5.90 in November 2021. This streak resulted in a refusal in early November 2022. The MANA price fell from the $0.50 level it was moving sideways to. The current low at $0.41 is the lowest since June 2021. If the downward move continues, the next closest support will be at $0.30. Conversely, a break from the resistance line is necessary for the trend to be considered bullish.