6 professional analysts, closely followed by the crypto money market, announced critical levels for the leading cryptocurrency Bitcoin (BTC)! So, what are the next levels for Bitcoin (BTC)? Here are the details…

Leading analysts of the cryptocurrency market commented on Bitcoin

cryptocoin.com As we have reported, Bitcoin (BTC) has been fluctuating for a long time and is very close to the 30 thousand dollar level. Instantly, TradingView data shows Bitcoin (BTC) surging to its May high of $29,529 on Bitstamp. The BTC/USD segment had dropped with US equities at the Wall Street open the previous day, but the weakness was short-lived as the $29,000 support returned. Ongoing market concerns stemming from the US banking crisis currently affecting many regional banks continue to shape observer sentiment.

What are we drinking this weekend, left or right bank? pic.twitter.com/Mp2yXcI2Fa

— Arthur Hayes (@CryptoHayes) May 4, 2023

“The stocks of 100 percent of all regional banks in the United States turned red for the first time today,” crypto media account Whalewire wrote on Twitter, adding, “This is Federal Reserve Chairman Jerome Powell saying that the US banking system is stronger than ever before. He came the day after he said it.” that was in his words. However, Financial commentator The Kobeissi Letter assessed the potential for the fallout to continue to float outward and said, “Today is the first day since March that markets have taken the banking crisis seriously,” as stocks and crypto fall. However, the expert continued his words as follows:

Regional banks are at new lows as the S&P 500 slumps more than 100 points from this week’s high. At first, the crisis was thought to be isolated. Maybe it’s not as isolated as it seems.

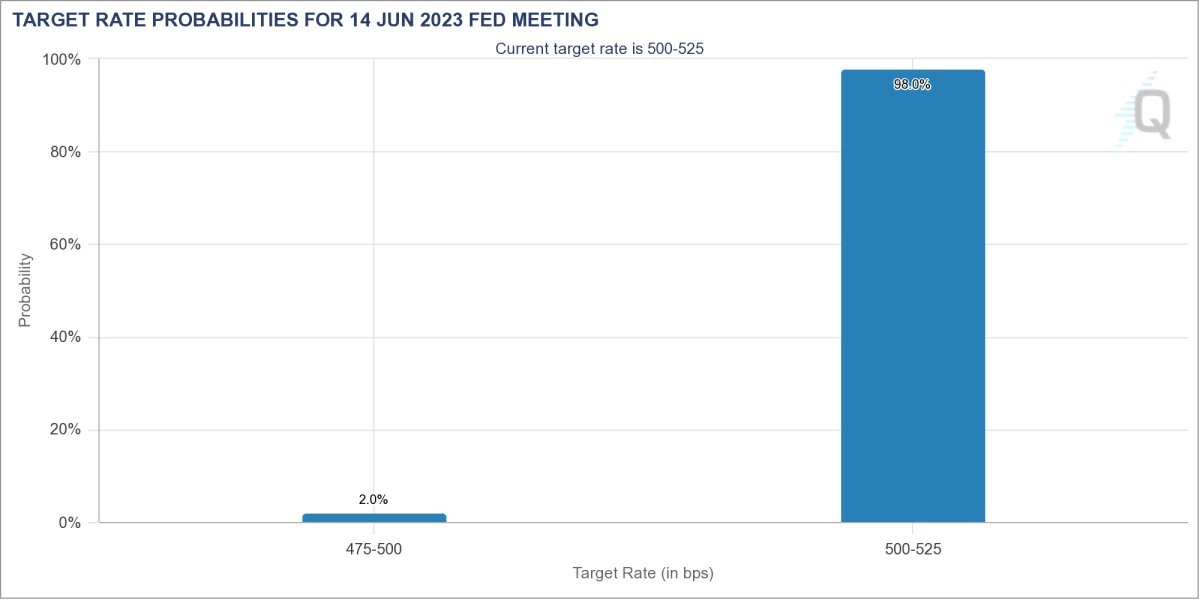

After the Federal Reserve hiked interest rates this week, market expectations still shifted to predict the end of the upward cycle. According to CME Group’s FedWatch tool, the next rate decision to be announced in mid-June will not lead to another increase.

Analysts announced critical levels for Bitcoin!

Crypto Tony, one of the leading analysts in the crypto money market, targeted the level of 32 thousand dollars for Bitcoin on Twitter with his recent analysis. Immediately after this, the analyst expects a decrease.

Playing around with ideas at the moment on #Bitcoin .. Now i do not use these sort of trend lines often, but i cannot ignore this one as coincides nicely with the range high i am looking for us to hold

Best case we tap range $32,000 and dump pic.twitter.com/1J7JfGzCvg

— Crypto Tony (@CryptoTony__) May 5, 2023

Another analyst commenting is Alan, the popular analyst known as Trader Tardigrade. “Bitcoin has entered the ‘Power storage’ phase,” the analyst thinks, emulating the exit of BTC in late 2020, along with a comparative chart to his Twitter followers. However, the analyst points to an upcoming bull run.

However, recently, fellow analyst Ninja set more conservative levels to bounce back as support. “Bulls should stay above $28.9-29k… The sooner they get above $29.2k, the better,” he wrote in one part of a new analysis.

Bitcoin (BTC) price technical analysis

From a macro perspective, the crypto market continued to consolidate on Thursday as the altcoin market is split evenly between winners and losers, as the price of Bitcoin has tightened further in its trading range since mid-March. The stock market, on the other hand, was under constant pressure throughout the trading day as the Fed’s latest rate hike and continued banking sector troubles weighed on asset prices. S&P, Dow and Nasdaq ended the day in the red, down 0.72%, 0.86% and 0.49%, respectively. Data from TradingView shows that Bitcoin price fluctuated around the $29,000 support level in Thursday trading, reached $29,430 in the morning and dropped back to $28,750 in the afternoon, returning to the support near $29,000.

According to technical analyst Jim Wyckoff, the price surge late Wednesday helped May Bitcoin futures rise in early trading.

“Bulls generally have the short-term technical advantage,” Wyckoff said, “The direction in which prices move above or below the range defined by the resistance and support lines seen in the chart above will most likely be the direction of the next continuously trending price move.” added his words.

Bitcoin price maintains its long-term positive outlook

More on Bitcoin following the Federal Reserve’s rate hike was presented by Didar Bekbauov, Founder and CEO of Bitcoin group mining company Xive, saying, “Bitcoin is 2.12%, which helped push the price of the leading coin above $29,000. It is retesting a new weekly high after growth of . According to Bekbauov, yesterday’s wave of sales highlights the anxiety experienced by institutional investors trying to manage the market fluctuation caused by concerns about the health of the global economy.

“Immediately after the US Federal Reserve announced its 10th rate hike of 25 basis points, the market reacted with a decline, confirming institutional investors’ fears about the economy causing them to sell bags of BTC,” Bekbauov said. It’s no surprise given the trend.” added his words. Bekbauov added that while the market does not expect a long-term sell-off by institutional investors, there are other headwinds that may trigger some owners to become risk-averse in the short-term, but the long-term outlook is positive. The words of the expert are as follows:

Bitcoin price is poised to close Q2 with no less than $35,000. The foundation on which this growth will be based is on the widely held belief by Bitcoin ideologues, myself included, that the coin will soon play a pivotal role in the future of money and be adopted as the leading cryptocurrency. Like many industry professionals, I see Bitcoin as the first choice for achieving long-term investment goals, as I consciously choose to stick to long-term strategies when investing in crypto.

As for which price point could be the sign of the next uptrend for the leading crypto Bitcoin, market analyst Michaël van de Poppe shared the following tweet, noting the horizontal nature of the current market and highlighting a price target of $29,200.

#Bitcoin is pretty much stuck in between. Bulls are happy, bears are happy and finding arguments.

I would say that a break above $29.2K and definite confirmation through a retest, that' my trigger for new highs.

Banks failing, how hard it may sound, is actually bullish for… pic.twitter.com/hu4vWqQxZa

— Michaël van de Poppe (@CryptoMichNL) May 4, 2023