The White House is pushing for an extra 30 percent tax on electricity used by cryptocurrency miners. If this request is approved, the DAME tax of $ 3.5 billion in 10 years is at the door. The details and justifications for this tax were also explained in the blog post of the White House Council of Economic Advisers, dated May 2, 2023.

The cryptocurrency ecosystem had to contend with numerous legal initiatives, especially in 2022 and 2023. The collapse of FTX in recent years has ignited the investigations opened especially for US-based stock markets. On the other hand, there have been moves that will provide cash flow from this market, which cannot be stopped from growing by ancillary regulations and that will take into account the ongoing discussions on environmental concerns. One of them emerged in a blog post recently published by the White House Council of Economic Advisers.

According to this blog post, the White House is asking the US Congress to pass an additional tax that will increase the cost of electricity used to mine cryptocurrencies by 30 percent. Even the name of this tax is ready: DAME consumption tax. So Digital Asset Mining Energy consumption tax.

So what exactly is said and asked in this blog post? Here are the striking statements in the report:

“Last month, the President (Joe Biden) unveiled the Fiscal Year 2024 Budget, which builds on progress made over the past two years to make critical investments to grow the economy, cut costs for families, protect and strengthen Medical Care Services and Social Security, and reduce the deficit.

The Digital Asset Mining Energy (DAME) excise tax, a new proposal in this year’s budget, is an example of the President’s commitment to addressing both longstanding national challenges and emerging risks (economic and environmental costs). After a phased transition period, firms will face a tax equal to 30 percent of the cost of the electricity they use to mine crypto.

Crypto mining is the process of verifying transactions between crypto-asset holders to record and transfer cryptographically secure assets into a distributed ledger, for example, using computing equipment to perform calculations to select the validator. Currently, crypto mining firms do not have to pay the full cost they impose on others in the form of local environmental pollution, higher energy prices, and the climate impacts of increased greenhouse gas emissions. The DAME tax encourages firms to better take into account the harm they do to society.

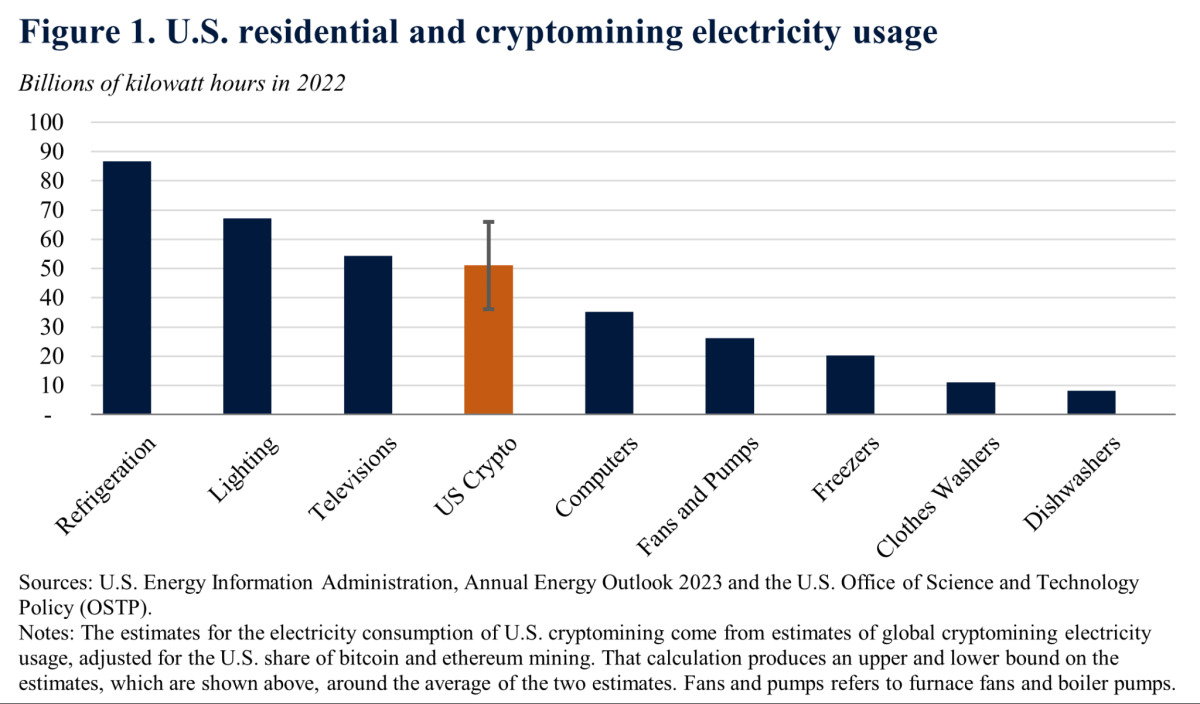

While cryptoassets are virtual, the energy consumption associated with their computationally-intensive production is very real and comes at very real costs, as highlighted in an episode of this year’s President’s Economic Report (titled “Digital Assets: Relearning Economic Principles”). Recent reports from the New York Times highlighted the scale of power consumption associated with 34 of the largest crypto mining operations, which they calculated equal to the power used by the surrounding 3 million homes. As shown in the figure above, the amount of electricity used in crypto mining in the United States in 2022 was similar to that used to power all of the nation’s home computers or residential lighting.

The high energy consumption of cryptominers has adverse effects on the environment, quality of life and electricity grids where these firms are located nationwide. Pollution from electricity generation falls disproportionately on low-income neighborhoods and ‘disadvantaged’ communities. The intense and often variable power consumption of cryptominers can also raise electricity prices for consumers and increase risks to local electricity grids; may strain the equipment, causing service interruptions and safety hazards. Still, as crypto mining is geographically mobile and the stability of its business model remains uncertain, local public administrations face financial risks if they invest in upgrading capacity that may not be needed if mining activity ceases or goes away.

Emphasis on environmental concern…

Even when miners use the clean power available, crypto mining has environmental implications. For example, in the case of hydroelectric units where crypto mining operations are frequently involved, increased electricity consumption by crypto miners reduces the amount of clean energy available for other uses, raises prices, and increases the overall reliance on dirtier electricity sources.

Besides these known costs and risks, crypto mining does not provide the local and national economic benefits typically associated with businesses using similar amounts of electricity. Instead, energy is used to produce digital assets whose broader social benefits have yet to be realized, as detailed in the President’s Economic Report. There is little evidence that it benefits local communities in the form of employment or economic opportunity, and studies have found that small increases in local tax revenue are more than offset by rising energy prices for firms and households.

Examples from China, Canada…

While the potential for crypto mining to move abroad (for example, to areas with more polluted power generation) is a concern, other countries are also moving increasingly to restrict crypto-asset mining. China, like eight other countries, completely banned such activities in 2021; All three Canadian provinces have announced or enacted crypto mining moratoriums. Similarly, some US States and territories now impose higher electricity prices for or restrict activity.

A national policy is needed to ensure that crypto mining is not simply pushed from one local community to another. Of course, the DAME tax is not a panacea; this is just one example of the Administration’s efforts to combat climate change, lower energy prices, and increase access to electricity options for all Americans. Similarly, it is just one example of the President’s larger efforts to enable responsible development of digital assets, modernize tax treatment, and mitigate financial stability risks. The primary purpose of the DAME tax, which is estimated to generate revenues of $3.5 billion in 10 years, is to help crypto miners to help local communities and communities. is to start ensuring that they pay their fair share of the costs imposed on the environment.”

Moreover, there are other politicians who will fiercely defend Biden. In March, Senator Ed Markey and Representative Jared Huffman made public the Crypto Asset Environmental Transparency Act, which requires crypto companies to disclose all their emissions. “When a year of Bitcoin mining in the US creates as much carbon emissions as 7.5 million gas-powered cars, we have a problem,” Markey wrote on Twitter. “The crypto industry is growing, but so is the fight for climate justice. We will hold these companies accountable.”

When one year of U.S. Bitcoin mining creates as many carbon emissions as 7.5 million gas-powered cars—we have a problem. Today's hearing made that even clearer. The crypto industry is growing, but so is the fight for climate justice. We will hold these companies accountable. pic.twitter.com/EA2vPrjcTy

— Ed Markey (@SenMarkey) March 7, 2023

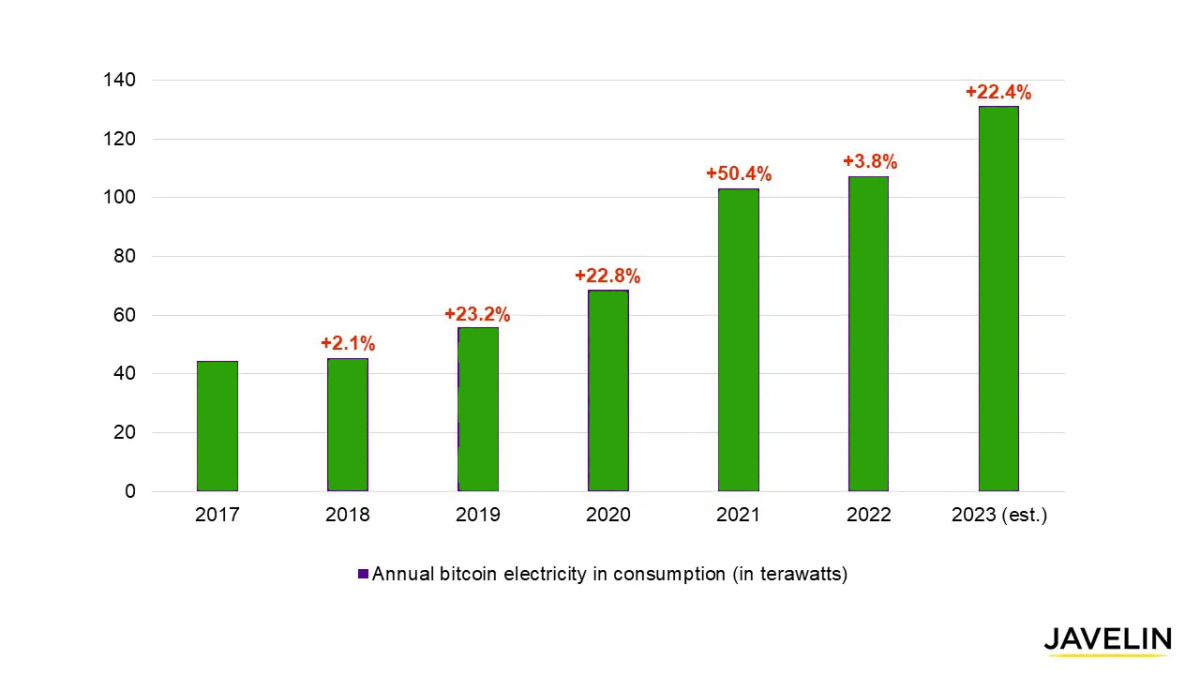

Actually, as mentioned in this blog post, this discussion is not a new one. With the decision of China that caused a short-term earthquake effect in the crypto money markets in 2021, the country took a series of measures that banned crypto mining. This caused large miners to shift their activities to geographies such as Canada, Russia, Kazakhstan, USA and Malaysia. The second major blow came from Canada, and practices penalizing mining activities were again implemented in three major provinces. The main discussion was on the electricity consumption and environmental effects of Bitcoin mining, especially with an old technology. Although mining activities for many altcoins focus on less energy consumption with newer technologies, the main reason that prevents this discussion from ending, according to the graphic below, is the increasing energy consumption of Bitcoin mining:

By contrast, Javelin Strategist and Research Analyst Joel Hugentobler is highly skeptical that this White House initiative will come to fruition. Hugentobler describes the proposed tax as an erroneous tool that, if enacted, will push the industry away from other countries:

Joel Hugentobler, Javelin Strategist and Research Analyst

“Taxing miners, for whatever reason, will divert it to another country where miners can find electricity just as cheaply and not have to pay taxes. The federal government keeps saying it wants to be a leader in innovation, but everything it has pondered over the years has proven otherwise.”

Hugentobler also objects to the administration’s tax initiative, pointing out that crypto miners are already benefiting from innovative approaches such as renewable energy.