The latest crypto market rout has led to heightened anxiety among investors, accompanied by layoffs at Coinbase and other big industry players. Now fresh signs are emerging that the nervousness is hitting Tether, the issuer of the most popular stablecoin.

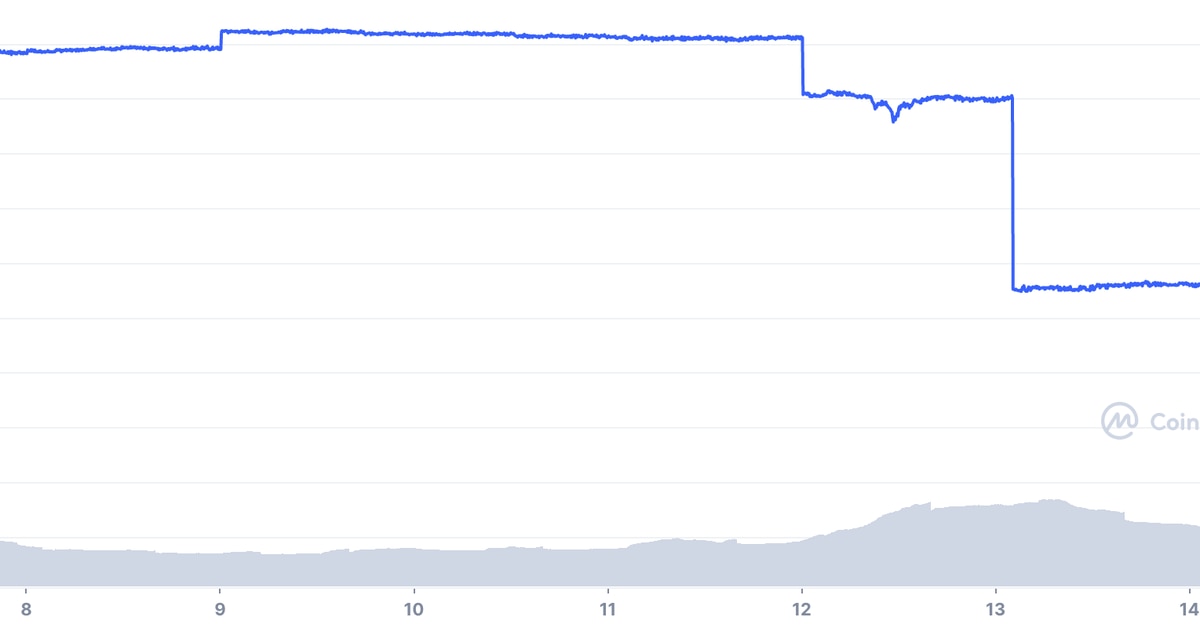

Investors pulled out about $1.6 billion in 48 hours from Tether’s dollar-pegged USDT stablecoin, reducing its circulating supply to $70.8 billion, the lowest since October 2021, according to price tracker CoinGecko.

Tether’s USDT has a different financial structure from the Terra blockchain’s UST “algorithmic stablecoin,” which collapsed last month. But USDT has long suffered from investor doubts about the assets backing it, and whether redemptions would be honored in a full-blown crisis.

“Confidence in cryptos remains depressed and some traders are worried that Tether could suffer a similar fate as Terra’s UST stablecoin,” Edward Moya, senior market analyst at Oanda, said. “Too many institutional crypto investors are down massively, and they are worried that if this part of the crypto ecosystem collapses, Tether will crash.”

Fear dominates in the crypto market as the price of cryptocurrencies crash and several big industry players face financial difficulties. Celsius, a crypto lender that once held over $10 billion in client assets, suspended withdrawals and transactions to prevent a run on its deposits and hired lawyers to restructure its liabilities. Three Arrows Capital, one of the largest crypto hedge funds, is also under scrutiny.

Paolo Ardoino, chief technology officer of Tether, said that Tether liquidated its Celsius position without a loss and has no exposure to Three Arrows Capital.

The composition of Tether’s reserve to back the price of USDT has long since been an area of concern in the crypto market, with questions surrounding the nebulous “commercial paper” holding and digital asset investments. According to Tether’s website, the reserve holds about $71 billion in assets.

In May, Tether lost $10 billion in market capitalization in the wake of the Terra ecosystem’s implosion and the crash of the third-largest stablecoin, terraUSD (UST), to near zero from its dollar peg, which shook investors’ trust in the stability of stablecoins.

A part of that money landed on Circle’s USD coin (USDC), the second largest stablecoin, which was perceived as a safer choice, Moya said then.

Read more: Crypto Whales Ditched Tether for USDC After Stablecoin Panic

The total market value of cryptocurrencies fell below $1 trillion for the first time since January 2021, as persistently high inflation and recession fears squeeze financial markets.

Amid the turmoil, Tron’s $700 million USDD stablecoin lost its peg to the dollar and has not recovered since then despite Tron founder Justin Sun’s pledge to deploy $2 billion in reserves to defend its stability.

USDT’s price has been holding up its anchor to the U.S. dollar, although it trades somewhat below $1 on crypto exchanges, indicating that the selling pressure is pushing its price down. At press time, USDT changed hands at 99.8 cents.

Read more about

Save a Seat Now

BTC$21,098.21

BTC$21,098.21

6.43%

ETH$1,119.78

ETH$1,119.78

8.92%

BNB$212.44

BNB$212.44

4.63%

XRP$0.311617

XRP$0.311617

2.85%

BUSD$1.00

BUSD$1.00

0.01%

View All Prices

Sign up for Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor.