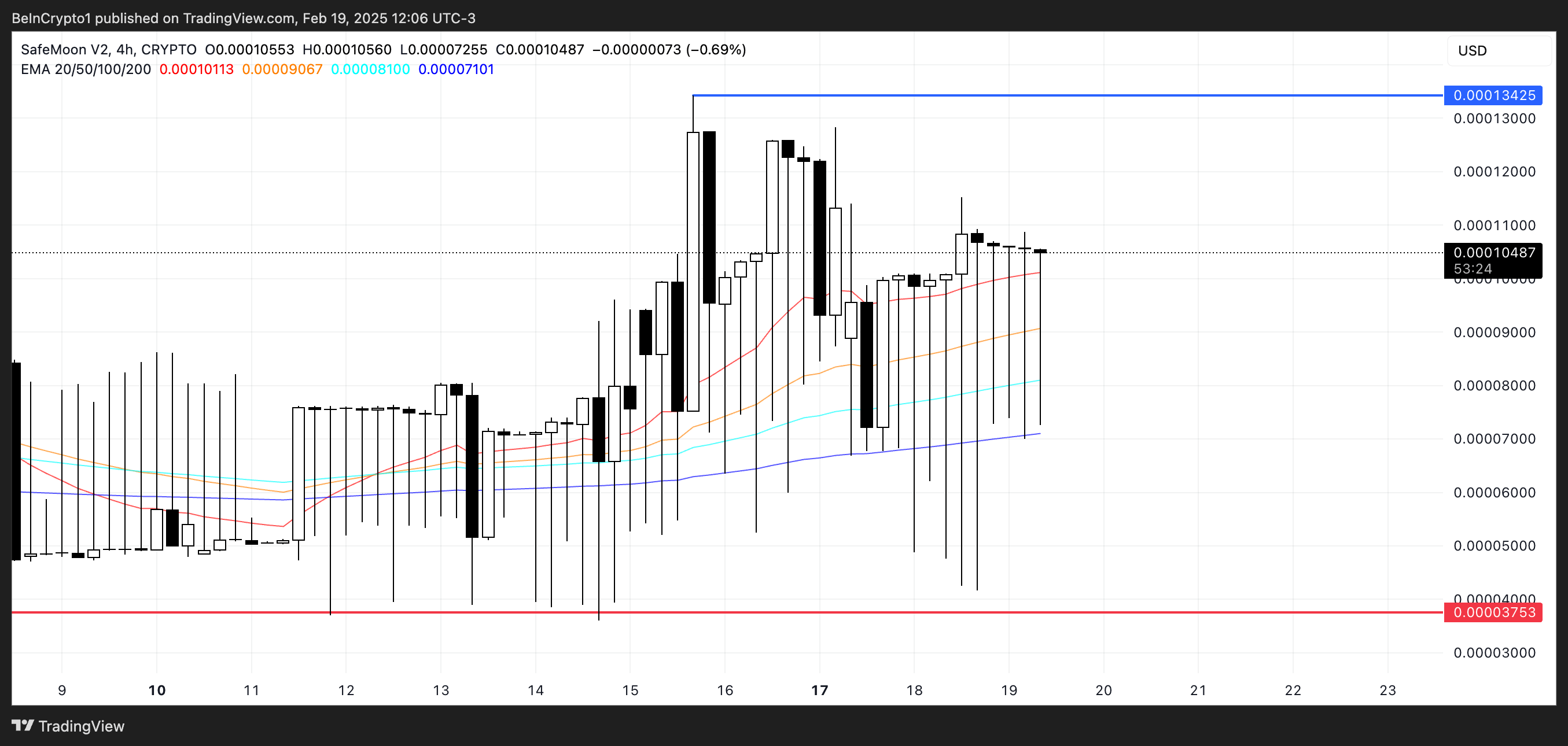

Safemoon (SFM), one of the prominent Altcoin projects of February, has experienced significant fluctuations in recent weeks. With the transition to a community -oriented model, he made a great rise. This transformation and gradual AirDrop process increased the price of SFM by 350 %per month. However, technical indicators show that the rise momentum is weakened.

Technical Indicators Altcoin Burned Red Light on the Price Rally

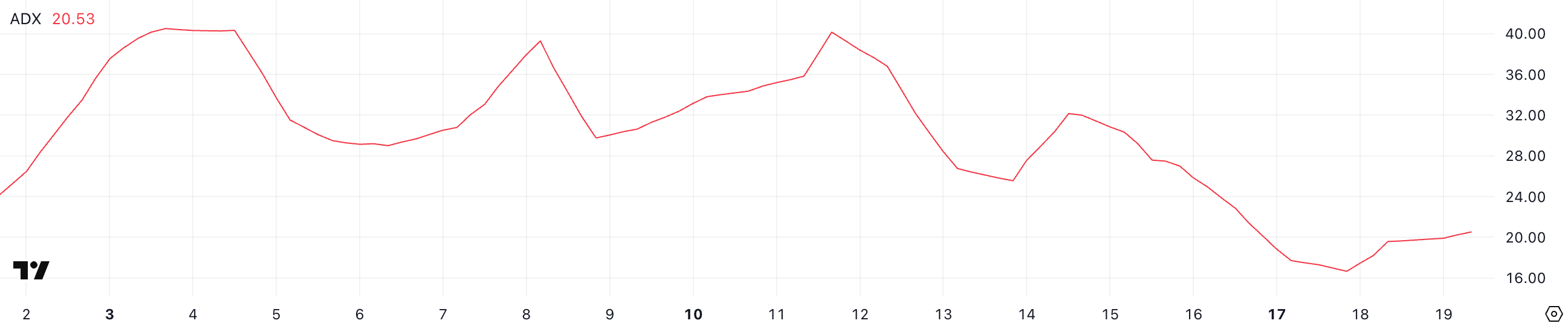

The ADX (Average Directional Index) indicator, which measures the trend power of Safemoon, indicates that the tendency to rise is weakened by decreasing to 20.5.

ADX, which reached 40 levels on February 11 and 32 on February 14, is now below the critical 25 threshold. This shows that the rise has lost speed and the price can move or retreat horizontally.

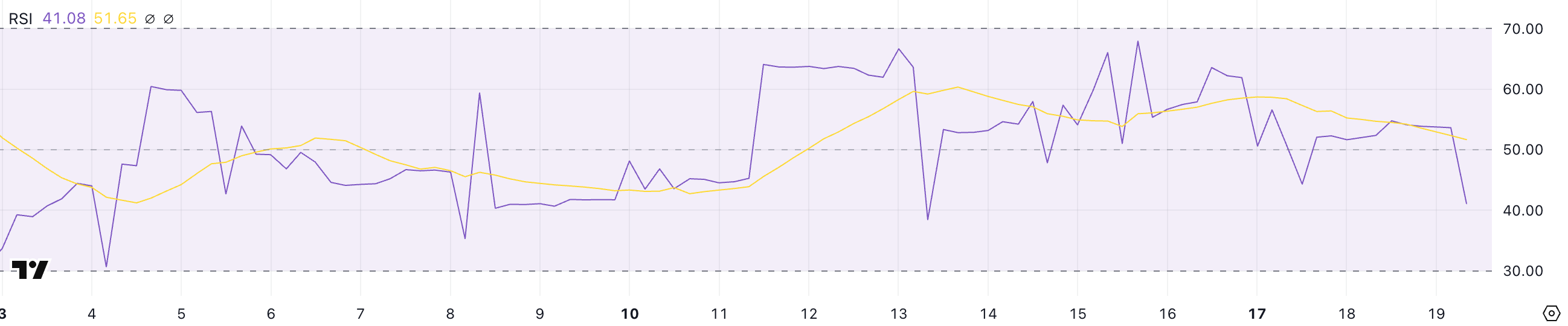

Another important indicator, RSI (Relative Strength Index), was at 67.9 four days ago, while now fell to 41. This shows that the procurement pressure is reduced and the price is moving away from the extreme purchase zone.

Safemoon’s announcement that he would take a solana -based breast coin increased the procurement pressure in the short term, but with the reduction of this excitement, the RSI fell again. If the RSI continues to decline to 30 levels, it is predicted that sales pressure may increase and the price may fall further.

What levels should Safemoon investors pay attention to in February 2025

Despite the big rise of Safemoon, the price continues to remain quite playful. The price of Altcoin increased by 153 %between 11-15 February. If this acceleration is maintained, it may be possible for SFM to test the dollar level of $ 0.00013 in the coming days and then reach a range of 0.00015 – 0.00020 dollars.

However, if the investor’s interest decreases and the general enthusiasm in the market decreases, Safemoon may decrease to $ 0.000037. As a result, the increase in procurement pressure in the coming period will play a critical role in determining the direction of the price.