A new development has come to the fore for the altcoin, which has a large amount in Binance’s hands. The TrueUSD (TUSD) stablecoin rose to $1.20 on the Binance exchange a few days ago. This is because it is displayed as a SUI farming pool on Binance. Here are the details…

Stable altcoin hits $1.20 on Binance

The TrueUSD (TUSD) stablecoin tumbled on several exchanges, including Binance. Unusually, the token has climbed above $1.20 relative to USDT on the exchange. Binance is one of the most popular exchanges for TrueUSD. Also, the trading platform allows TUSD to be traded without transaction fees. The nearly 20% increase in price may be due to high demand for the token and the inability to keep up with liquidity. Kaiko said, “TUSD liquidity has not been able to keep up with its volumes. This makes such depegging more likely,” he said. As we have also reported as Kriptokoin.com, “depeg” means that a coin loses its stable.

Kaiko also noted that users on Aave and Compound started borrowing large amounts of tokens when depegging started. Regarding the trading strategy used, Kaiko said:

Most of these transactions seem organic rather than bot-driven. The most common strategy was to borrow TUSD and exchange it for USDC, effectively shorting TUSD at its higher price. However, since neither Aave nor Compound has a large supply of TUSD, borrowing rates have skyrocketed, reaching over 100 percent yields on both protocols.

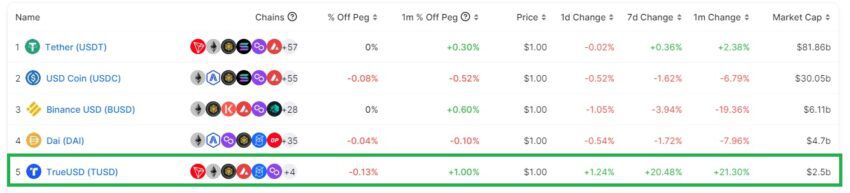

What is TrueUSD (TUSD)?

TruseUSD (TUSD) is an ERC-20 stablecoin pegged to the US dollar. According to DeFiLlama, it has become the fifth largest stablecoin with the recent increase in market capitalization. It currently has a market cap of $2.5 billion and had a 20 percent increase in market capitalization last week. The increase could be due to SUI farming pools on Binance. Sui is a layer-1 Blockchain network and users can deposit BNB and TUSD to trade the token.

cryptocoin.com As we have also reported, there was some controversy after the founder of TRON, Justin Sun, sent 50 million dollars of TUSD to Binance. Speculation was that Sun was trying to leverage the SUI liquidity pools on Binance. Changpeng Zhao tweeted that Binance will take action against any farming activity. Sun reversed the transfer.

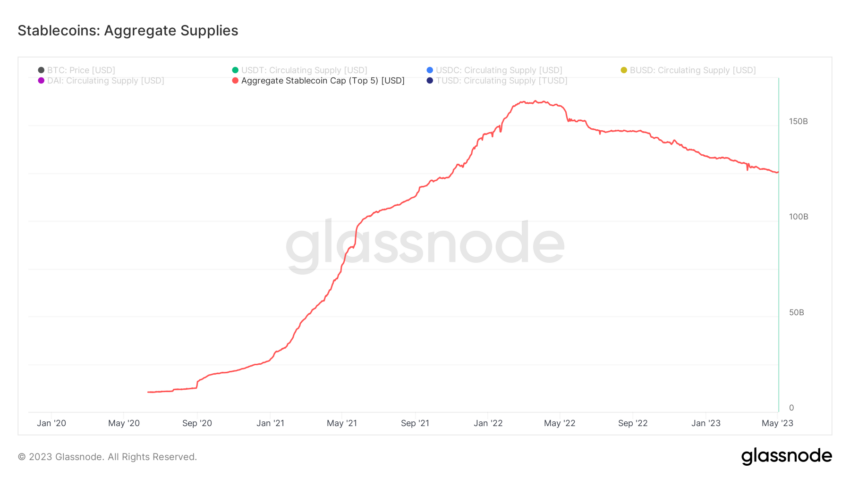

The overall stablecoin supply is declining

The stablecoin market has had a volatile 2023, but recent days have not been very optimistic. According to data from Glassnode, the total supply of the top 5 stablecoins has dropped by nearly 23 percent this year. Tether (USDT) continues to dominate the stablecoin market, with market share rising to a 15-month high in March. Other stablecoins have also taken a hit, such as USDC, which saw billions of dollars out a few months ago. USDC remains the second largest stablecoin at $30 billion, well behind Tether’s $82 billion.