In a surprising move that has caught the attention of financial analysts and investors, well-known name Michael Burry, who famously predicted the 2008 financial crisis, has recently placed significant bearish bets against the US stock markets. Burry’s actions in the crypto space, especially with coins like SHIB and DOGE on the decline, point to a lack of confidence in the ongoing economic recovery and a potentially more bearish scenario. Here are the details…

Michael Burry’s latest moves draw attention

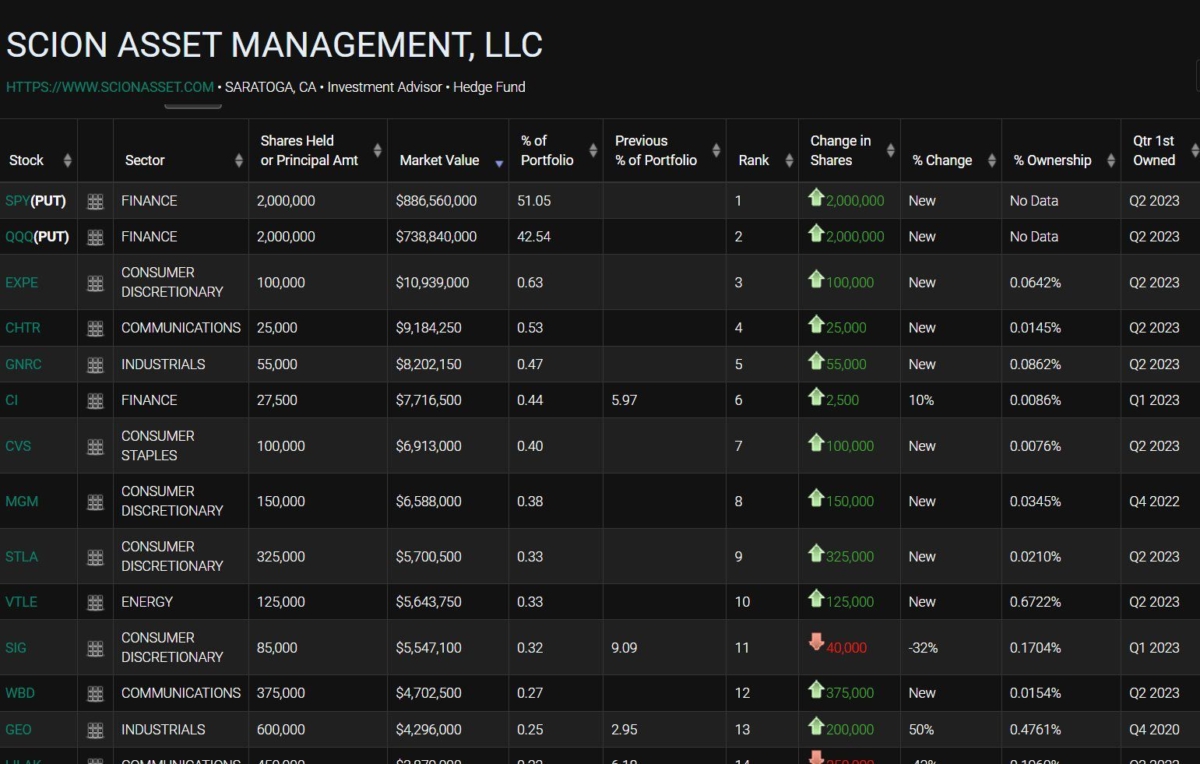

Michael Burry’s Scion Asset Management took a bold stance against the markets, taking a staggering $1.6 billion bearish position against the stock market. These bets, primarily targeting the S&P 500 and Nasdaq 100 indices, have sparked controversy about their potential impact on the broader financial landscape. Burry, whose previous predictions were immortalized in the book and movie “The Big Short”, gained a reputation for his foresight and ability to profit from market downturns. His recent actions have caused many to speculate about the reasons behind their recent bearish positions.

Down bets are primarily put options that give investors the right to sell shares in the future at predetermined prices. Scion Asset Management purchased $886 million in face value put options against the SPDR S&P 500 ETF Trust and $739 million against the Invesco QQQ Trust ETF. These funds track the S&P 500 and Nasdaq 100 indices, respectively. It makes Burry’s positions an indication of his skepticism towards the performance of the broader market. What is remarkable about Burry’s recent actions is that the $1.6 billion committed to these bearish positions represents a significant portion, -93%, of Scion Asset Management’s entire portfolio. The move underscores Burry’s belief in his predictions and adds to the intrigue surrounding the potential market developments he envisions.

He criticized SHIB and DOGE

While Burry’s downside bets have sparked curiosity and controversy, it also raises concerns about its potential impact on other financial assets, including the cryptocurrency markets. Due to Burry’s track record of accurate market forecasts, some analysts speculate that a significant market downturn could reduce investor appetite for riskier assets, including cryptocurrencies. While the financial world is watching how things unfold, experts are divided over the possibility of a recession in the second half of the year. Burry’s actions added an extra layer of uncertainty to the already complex economic landscape.

While some are optimistic about potential growth catalysts such as ETF approvals and greater adoption of cryptocurrencies, others share Burry’s concerns about the direction of the broader market. In the coming weeks and months, investors will be keeping a close eye on market trends, economic indicators and other developments regarding Michael Burry’s bearish positions. Meanwhile, cryptocoin.com As we reported, Burry said that they were “unimportant” about popular altcoins SHIB and DOGE in the cryptocurrency space. He stated that he did not see these as an important investment. He described DOGE as pointless.