Gold prices could have room to move higher next week as the bullish trend continues among retail investors looking to hedge the biggest banking crisis since 2008. However, Wall Street analysts’ gold forecast has taken a more conservative stance in the near term.

Conditions are ready for a strong gold bull market, but…

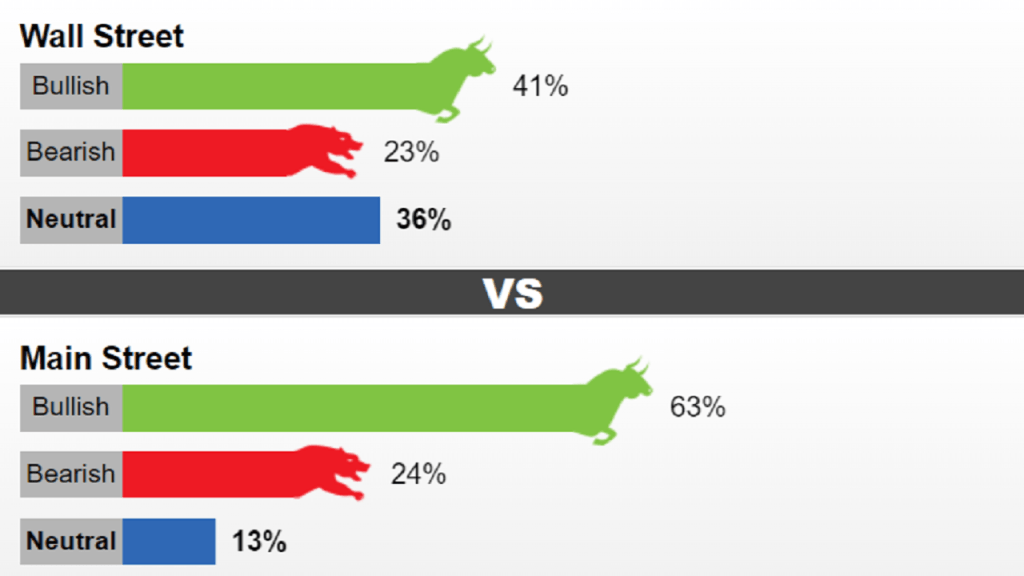

The latest Kitco Gold Forecast Survey shows sentiment among Main Street investors has reached a three-month high as gold sees its best weekly gain since March 2020. However, sentiment among Wall Street analysts is a little more mixed. Accordingly, bullish sentiment is only a slight advantage and a strong possibility sitting on the sidelines.

cryptocoin.com As you follow in , growing financial market turmoil could force the Federal Reserve to end its aggressive year-long tightening cycle as early as next week. Therefore, many analysts are expecting a bullish trend in gold this year. The market appears to be overbought, although analysts say gold is on the verge of hitting an all-time high this year. Adrian Day, head of Asset Management, comments:

Conditions are ready for a strong gold bull market as the Federal Reserve abandons QT in the face of bank failures. Many say the Fed will stay tight until ‘something breaks’. And now something is broken. However, after such a strong move, gold is at its peak in January and last April. Therefore, before we break out, we may see some back and forth movement in the short term.

What does the gold forecast survey show?

This week, 22 Wall Street analysts took part in the Kitco Gold Forecast Survey. Nine analysts (41%) among respondents expect gold to rise in the near term. At the same time, five analysts (23%) were bearish for the next week, and eight (36%) predicted prices will remain flat.

Meanwhile, 707 votes were cast in an online Main Street poll. Of these, 445 (63%) expected gold to rise next week. Other 169 (24%) said it would be lower, while 93 voters (13%) remained neutral in the near term. Main Street’s bullish outlook comes as gold prices rose more than 5% this week and saw their best weekly performance in three years.

Bull gold prediction: If this happens, gold may explode!

The Kitco survey showed retail investors averaged around $1,922 for gold for the coming weekend. However, digging into the details of the results, less than a third of respondents predicted that gold prices will fall below $1,900 next week.

Bullish Wall Street analysts see significantly more potential in gold next week, with some pointing to $2,000. Gold is looking good now that the Federal Reserve is stuck, says Kevin Grady, head of Phoenix Futures and Options. Although markets see a chance for the US Federal Reserve to raise interest rates by 25 basis points next week, Grady says there may be a much tighter race than expectations suggest. In this context, Grady makes the following statement:

I think there’s a good chance the Federal Reserve will leave interest rates unchanged. Because they don’t want to add more stress to what has become a global banking crisis. Another quarter point increase could push another bank aside. If this happens, you will find that gold prices are much higher.

Everything seems to depend on the Fed

Analysts point out that gold will be sensitive to emerging market sentiment if government regulators, along with the Fed, can get the crisis under control. Colin Cieszynski, chief market strategist at SIA Wealth Management, comments:

I think gold could make a big move, but I’m not clear on the direction. Gold benefited from capital flows to defense havens due to the weakening of the US dollar and stress in the global banking system. This trend can easily continue next week. On the other hand… investor confidence could rise, which could turn the current headwind into a headwind. Basically, it depends on what the Fed does on Wednesday. A pigeon Fed could be bullish for cold gold, while a neutral to hawkish Fed could potentially be bearish for gold.