Analysts draw attention to the increasing Ethereum outputs from crypto currency derivative exchanges. This may lead to a decrease in sales pressure and the closure of leverage positions. So he thinks ETH is tending to rise.

Ascension signals are coming for Ethereum!

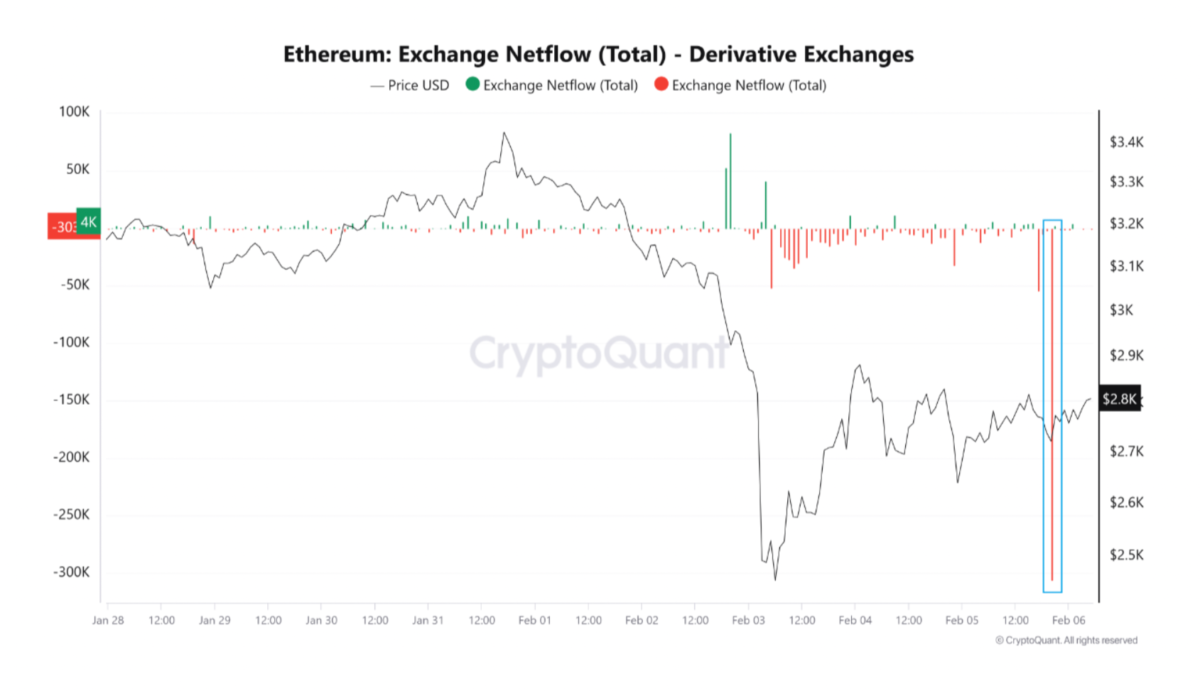

The amount of Ethereum extracted from crypto currency derivative exchanges has reached the highest level since August 2023. Analysts interpret it as a positive signal for ETH price. Ethereum net flows in crypto derivative exchanges were negatively 300,000 ETH, representing an output of approximately $ 817.2 million on February 6, on February 6. Meanwhile, ETH was traded for $ 2,724 during the article.

ETH net flows in crypto derivatives were -300,000 ETH. Source: cryptoquant

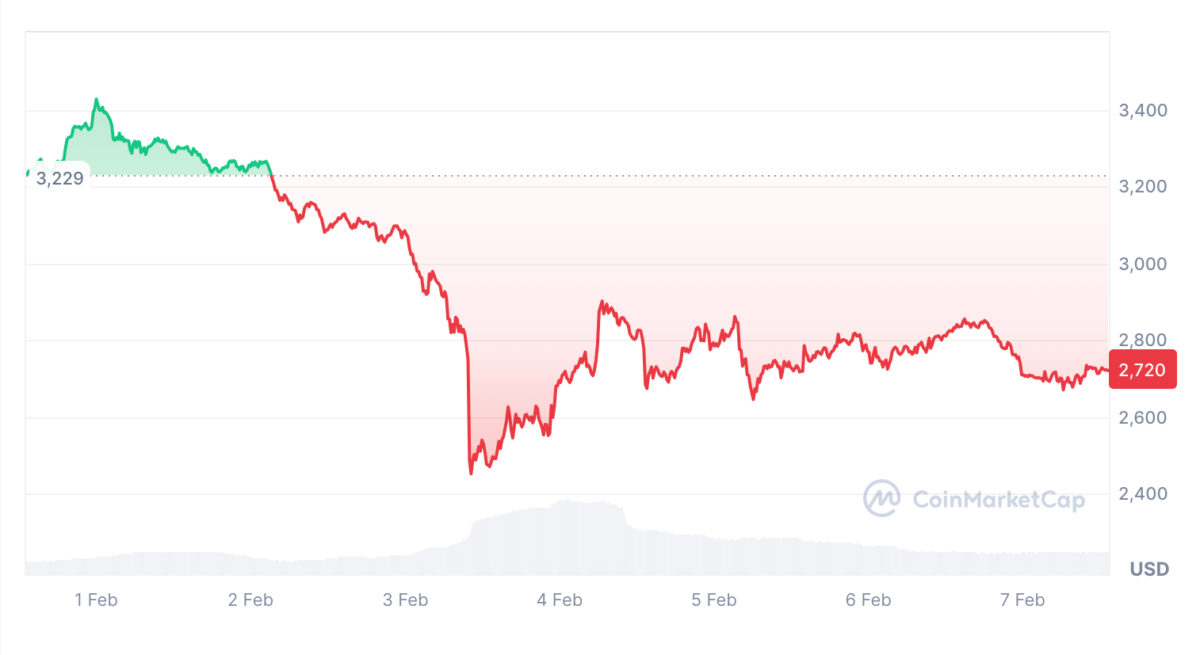

ETH net flows in crypto derivatives were -300,000 ETH. Source: cryptoquantCryptoquant Analyst Amr Taha said in a note dated February 6, because the traders withdraw their ETHs from the derivative stock market, the closure of leverage positions and potentially reducing the sales pressure of ETH to the cold warehouse, he said. Taha said that the increase in Ether from the derivative exchanges reduces the ör emergency supply for sale ve and makes it difficult for Ether’s price to decrease. ETH has experienced a decrease of 19.42 %in the last 30 days, and since February 3, it has been traded below the price level of $ 3,000, which has been psychologically important. “If the demand remains constant or increases, the price tends to increase due to the reduction of the current supply,” the analyst adds.

Ethereum was traded for $ 2,720 during the article. Source: coinmarketcap

Ethereum was traded for $ 2,720 during the article. Source: coinmarketcapOther rise catalysts for crypto currency!

Analyst Analyst Kyle Doops said in an X post of 6 February, “Big movements like this typically mean less sales pressure and large position closing. This is usually a rise signal. ” Only days after US President Donald Trump’s son Eric Trump wrote to X as “a great time to add ETH”.

This follows the increasing rise catalysts for Ethereum. These include the potential launch of a fund traded on the Ether stock market, and Donald Trump’s World Liberty Financial Crypto project continues to increase Ethereum assets. Kriptokoin.comAs he has followed from Consensys, Joe Lubin, the founder of Consensys, said that the ETF exporters are hopeful that the funds that offer stocks can be allowed soon. Lubin, “We have held talks with ETF providers and they are already working hard on this, so they expect to light green light in a reasonable time,” he said.