The crypto currency exchange Kucoin reached an agreement with US officials for $ 300 million because it was unlicensed. Founders will resign Michael Gan and Eric Tang and lose their $ 2.7 million assets, and BC Wong will start as CEO. The agreement follows the allegations that Kucoin does not implement the necessary AML and KYC protocols and did not register for Fincen. Despite the conflict, Kucoin assured users that their global operations will not be affected and emphasized their latest harmony and security improvements.

Penalty for the Crypto Money Exchange: At least 2 years will be released from the US market

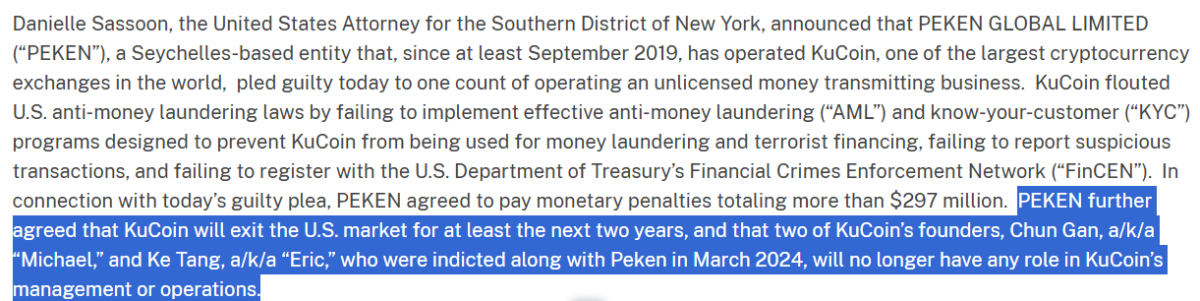

Kucoin admitted that he was guilty of violating US regulations by conducting an unlicensed money transfer business. The founders who acknowledged that he was guilty resigned and agreed to pay a fine of approximately $ 300 million in the case that has been active since 2024. Kucoin was accused of opposing anti -laundering laws just a few years after the conclusion of a similar legal case in New York state. Peren Global Ltd. On Monday, the US Regional Judge Andrew Carter in Manhattan responded to charges.

Source: Justice.gov

Source: Justice.govIn his decision, the judge fined about $ 113 million and lost $ 184.5 million. In March 2024, the stock exchange and two founders Chun Gan and Ke Tang were brought to court on the grounds that they planned to carry out an unlicensed money by violating the money laundering prevention program. The two founders later accepted the postponement of the prosecution by losing approximately $ 2.7 million. In December 2023, the stock market platform fined a $ 22 million fine and refund in New York; He also agreed to end trading in New York as a result of a case that the State Chief Public Prosecutor did not register as a securities and commodity broker and claimed that he was wrongly represented as a crypto exchange.

Kucoin had difficulties in compliance with the legislation

“Kucoin has refrained from implementing the anti -money laundering policies designed to identify crime actors and prevent illegal procedures,” US prosecutor Danielle R. Sasoon said. As a result, Kucoin was used to facilitate billions of dollars worth of suspicious transaction and to transmit potentially criminal offenses, including income from Darknet markets and malware, ransom software and fraud plans.

Kucoin is struggling with legal compliance in different regions and judicial fields. Far from the United States, the company faced regulatory challenges in Canada. The Ontario Securities Commission put an embargo on the service of Kucoin in 2022 to serve the users in the country because Kucoin did not meet the legal threshold to operate there.