Frax Finance founder Sam Kazemian proposed a $20 million buyback in the project’s own token, FXS, amid the recent altcoin crash. If the royalty passes, Frax Finance will receive $20 million in FXS tokens.

Critical decision from Frax Finance as altcoin market plummeted, price made 10%

Sam Kazemian says FXS token is “significantly undervalued”. Besides, he stated that it does not represent the true value of the Frax protocol or the “flexibility” of the algorithmic stablecoin FRAX.

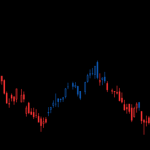

Frax network’s native cryptocurrency, FXS, rose 12% after this news. It later slashed those gains to $5.89. On June 11, it could not escape the hands of the sellers and reached $5.2. Thus, it has lost more than 85% from the ATH price reached at $43 in January. It continues its downtrend, with an additional 10% depreciation in the last 24 hours.

The team supports this plan

Sam Kazemian’s buyback decision comes while the cryptocurrency market is in decline. Bitcoin and altcoins have been in the red for the past six months. The situation got worse with the collapse of LUNA in early May. Kazemian’s decision also came at a time when the market was turbulent. Since its November peak, the meltdown has wiped more than $1.6 trillion in value from the market. In a new governance proposal he co-wrote with founder Travis Moore, Kazemian states:

FRAX’s mechanism is unquestionably flexible. He never doubted. It has been perfectly preserved since its inception. The protocol as a whole is in excellent condition. Therefore, the core team no longer believes that the significantly worse performance of FXS compared to other tokens is no longer justified…

Kazemian “defies market irrationality”.

Frax protocol is split between a stablecoin and Frax (FXS), a governance token. FRAX is a stablecoin pegged to the US dollar. It maintains this parity by being partially collateralized by USDC. FXS also helps stablecoin as it accrues fees and seigniorage income.

Kazemian said the protocol generates $80 million in annual revenue and “[FXS’s] has tremendous fighting and cash flow to take advantage of this mispricing.” In its proposal, it stated that Frax would finance the buyback through a combination of available cash and profits.

If the bid is approved, the $20 million repurchase program will be executed over a 30-day period using a method known as the ‘time-weighted average market maker’ (TWAMM). The method allows large long-term orders to be split into several smaller orders executed over time to minimize price shocks. Here is Kazemian’s recommendation:

Frax is strong and profitable enough to take advantage of the market irrationality in governance tokens. If the bid passes, all of the repurchased FXS tokens can be burned. It can also be placed in the FXS yield. It may also be held in the treasury until future management allocates it for use.

Is this just a temporary relief for the altcoin?

Finally, there are approximately 16.2 million FXS tokens in circulation out of a total supply of 100 million according to Coinmarketcap. Kazemian hopes that a reduction in supply will help boost the token’s price. But not everyone agrees with his proposal.

For example, an expert nicknamed Seba explained why Frax shouldn’t spend $20 million on buybacks. Seba said the buyback would be “no more than a temporary relief and an opportunity for uncommitted investors to sell their FXS.”