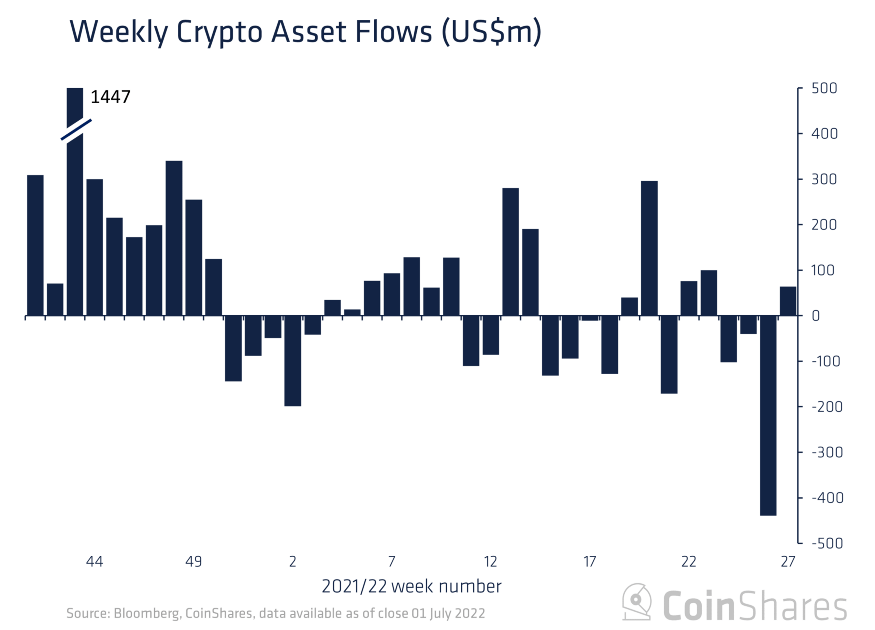

Digital asset investment products saw a total inflow of $64 million last week. However, the headline figures show that a significant majority are entering short Bitcoin investment products. In addition, there was a total of $20 million in small inflows into long investment products in non-US regions. Meanwhile, the leading altcoin continues to see re-entries. In addition, 3 more altcoin projects managed to attract funds.

US traders welcome short Bitcoin

cryptocoin.com As we reported, there was a total of $64 million inflows in digital asset investment products last week. However, the figures in the headline do not hide the fact that a significant majority are turning to short Bitcoin investment products.

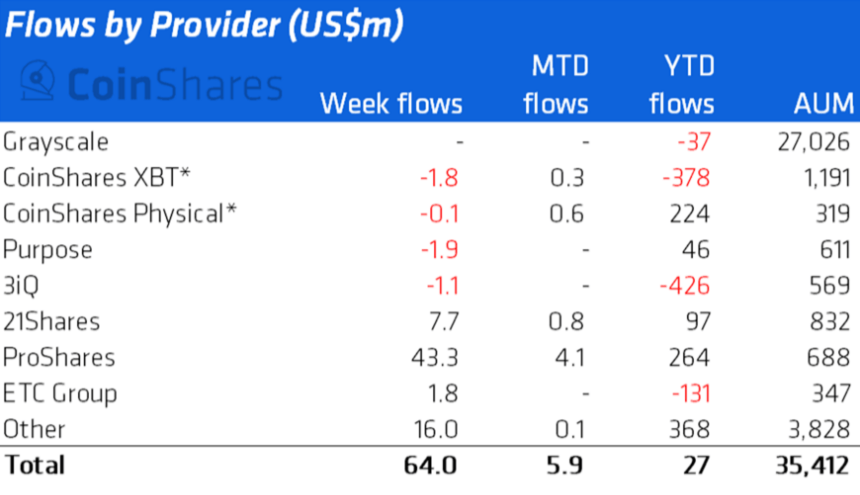

The ProShares Short Bitcoin Strategy ETF was launched on June 21, 2022. The fund tracks bets against Bitcoin prices. In other words, it moves inversely to the token. Of all the investment product providers, only ProShares had $43 million worth of inflows last week. Europe’s 21Shares is a long way from it, with $7.7 million in revenue.

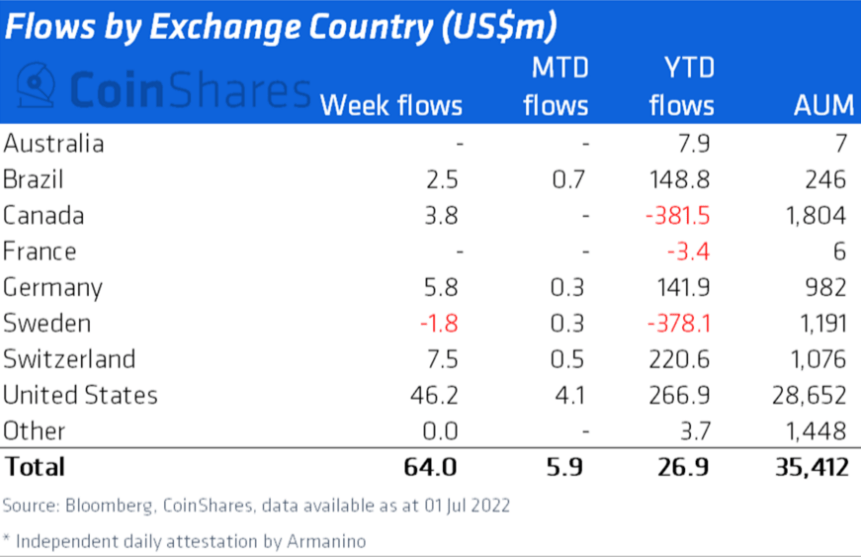

There was a total of $20 million in small inflows into long investment products in regions other than the USA, such as Brazil, Canada, Germany, and Switzerland. This shows that investors are adding to long positions at current prices. He also emphasizes that the short Bitcoin introductions were likely due to US-first accessibility rather than renewed negative sentiment.

While Bitcoin is exiting, there is serious entry in Short-Bitcoin

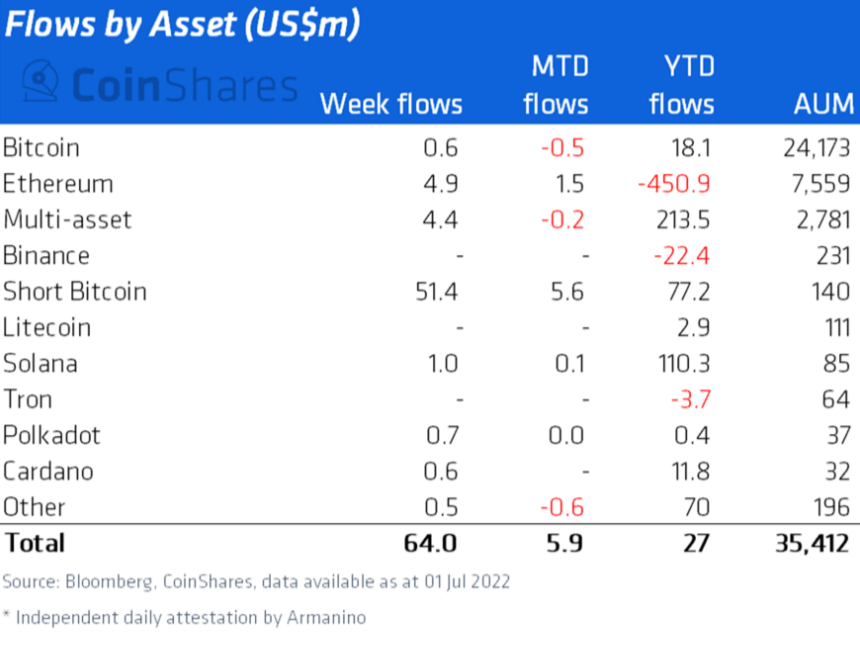

Bitcoin saw very little inflows of just $0.6 million during the week. Short-Bitcoin saw record inflows totaling $51 million after the product launch in the US.

The increased interest in revealing Bitcoin came after the token tumbled by nearly 60% in the second quarter. This is his worst performance since 2011. Concerns over the recession in the US, coupled with a string of bankruptcies in the crypto space, have hit Bitcoin prices in recent months.

SOL, along with DOT and ADA, managed to attract funds again to the leading altcoin

Ethereum saw an inflow week totaling $5 million last week. The leading altcoin has broken its 11-week exit spell, with a second weekly entry. Multi-asset (multi-crypto) investment products saw total inflows of $4.4 million. It continues to be the product that has been least affected by the last negative emotions, with small exits in only 2 weeks of this year.

A number of altcoins have seen entries suggesting investors are starting to diversify again. Notably, Solana (SOL), Polkadot (DOT), and Cardano (ADA) attracted $1 million, $0.7 million, and $0.6 million, respectively.